Economic calendar (Universal time)

Against the background of the lack of important news and indicators from overseas in today's economic calendar, some market inspiration and recovery can be expected with positive statistics from the Eurozone (8:55 PMI in the manufacturing sector) and the UK (9:30 PMI in the construction sector).

EUR / USD

Players on the rise were able to follow the month as optimistically close the week. As a result, in the case of getting rid of the current attraction of such levels as weekly Kijun (1.1146) and monthly Tenkan (1.1164), we can expect a continuation of the rise. The most significant benchmarks, after the recovery of the daily upward trend, are now concentrated in two resistance zones 1.1208-20 (the lower boundary of the monthly cloud + the final boundary of the weekly dead cross + historical level) and 1.1287 - 1.1333 (target for the breakdown of the daily cloud + lower border of the weekly cloud). If the players on the rise take a break and go down under the current zone of attraction (1.1146-64) in the near future, then support will come into work, which, with the opening of a new working week, has not practically changed its location. The nearest supports are 1.1124 (daily Tenkan) – 1.1094-82-65 (daily cloud + weekly Fibo Kijun) - 1.1030 (daily Kijun + weekly Tenkan).

Support for technical instruments on H1 is now completely on the side of players to increase. The classic pivot levels 1.1182 (R1) - 1.1199 (R2) - 1.1226 (R3) can act as intraday resistance while continuing to strengthen the bullish moods. The key supports in the development of the downward correction are 1.1155 (central pivot level) and 1.1131 (weekly long-term trend). Further, the support role can go to S2 (1.1111) and S3 (1.1094).

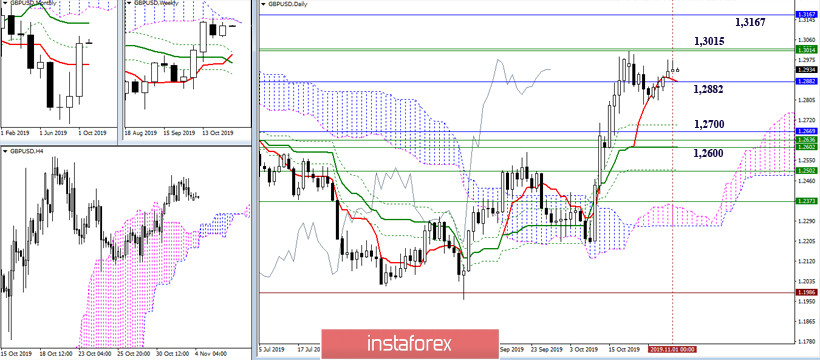

GBP / USD

Despite the uncertainty of Friday and the work in the minimum range, the players on the rise managed to maintain the bullish character of the weekly candle. As a result, updating the maximum of October (1.3012) and overcoming the resistance of the weekly cloud (1.3015). It should be noted that this it is the narrowest place which will open up opportunities for the continuation of the rise, where the monthly medium-term trend (1.3167) will serve as the closest reference point. If the upside players fail to cope with these upward prospects, then the loss of current support 1.2882 (daily Tenkan + monthly Fibo Kijun) will most likely lead to a rather deep decline in the support area, combining the levels of different time intervals 1.2700 - 1.2600 ( daily Fibo Kijun and Kijun + monthly Tenkan + weekly Tenkan and Fibo Kijun).

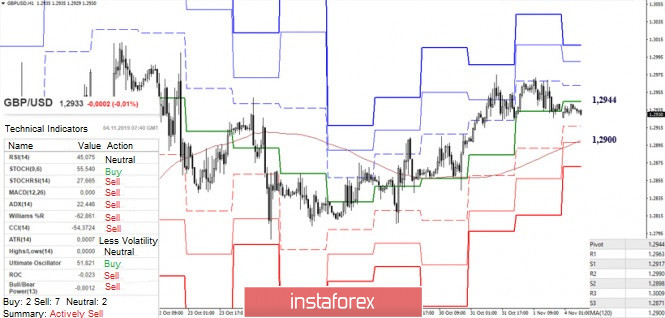

The pair is in the correction zone, which is why the upward players have already begun to take their positions. To date, this has led to a loss of support for the central pivot level (1.2944) and a change in the preferences of most technical indicators. Further, the most important and significant support today is the weekly long-term trend (1.2900), and 1.2871 (S3) can also be noted. For players to increase in this situation, it is important to regain the central pivot level (1.2944) and update the maximum first last week (1.2975) and then last month (1.3012).

Ichimoku Kinko Hyo (9.26.52), Pivot Points ( classic ), Moving Average (120)