The US employment data released on Friday suggested that the Federal Reserve may pause the cycle of lowering interest rates this year. According to some Fed officials, the three declines that could be observed are enough to maintain the current steady pace of economic growth. Many economists feared that amid the strikes in the automotive industry, the pace of hiring would decline in October this year, but this did not happen. But the US dollar did not receive the necessary support, as the data on activity in the manufacturing sector, which were released later, pointed to problems in this industry.

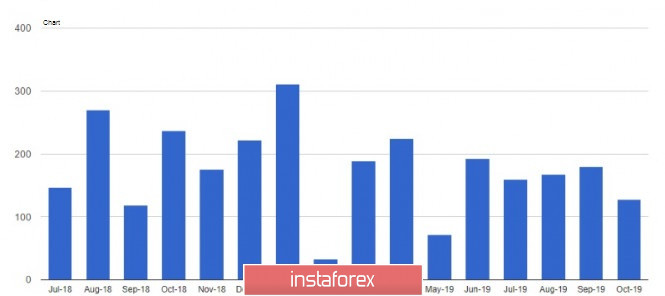

According to a report by the US Department of Labor, the number of jobs outside the US agriculture rose by 128,000 in October 2109, while economists had expected a weaker growth of 75,000. Unemployment in October coincided with forecasts and rose to 3.6% against 3.5% in September. Given that wage growth continued to outpace inflation, average hourly earnings increased by 3.0% compared to the same period in 2018.

The data was enough to make Fed officials seriously talk about a pause in the cycle of lowering rates. The risks associated with international trade and Brexit have eased somewhat, allowing a pause in the series of rate cuts. Federal Reserve Bank of Boston President Eric Rosengren on Friday said he voted against cutting interest rates because the US economy is in good shape, even though global risks threaten it, which are gradually declining. According to Rosengren, inflation is close to the target level, and GDP growth is in line with the forecast.

Fed Vice Chairman Richard Clarida also said that the economic situation in the United States is very good, as evidenced by the employment report, which has many positive aspects. According to Clarida, the recent strengthening of the US dollar is not an obstacle to achieving the inflation target.

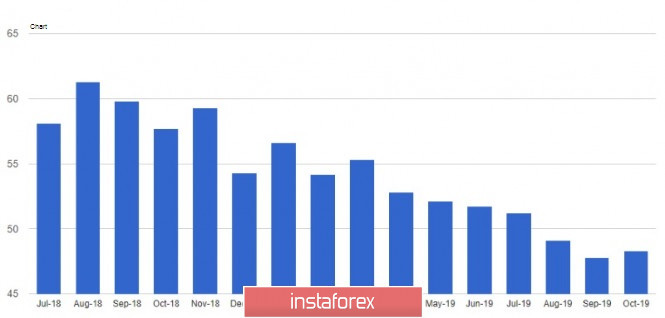

The growth of the US dollar, after the release of the employment report, was temporary, since then data were published on activity in the US manufacturing sector, which continued to decline in October, albeit at a slower pace. According to the Institute for Supply Management (ISM), the index of supply managers for the US manufacturing sector in October 2019 rose to 48.3 points against 47.8 points in September. However, index values below 50 points indicate a contraction in the activity. Economists had expected the index to reach 49.1 points in October.

A similar index from IHS Markit in October rose to 51.3 points.

Despite the growth of the index and its gradual return to the mark of 50 points, talking about a real change in the situation for the better amid continuing concerns about trade relations between the US and China, as well as a slowdown in global economic growth, is not a good time.

Data on the growth of construction costs in the US did not affect the US dollar. According to a report by the US Department of Commerce, construction spending in the US in September increased by 0.5% compared to August and amounted to 1.294 trillion US dollars. Economists predicted that construction costs will rise by 0.2% in September.

As for the technical picture of the EURUSD pair, it has not changed much. The bulls still have the same problems with the level of 1.1180. Only the breakthrough of this maximum will strengthen the demand for risky assets and open a direct road to the 12th figure. The target will be the levels of 1.1230 and 1.1270. Another bullish setback could seriously put pressure on the euro, especially after today's data on manufacturing activity in the eurozone, which may continue to decline. In this case, support can be expected in the area of a minimum of 1.1130 or at a larger level of 1.1080, which was formed at the end of last week.