To open long positions on EURUSD, you need:

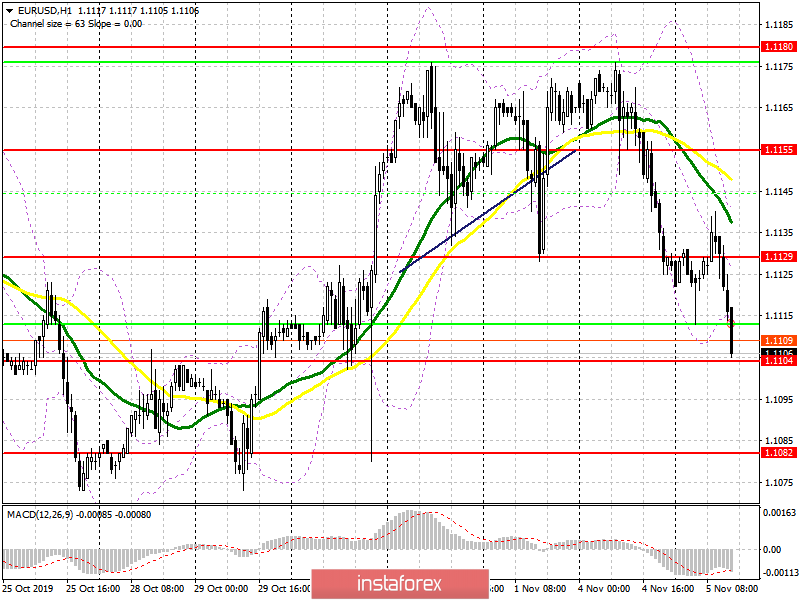

Data on the lack of growth in eurozone producer prices once again pointed to problems with inflation, which hit the positions of the European currency, which reached the support level of 1.1105, which I drew attention to in my morning survey. At the moment, only the formation of a false breakdown in this area will be a signal to open long positions, otherwise, it is best to buy the euro for a rebound from a larger minimum of 1.1082. The main task of the bulls will be to return to the resistance level of 1.129, which was not done in the first half of the day. Only after that, it will be possible to talk about updating the larger highs in the area of 1.1155 and 1.1180, where I recommend taking the profits.

To open short positions on EURUSD, you need:

Sellers coped with the morning task and did not let the euro above the resistance of 1.1129, and the formation of a false breakdown in this range led to another wave of decline in EUR/USD to a minimum of 1.1104. The purpose of the bears for the second half of the day will be a breakthrough and this support, which will increase the pressure on the pair and push it even lower to the area of 1.1082, where I recommend taking the profits. The report on activity in the non-productive sphere of the USA will be able to help in this. In the scenario of EUR/USD growth after the report, it is best to consider new short positions when forming a false breakdown in the resistance area of 1.129 or sell the euro immediately on a rebound from the maximum of 1.1155.

Indicator signals:

Moving Averages

Trading is below the 30 and 50 moving averages, indicating a further decline in the euro.

Bollinger Bands

In the case of an upward correction, it is best to open short positions on the euro on a rebound from the upper border of the indicator around 1.1140.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20