Economic calendar (Universal time)

Today is not characterized by saturation and importance of indicators of the economic calendar, so most likely, the day will be held at a minimum of activity again and without emotional outbursts. However, there are some points to pay attention to. In the near future (9:30), we will expect significant statistics from the UK (composite index PMI + index of business activity in the service sector). Moreover, important statistics from the US will be released today at 15:00 (index of business activity in the non-manufacturing sector + the number of open vacancies in the labor market).

EUR / USD

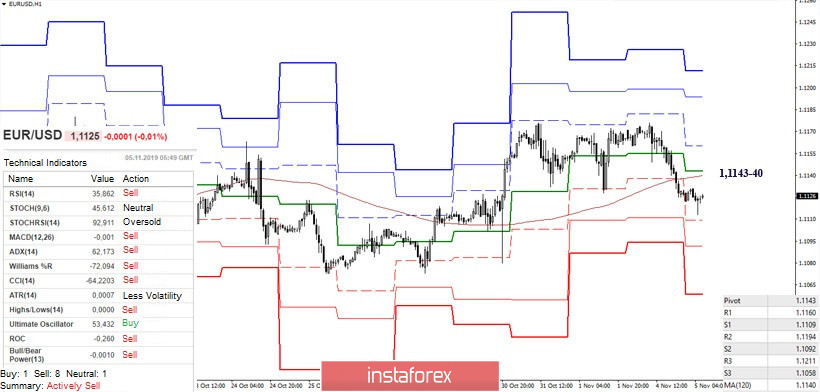

Having coped with the tasks and, apparently, lost a lot of energy, the players took a break for an increase, returning to the support of the daily short-term trend (1.1124) yesterday. The loss of this support will result in a deepening daily downward correction. In this case, the following support levels and zones may come into operation - 1.1082-65 (daily cloud + weekly Fibo Kijun) and 1.1030 (daily Kijun + weekly Tenkan). If the pair manages to stay in the zone of attraction formed by the weekly Kijun (1.1146) and the monthly Tenkan (1.1164), while maintaining the support for the daily short-term trend (1.1124), then we can expect that after a pause and consolidation, the rise will continue. Today, the upward benchmarks remained the same - 1.1208-20 (the lower boundary of the monthly cloud + the final boundary of the weekly dead cross + historical level) and 1.1287-1.1333 (target for the breakdown of the daily cloud + lower limit of the weekly cloud).

The downward correction led to a change in the balance of power of lower time intervals. Thus, technical indicators were rebuilt to support players to lower, so now, the priority is to maintain and develop bearish sentiment. Today, the downward trends within the day are 1.1109 (S1) - 1,1092 (S2) - 1.1058 (S3). Key resistances that are possible to delay the development of the situation, and if not changed, then add uncertainty to it, are currently located at 1.1143-40 (weekly long-term trend + central Pivot level). Further, the role of resistances can be performed by the classic pivot levels - 1.1160 - 1.1194 - 1.1211.

GBP / USD

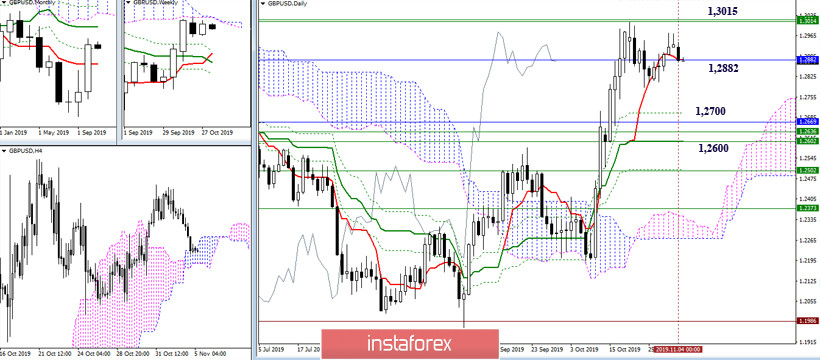

The lack of necessary opportunities and, as a result, some activity among the players to increase led the couple to significant support for this area of 1.2882 (daily Tenkan + monthly Fibo Kijun). A reliable consolidation below is likely to provoke the development of a daily downward correction. This is now facilitated by a significant discrepancy in the levels of the daily cross (Tenkan 1.2882 - Kijun 1.2603). The support zone, which in this case will become the main bearish reference point, is located in the region of 1.2700 - 1.2600 (daily Fibo Kijun and Kijun + monthly Tenkan + weekly Tenkan and Fibo Kijun).

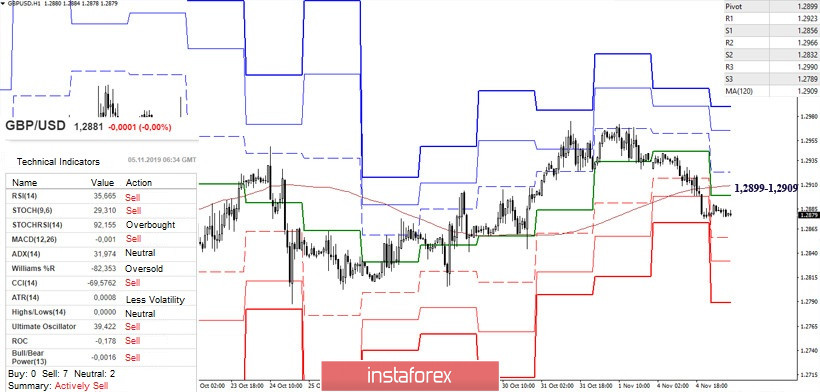

At the moment, technical indicators at lower time intervals give preference to players for a fall. The downward trends within the day are the support of the classic pivot levels 1.2856 - 1.2832 - 1.2789. Today, with the development of an upward correction on H1, the most significant resistance zone is located in the region of 1.2899 - 1.2909 (central pivot level + weekly long-term trend). Consolidating above will affect the current balance of forces and, possibly, will lead to further strengthening of the players' positions on the increase.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)