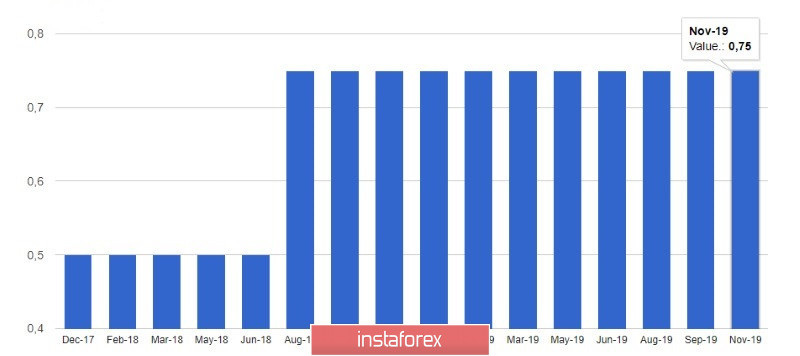

The British pound resumed its decline against the US dollar after the Bank of England left the key interest rate at 0.75%. However, this decision was not the catalyst for pound sales. It can be seen from the minutes of the meeting that the number of votes cast to lower the key rate was seven to two. Seven people voted to keep the key interest rate unchanged, and two people voted to lower the rate to 0.50%, which and led to the sale of the pound.

Haskel and Saunders, who voted in favor of lower rates, said the risks from a weak global economy and persistent uncertainty around Brexit continue to put pressure on the UK economy, which needs further stimulus. They also pointed to signs of a changing situation in the labor market.

As I noted in the morning review, the Bank of England revised its forecasts for GDP growth and inflation. Traders were not very pleased with the fact that the English regulator predicted acceleration of inflation only by the middle of 2020, and its return to the target level only by the 4th quarter of 2022. Such a scenario retains a rather high probability of further lowering of interest rates, if necessary, since there is no threat of a sharp inflationary jump.

As for economic growth, Bank of England economists expect GDP growth in the 3rd quarter of 2019 at 0.4%, and in the 4th quarter at 0.2%. The risks that could affect the economic recovery are shifted in the negative direction, reflecting the uncertainty regarding the details of the trade agreement and Brexit. The Bank of England predicts that growth in company investment will accelerate economic growth and expects UK GDP growth in the 4th quarter of 2022 to 2.1%. By 2020, the economy should show growth of 1.6%.

As I noted above, the regulator did not rule out the possibility of a rate cut if global growth disappoints and the uncertainty surrounding Brexit does not go anywhere. The BoE will return to the cycle of raising rates only after accelerating economic growth in accordance with forecasts.

As for the technical picture of the GBPUSD pair, it has not changed much. Pound sellers have achieved major support in the region of 1.2805, which led to a slight profit taking, however, the pressure on the trading instrument is likely to continue. A break of 1.2805 will lead to the sale of the pound in the area of 1.2760 and 1.2710. It will be possible to talk about the return of buyers to the market only after consolidating above the resistance of 1.2880, from which the current decline in the pound is observed.

On the other hand, economic news is now less important for the pound than the publication of opinion polls about the general election in the UK, which will be held in December this year. The direction in the GBPUSD pair will depend on the results of the polls, since the clear advantage of the Conservative party will indicate the implementation of the Brexit scenario by the end of this year.

EURUSD

Today's European Commission report has limited the upside potential of the European currency in the morning. Although traders ignored data on a sharp reduction in German industrial production, the revision of forecasts for GDP growth for the worse did not go unnoticed.

According to data, German industrial production fell immediately by 0.6% in September of this year compared with August, and fell by 4.3% compared to the same period in 2018. Economists had expected a decrease of only 0.4% and 4.4%, respectively. Weakness in the industrial sector remains a major problem in Germany, the economy of which is gradually sliding into a technical recession.

As I noted above, the report of the European Commission put pressure on the euro. According to the data, eurozone GDP growth will be only at 1.1% in 2019 compared to the previous forecast of 1.2%. By 2020, the economy will add only 1.2%, against the previous forecast of 1.4%, as in 2021.

As for inflation, it is forecasted at 1.2% in 2019 against the previous forecast of 1.3%. By 2020, at 1.2% against the previous forecast of 1.3%. Unemployment in the eurozone in 2019 is expected to reach 7.6% against the May forecast of 7.7%.

All this suggests that the actions of one European Central Bank are not enough to maintain economic growth in the region and it is necessary to use all available levers, including through fiscal policy by increasing costs. The current uncertainty that has emerged due to the US-China trade war, Brexit situations and geopolitical tensions are also holding back investment and production activity in the region, which will preserve a period of weak inflation in the future.

As for the technical picture of the EURUSD pair, sellers will continue to focus on breaking the support of 1.1050, which will increase pressure on the trading instrument and lead to updating lows of 1.1020 and 1.0970. The areas of 1.1090 and 1.1130 can be considered as stable resistance levels.