Hello, dear colleagues!

The main events of last week can be called the Fed's decision on the interest rate and data on the US labor market. They had an impact on the dynamics of the US currency, which weakened against all major competitors, except for the Canadian dollar.

On Wednesday, October 30, the Federal Reserve System (Fed) at the end of its two-day meeting decided to reduce the interest rate to 1.5%-1.75%. Characteristically, this is the third rate cut in federal funds this year, and it is explained by fears of a slowdown in US economic growth.

The US Central Bank denied the option of further easing monetary policy in the short term, although the Open Market Committee (FOMC) said it would continue to monitor incoming macroeconomic data and, if necessary, act accordingly to maintain economic stability.

After the results of the FOMC meeting, the US dollar traded quite volatile, but still ended with a decline in a wide range of markets.

On the last day of trading last week, there were releases on the American labor market, which cannot be called bad. Rather, the reports were mixed.

Thus, the unemployment rate coincided with economists' expectations and amounted to 3.6%. Hourly wages (every month) grew less than the forecast of 0.3% and was within 0.2%. At the same time, new jobs in non-agricultural sectors of the economy (Nonfarm Payrolls) were created more than analysts predicted – 128 thousand against the estimated 89 thousand.

However, the US dollar was not able to bring labor statistics for October into its asset and, after the initial strengthening, turned to a downward trend.

This week, November 4-8, the main events for the EUR/USD pair will be:

- Reports on business activity (PMI) in the US and the eurozone;

- Manufacturing orders, trade balance, consumer sentiment index from the University of Michigan, USA;

- Retail sales in the eurozone.

Well, let's move on to the technical picture that has developed for the main currency pair, and since the October trading recently ended, let's start with the monthly timeframe.

Monthly

Although the EUR/USD pair strengthened significantly last month, the question of further upward movement remains open. In my opinion, this is due to the strong technical area of 1.1180 – 1.1250, where the maximum values of the October and August trades were shown. Only the passage of this zone and the closing of November above 1.1250 will indicate the further ability of the bulls to move the price up. In this case, the next objectives of the players to increase the rate will be 1.1370 and 1.1410.

A breakdown of the support around 1.0880 will signal a bearish market, but this will not be an easy task for sellers.

Judging by the most senior timeframe, the most likely scenario for November trading can be considered ascending. However, this does not exclude corrective pullbacks down.

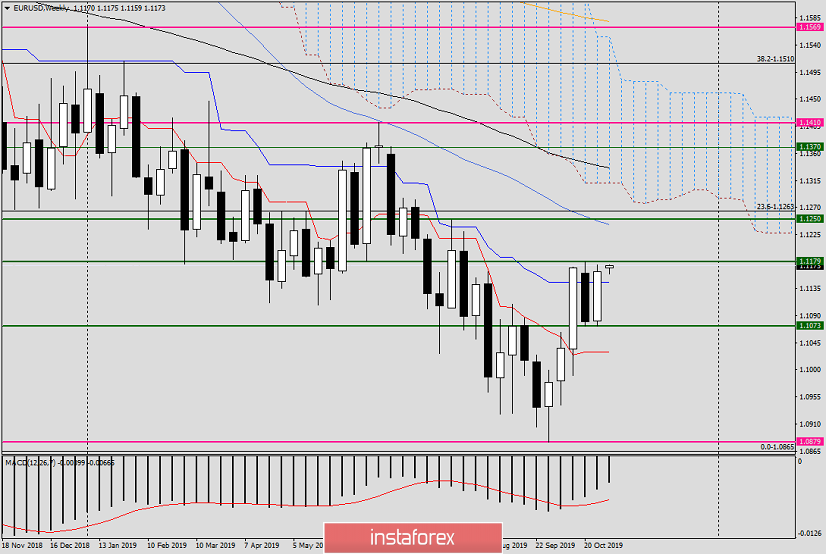

Weekly

On Mondays, you should carefully analyze the weekly schedule. It is, in my opinion, one of the strongest and most reliable (in terms of signals) time intervals.

For the sake of justice, it is necessary to recognize that on "week" the current situation is far from clear. We see that the pair circles around the strong Kijun (blue) line of the Ichimoku indicator, alternating the closing of the last candles above and below this line.

The fact that they failed to raise the price to the previous highs of 1.1179 and test this resistance level for a breakdown can indicate a possible weakness of the euro. I believe that the ability to overcome this threshold will determine the prospects of the euro/dollar pair, at least in the short term.

If, as a result of the decline, strong support is broken at 1.1073, we can assume that the market is under the control of the bears and prepare for sales after corrective pullbacks to the area of 1.1070 – 1.1100.

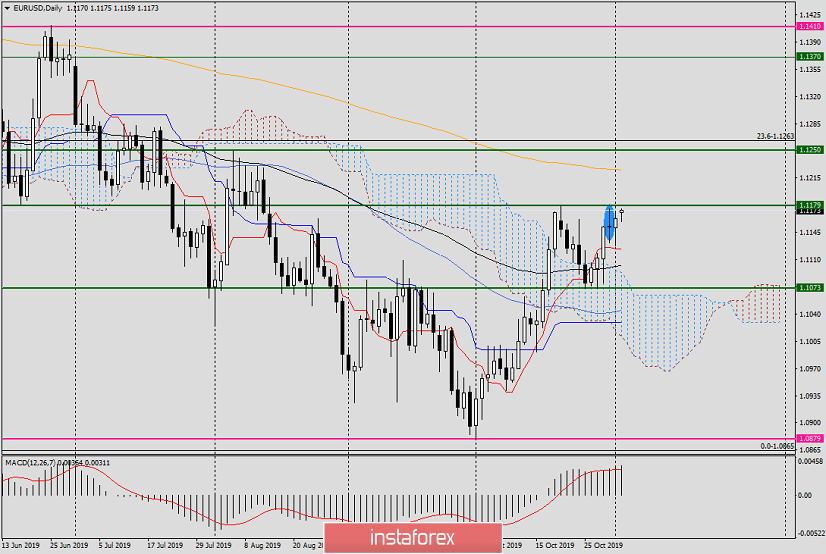

Daily

And the last chart that I would like to consider today is the daily one. However, the situation is quite delicate and uncertain.

Although the pair came out of the Ichimoku cloud and then closed above the Tenkan line three days in a row, the Doji rickshaw candle formed on October 31 is a reversal bearish pattern. As long as this pattern is not blocked by growth and the pair has not broken above 1.1180, the probability of a reversal to a decrease should not be discounted.

In the current situation, I do not want to give specific trading recommendations. It is better not to hurry and wait for a little.

In my opinion, the exit from the current trading range of 1.1179 – 1.1073 may indicate the further direction of EUR/USD. Tomorrow, we will look at lower timeframes and try to find points to enter the market.

And yet, in conclusion, I would like to express my personal opinion that a bullish scenario still looks the most likely. Some cautious optimism, if you like. Till tomorrow.

Have a nice day!