To open long positions on GBP/USD, you need:

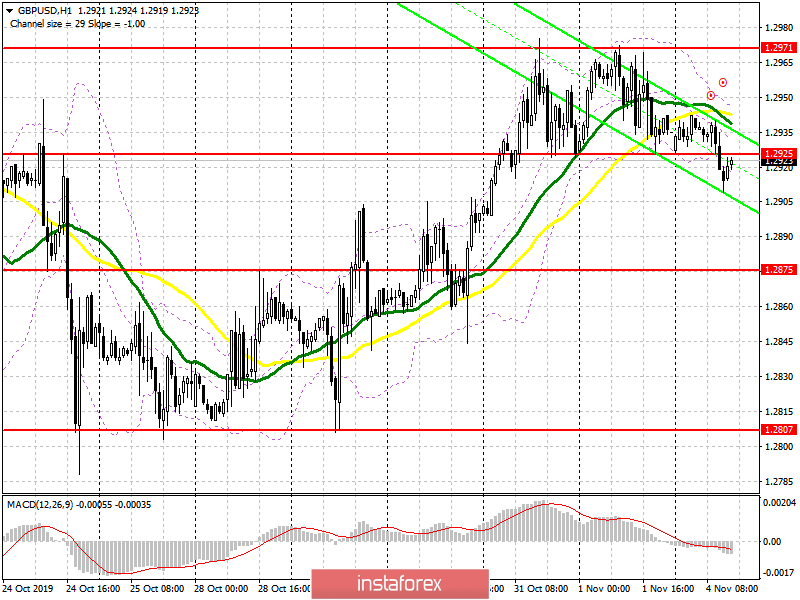

The lack of news on Brexit returns the market to a calmer track. Buyers of the pound failed to keep the pair above the intermediate support of 1.2925, which I paid attention to in my morning review. Weak data on activity in the UK construction sector helped sellers gain a foothold below this range. At the moment, it is best to consider long positions in GBP/USD only after returning to the morning resistance of 1.2925, which will push the pound higher to the highs of 1.2971 and 1.3017, where I recommend taking the profits. While maintaining pressure on the pair, it is best to consider new long positions after updating the minimum of 1.2875.

To open short positions on GBP/USD, you need:

Against the background of weak data on the construction sector, the bears coped with the morning task and consolidated below 1.2925. While trading will be conducted under this range, we can expect the continuation of the downward correction to the support area of 1.2875, where I recommend taking the profits. If the sellers do not show any activity in the US session, and the pair returns to the resistance of 1.2925, it is best to count on new short positions after updating the last week's high of 1.2971, or on a rebound from the larger monthly high of 1.3017.

Indicator signals:

Moving averages

Trading is conducted around 30 and 50 daily averages, which indicates the lateral nature of the market.

Bollinger Bands

If the pound rises, the upper limit of the indicator around 1.2955 will act as a resistance.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20