The single European currency, despite the growing strengthening of the greenback, does not want to remain in the red. The euro is doing its best to stay afloat, and the currency most often succeeds. Analysts pay attention to reducing risks for the single currency, which also contributes to a positive mood.

The main risks for the European currency are the slowdown of both the global economy and the eurozone economy, as well as the threat of a chaotic Brexit. The latter factor is now weakened, analysts said. Uncertainty in trade relations between the US and China, weakening the dollar, also plays into the hands of the euro. Reducing key risks gives the single currency the strength and confidence to move on, while maintaining the hope of strengthening.

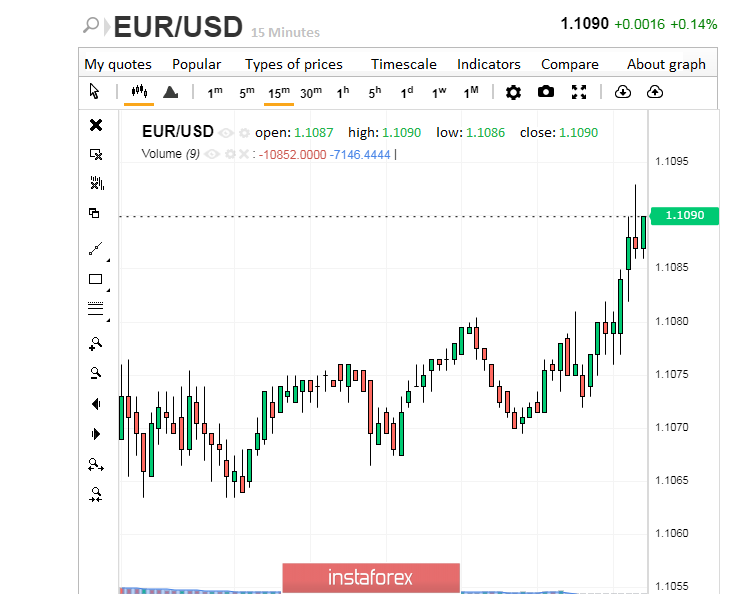

Reducing the risks for the euro encouraged investors and helped to improve the business climate in the eurozone, analysts at MUFG Bank said. However, the single currency is still trading near an annual low between $1.1000 and $1.1100. On Tuesday, November 5, the EUR/USD pair failed to continue to grow. She dipped 0.34% to 1.1090. On Wednesday morning, November 6, the EUR/USD pair was trading in the low range of 1.1077–1.1078, trying to rise up.

The growth attempt was unsuccessful. After some time, the classic pair was even lower, at the level of 1.1073.

The euro did not lose hope, which nevertheless came true. The EUR/USD pair managed to overcome the price barrier and rise to the levels of 1.1079–1.1080.

Now the pair has gained height, successfully trading within 1.1089–1.1090 and showing a tendency to further rise.

According to economists at MUFG Bank, the growth potential of the euro is limited by using it as a financing currency. This narrows the range of application of the euro, analysts said. Recall, the single currency is a product of current political agreements. Their abolition can lead to economic disasters comparable to or even surpassing the 2008 financial crash, analysts emphasize.

In the near future, analysts do not expect a powerful movement of the classic currency pair. However, in the short term, they assess the euro's chances as positive. Analysts recommend short-term purchases when analyzing the dynamics of the EUR/USD pair. They are confident that reducing current risks will help raise the European currency.