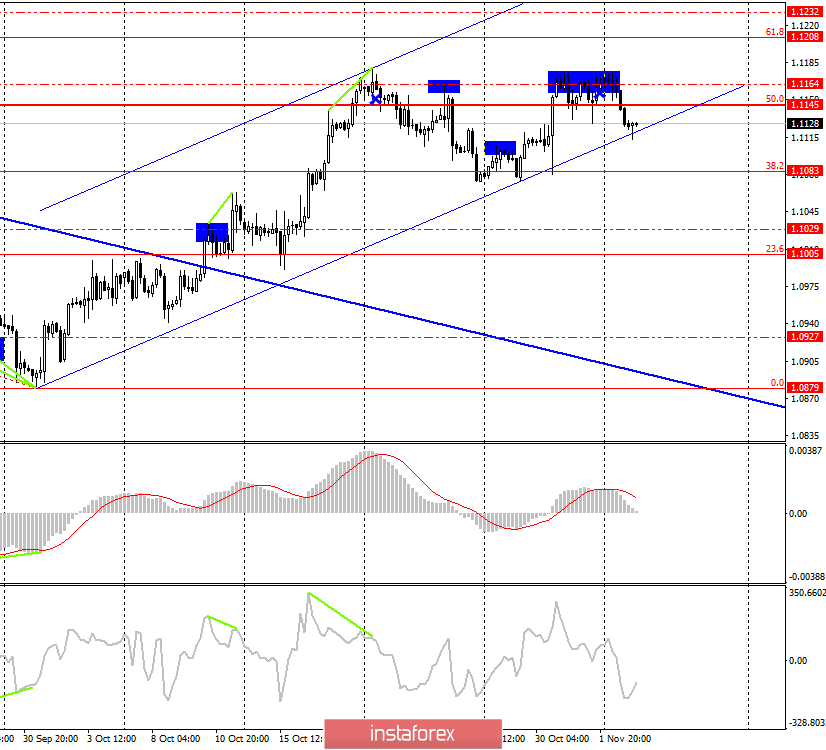

EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair performed a reversal in favor of the US currency near the level of 1.1164, from which it performed another rebound, although it showed signs of closing over it. At the moment, the pair's quotes have performed a fall to the bottom line of the upward trend channel, which has been rebuilt several times due to the ambiguous behavior of the euro/dollar pair. Fixing the pair's rate under this line will work in favor of continuing the fall towards the next correction level of 38.2%, and most importantly – will indicate a "bearish" mood of traders.

For the euro/dollar pair, Monday was relatively uninteresting, although there were economic reports, the euro did not stand still, and Christine Lagarde made a speech. However, all these events were not impressive. In short, business activity in the manufacturing sector of the eurozone remained at a depressing level, Christine Lagarde devoted her speech only to general phrases about "the need to unite in a difficult moment for the European Union." But a very loud statement was made by the Head of the Central Bank of Hungary Gyorgy Matolcsy. He said that EU countries should be able to abandon the euro currency in the coming years. According to Mr. Matolcsy, the European Union, which has become a successful, profitable and useful solution for all countries, did not need the introduction of a single currency at all. EU member states have not benefited from the use of the euro.

"It's time to wake up from a useless dream. For various reasons, a single currency is a trap for almost all members of the European Union. EU states must recognize that the euro was a strategic mistake. The creation of a new global currency, competing with the dollar, posed a challenge to America. The European course has provoked an open and secret war of the USA against the EU, which has been going on for the past two decades," Mr. Matolcsy said. The head of the Central Bank of Hungary also states that the idea of competing with America through the introduction of the euro currency is risky in itself.

It is difficult to imagine how real the idea of abandoning the use of the European currency is. However, in one form or another, it has emerged from time to time since 2011, with the onset of the debt crisis in Greece, Spain, Portugal, and other eurozone countries. Mario Draghi, who is called the "savior of the euro," did everything in his power, but would Christine Lagarde stick to his policy.

Forecast for GBP/USD and trading recommendations:

On November 5, traders will attempt to consolidate under the upward trend channel. This line is now extremely important for the prospects of the US dollar. Closing under the channel will allow us to count on a stronger strengthening of the dollar, despite all the political showdowns that have taken place recently between Democrats and Donald Trump. The former wants to remove the US president from office, accusing him of high treason and abuse of power, the latter wants to be re-elected for a second term, for which he needs to lower the political ratings of his main rival, Democrat Joe Biden. So far, the US dollar is not experiencing any pressure in connection with the impeachment procedure of the president. So it may well continue to grow.

The Fibo grid is based on the extremes of June 25, 2019, and October 1, 2019.