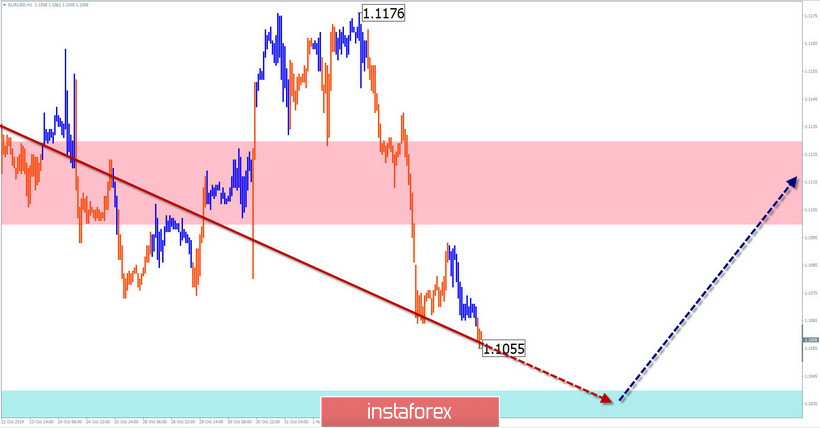

EUR/USD

Analysis:

The direction of intraday trends of the euro is set by the algorithm of the rising wave of September 3. In a larger wave model, this is a correction. Its structure does not look complete. Within its framework, a counter corrective wave has been forming in the last 2 weeks. The price is approaching the upper boundary of the preliminary target zone.

Forecast:

In the coming sessions, the price is expected to decline, until the full completion. By the end of the day, the probability of a reversal and a price rise increases. The turnaround time is likely to be adjusted with the release of news blocks from the US.

Potential reversal zones

Resistance:

- 1.1100/1.1130

Support:

- 1.1040 / 1.1010

Recommendations:

Euro sales are possible in the next session with a reduced lot. In the support area, it is recommended to monitor the instrument purchase signals.

AUD/USD

Analysis:

The Aussie chart is dominated by a bearish trend. On September 12, the next wave on the main course started. All last month, a counter wave developed, which in the structure became a correction. At its end, a small-scale reversal wave formed.

Forecast:

Today, a flat mood is expected. In the morning, pressure on the support zone is possible. By the end of the day, volatility is expected to increase and the price will roll back to the resistance zone. A short puncture of the boundaries of the designated zones is not excluded.

Potential reversal zones

Resistance:

- 0.6930/0.6960

Support:

- 0.6860/0.6830

Recommendations:

Supporters of long-term trading should refrain from entering the pair's market today. Until the emergence of clear signals of sale, the main direction of transactions for the intraday remains purchases. A lot more sensible to reduce.

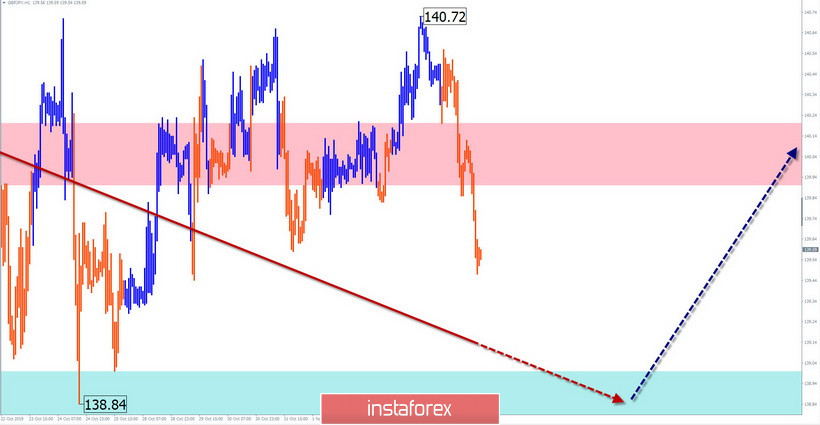

GBP/JPY

Analysis:

The direction of the short-term trend of the cross is upward. In the wave of August 5, from mid-October, an intermediate correction is formed in the form of a flat. After its completion, the main wave will continue.

Forecast:

In the first half of the day, the pair is expected to go down. In the US session, you can expect the beginning of the price rise. A sharp increase in volatility is possible. The reference point for a reversal may be the release of news on the American dollar.

Potential reversal zones

Resistance:

- 139.90/140.20

Support:

- 139.00/138.70

Recommendations:

Sales are relevant today for intra-session trading. When comprehending the price of the calculated support area, it is recommended that the main attention be paid to the emerging signals of the pair's purchase.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure, dotted – the expected movement.

Attention: The wave algorithm does not take into account the length of time the tool moves!