The British pound only slightly strengthened against the US dollar after the news that the UK services sector again began to show signs of life. The service sector is a critical sector for the UK economy, and its proximity to another recession will negatively affect the prospects for economic growth, which also leaves much to be desired. The uncertainty of the immediate political and economic prospects put pressure on this area.

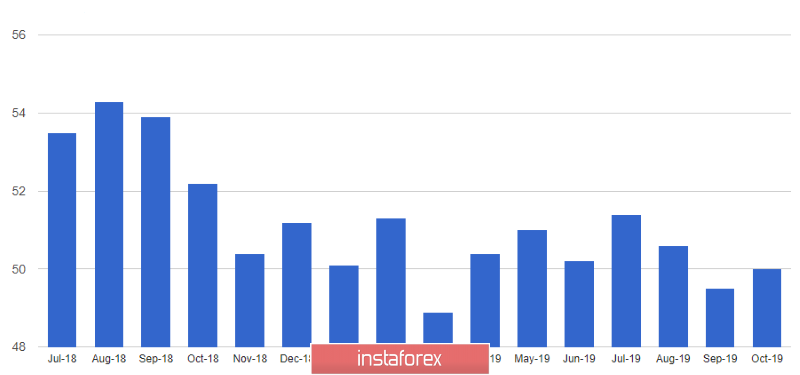

According to the IHS Markit/CIPS report, the index of procurement managers for the UK services sector rose to 50.0 points in October this year after a sharp decline to 49.5 points in September. Economists had expected the index to go even lower in October at 49.0 points. Let me remind you that a value above 50 points indicates an increase in activity. Despite the positive aspects, the report indicates that growth was mainly achieved through the conclusion of new contracts, while new orders continued to decline. Decrease in orders is observed for the second consecutive month, which will negatively affect the index in the future.

It is not surprising that experts attribute the protracted Brexit process to the problems of the sector, on which there is still no certainty. Another delay and the holding of general elections do not add confidence to the market and traders.

Let me remind you that a regular meeting of the Bank of England will be held on Thursday, at which forecasts on the rates of economic growth and inflation will be lowered, which will put additional pressure on the British pound. Talking about the prospects for raising interest rates in the current conditions will be ridiculous.

A number of economists do not predict that the Bank of England will go for any incentive measures, and even more so for changes in monetary policy. According to CME Group, the futures market estimates the likelihood that the Bank of England will leave rates unchanged on Thursday at 99%. The current rate is 0.75%.

More serious pressure and a surge in market volatility will be exerted by opinion polls, which is much more important than current monetary policy or economic data, as the fate of Brexit directly depends on this.

Regarding the current technical picture of the GBPUSD pair, support continues to be provided by the level of 1.2875, a break through which will increase the pressure on the pair and will lead to the updating of the lows in the region of 1.2840 and 1.2800. A breakthrough of this range will seriously affect the further technical drawing. To resume bullish growth, a return to the resistance of 1.2925 is required, which was lost yesterday. Only with such a nature of the market will it be possible to talk about updating the high of 1.2970 and returning the trading instrument to the area of 1.3020.

EURUSD

The European currency continues to decline gradually amid weak economic indicators.

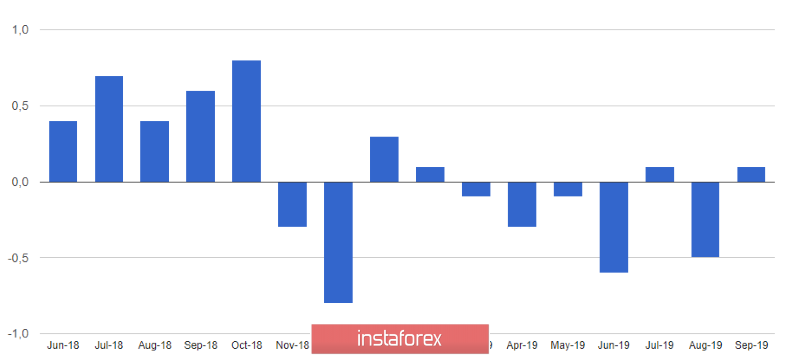

It would seem that the report on producer prices is not very important for the market, however, the lack of growth directly indicates that, despite all the actions of the European Central Bank, there is no steady inflation rate. Today is the above report, which stated that the eurozone PPI producer price index increased by only 0.1% in September of this year compared with August and immediately fell by -1.2% compared to September 2018. The data fully coincided with the forecasts of economists. The base index, which does not take into account energy sources, remained unchanged in September this year compared to August and grew by only 0.4% compared to September 2018.

As for the technical picture of the EURUSD pair, the bears continue to put pressure on risky assets, and the next break of support of 1.1100 may lead to a more powerful downward momentum of the trading instrument to the lows of 1.1050 and 1.1020.