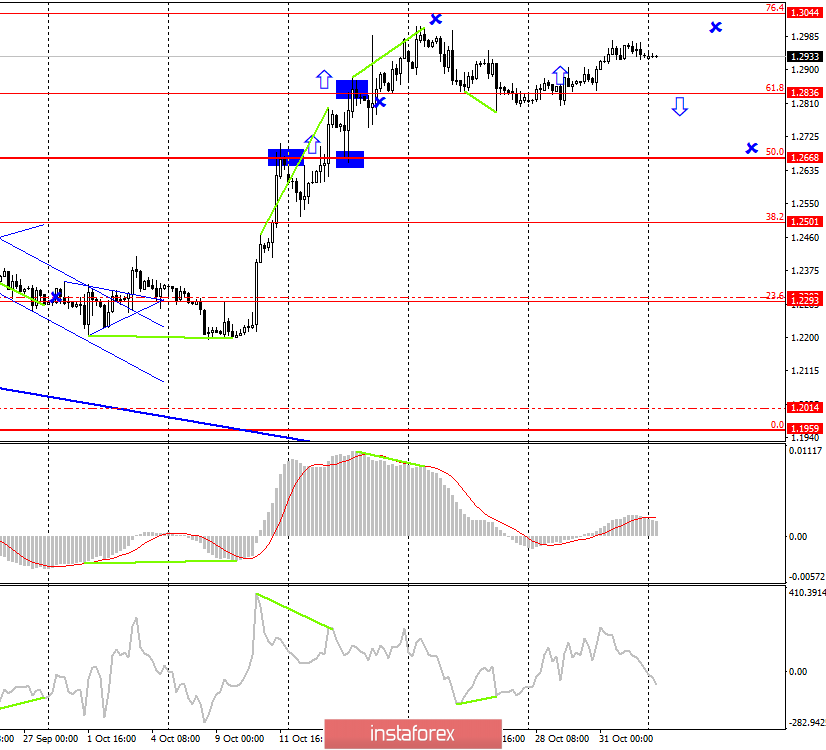

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair continues the systematic process of growth in the direction of the correction level of 76.4% (1.3044), after rebounding from the Fibo level of 61.8% (1.2836). The rebound of the pair from this level of correction will allow traders to expect a reversal in favor of the US currency and some fall towards the level of 61.8%. Today, the divergence is not observed in any indicator. The upward trend is unstable, it is impossible to build a trend channel.

Donald Trump, who at a time when his head is not preoccupied with problems associated with a possible impeachment that is unlikely to ever happen, is dreaming of Britain's fastest possible exit from the European Union. I have already written earlier that the fact of the weakening of the European Union is positive for America, as well as for any other country that considers itself a competitor to the EU. This explains the zealous approval of all the actions of Boris Johnson by the American President, the support of Nigel Farage and his "Brexit" party. This explains Trump's promise to sign a "huge trade agreement" with London, as soon as London leaves the European Union. That is, Trump needs a split in the European Union, by any means, as quickly as possible. Thus, his recent calls to unite the conservatives and the "Brexit" party look quite justified. These two parties are in favor of leaving the EU at any cost, which is what Trump needs. According to the US President, such cooperation could guarantee the expansion of trade between the US and the UK. Trump also reiterated his full confidence in Boris Johnson, calling him "the right man for Britain for this time."

The economic information background is now both rich and not rich for the British pound at the same time. On Friday, we received from the UK only an indicator of business activity in the manufacturing sector for October, which has not yet reached the necessary level to note an improvement in the UK industry. Today, the indicator of business activity in the construction sector will be released, which has already fallen "below the plinth". Thus, the news from Britain still cannot cause additional demand for the pound. The only reason why the pound continues to stay afloat is the weak economic reports from the US. Today in America, there will be only one report – production orders for September, but this is a report of the so-called "second-tier".

Forecast for GBP/USD and trading recommendations:

The pound/dollar pair continues the process of growth in the direction of the Fibo level of 76.4% (1.3044). However, in the coming days, I expect a downward pullback, since, as I have already said, there are few reasons for the further growth of the British pound. Thus, the rebound of quotations from the level of 76.4% will increase the probability of a strong fall in the pound. I recommend selling the British pound after the close under the Fibo level of 61.8% (1.2836) with a target of 1.2668. A weak report on business activity in the UK construction sector may cause a decline in demand for the pound.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.