The euro slightly strengthened against the US dollar, and the downward movement in the EURUSD pair, observed since the beginning of this week, has stopped. The good data on the growth of the services sector of all the major countries of the eurozone, as well as the increase in orders in the German industry, although they did not return faith in the rapid growth of the euro region's economy, they managed to push away thoughts of stagnation.

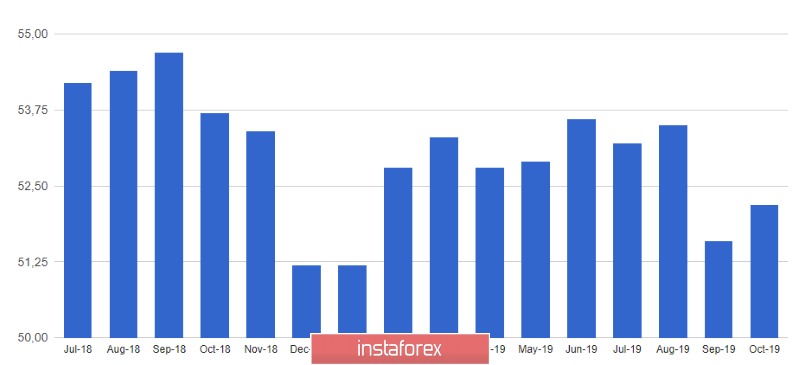

According to the data, the Purchasing Managers Index (PMI) for Italy's services sector rose to 52.2 points in October this year against 51.4 points in September, while economists had expected a decline to 51.0 points. In France, a similar indicator in the service sector rose to 52.9 points in October, against 51.1 points in September this year, although growth was forecast at 52.9 points.

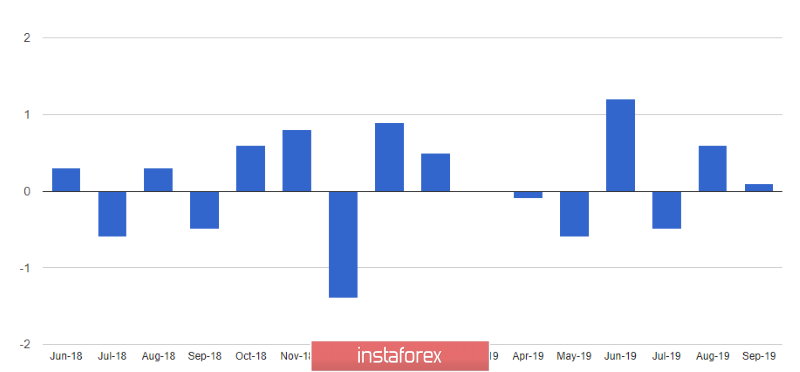

Germany also managed to please today with fundamental statistics. Even before the opening of trading on European markets, data showed that the stagnation of the economy, apparently, could be avoided. The report indicates that orders in the German manufacturing sector increased in September this year, which indicates the likelihood of stabilization after a significant reduction. So, orders in the domestic market compared to August 2019 immediately increased by 1.6% with a growth forecast of only 0.1%.

However, the ongoing trade conflicts and protectionist measures by the United States continue to negatively affect not only the foreign market, but also the domestic one, as companies continue to look pessimistically into the future, reducing investment. It should be noted that, despite the positive report, there is little optimism, since a decrease was observed in orders for machine tools and equipment, while growth was demonstrated only by the volatile category "other orders". Domestic orders in the German engineering sector in September fell 9% compared to the same period last year.

With regard to the service sector, according to Markit, the PMI for the German services sector rose to 51.6 points in October this year against 51.4 points in September. Economists had forecast a decline to 51.2 points. As can be seen from the report, problems in the manufacturing sector in Germany have not yet reached the service sector, which economists so much feared.

As I noted above, in the eurozone as a whole, the PMI for the services sector rose to 52.2 points in October with a forecast of 51.8 points. In September, the indicator was at the level of 51.6 points.

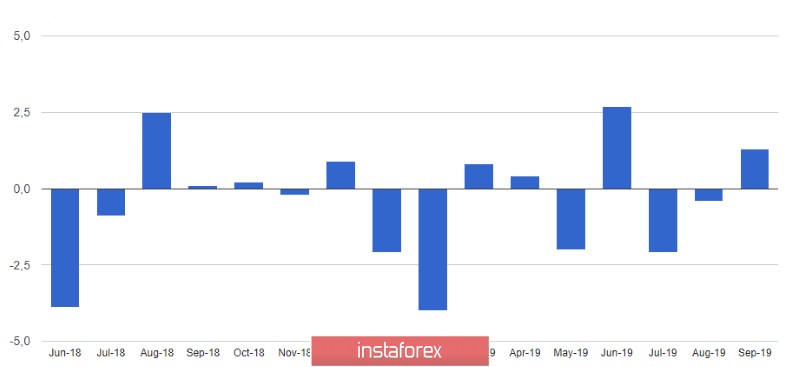

Retail sales were ignored, as they completely coincided with the forecast. Given the weak sales figures, one can hardly expect more intensive GDP growth in the third quarter of this year. The report indicates that retail sales in the eurozone increased by only 0.1% in September of this year and by 3.1% compared to the same period in 2018. In August, sales were revised to 0.6% and 2.7%, respectively.

As for the current technical picture of the EURUSD pair, the further weakening of the European currency is in question. It can be seen how the sellers took a short pause to clarity in the negotiations between the US and China, and the small upward correction, which is now being formed, will allow the bears to return to the market at more reasonable prices. The nearest resistance levels are seen in the areas of 1.1105 and 1.1150, where the trading instrument is now aiming for. As for the downward movement, it will be limited by an intermediate support level of 1.1050, however, a larger range can be seen around 1.0995 and 1.0940.