4-hour timeframe

Amplitude of the last 5 days (high-low): 44p - 44p - 51p - 76p - 28p.

Average volatility over the past 5 days: 49p (average).

The fourth trading day of the week was again in a downward movement for the EUR/USD pair. The pair tried to start a new round of upward correction at the beginning of the European trading session, but very soon the mood of traders changed to a downward one. We have already said that now the general economic picture and technical factors speak in favor of continuing the fall of the euro and the growth of the US dollar. The bulls showed extreme weakness after October 21, and the bears simply waited for their moment and calmly moved to new short positions. The euro/dollar has already fallen to the second support level of 1.1035 today. A price rebound from this level may trigger a round of corrective movement, but there are still no prerequisites for the start of an upward trend or strong growth of the European currency.

The only macroeconomic report of the day - industrial production in Germany - can be confidently called a secondary report. Firstly, even a report on industrial production in the entire eurozone could never be called a report of the first degree of significance. Secondly, this is just one country out of 27, one indicator out of 27, of which the total indicator for the EU is formed. However, it has long been known to everyone that the German economy is the locomotive of the European Union. If industrial production is reduced by 4.0% in September, and by 4.3% in October, this means that the problems are not only in Germany, but throughout the European Union. The most optimistic forecasts predicted a decline of 2.9%. As you can see, they were not destined to come true. Thus, the fall of the euro on November 7 is absolutely justified.

At the same time, the European Commission significantly, from our point of view, lowered its forecasts for GDP and inflation for 2019, 2020 and 2021. According to the organization's report, in 2019, eurozone GDP will increase by 1.1% (previously + 1.2% YOY), and in the next two years, growth will amount to 1.2%. According to the same report, the main reasons for the decline in forecasts and, in fact, the slowdown in all macroeconomic indicators of the EU lie in trade tension between China and the United States, which has a pronounced negative reflection on the entire world trade, as well as in geopolitical uncertainty. It is expected that global GDP growth will remain weak, respectively, the stability of the EU economy will depend more on the domestic market. The state of the domestic market will depend on the labor market and financial conditions. As for inflation, it is expected that this year it will not exceed 1.2% YOY, in the next two years it may accelerate to +1.3%.

What can I say? Regarding inflation ... We recall that the target inflation rate of the ECB is 2.0% and the unattractiveness of the euro in global currency markets is already becoming clear. We look at the current inflation rate (+ 0.7% YOY) and understand that the indicator may significantly fall short even before the forecasts of the European Commission. We look at the current parameters of the ECB monetary policy and understand that it is becoming more and more difficult to stimulate the economy, as there are not so many tools for this. What should the regulator do next? To further reduce the key rate? Further expand the quantitative easing program? Apply a helicopter money policy? All these questions can now be addressed to Christine Lagarde. But the question "why the euro is falling and will it fall in the future?" can be answered by almost any trader.

The hope of salvation, as usual, lies somewhere overseas. It is the United States that has to significantly worsen their macroeconomic indicators, lower the Federal Reserve rate to a negative value, print dollars in tons to overtake the EU economy in weaknesses. It is in this case that we can expect a strong strengthening of the European currency against the American one. But since such an outcome is not expected in the near future, it is likely that the decline will continue slowly but surely. From a technical point of view, all indicators are directed downward, which indicates a downward trend. This week, even hypothetically, due to what the mood of traders will change to the upward. Not a single report will be published today. The University of Michigan consumer confidence index (preliminary value) will be released tomorrow.

Trading recommendations:

EUR/USD continues to move down. Thus, it is now recommended to sell the currency pair with targets of 1.1035, 1.1015 and 1.0997. Turning the MACD indicator up may indicate a round of correction, but it seems that traders are set for large and long-term sales of the euro, so a strong correction is not expected. It is recommended to return to purchases of the euro currency no earlier than the bulls breaking the Kijun-sen critical line.

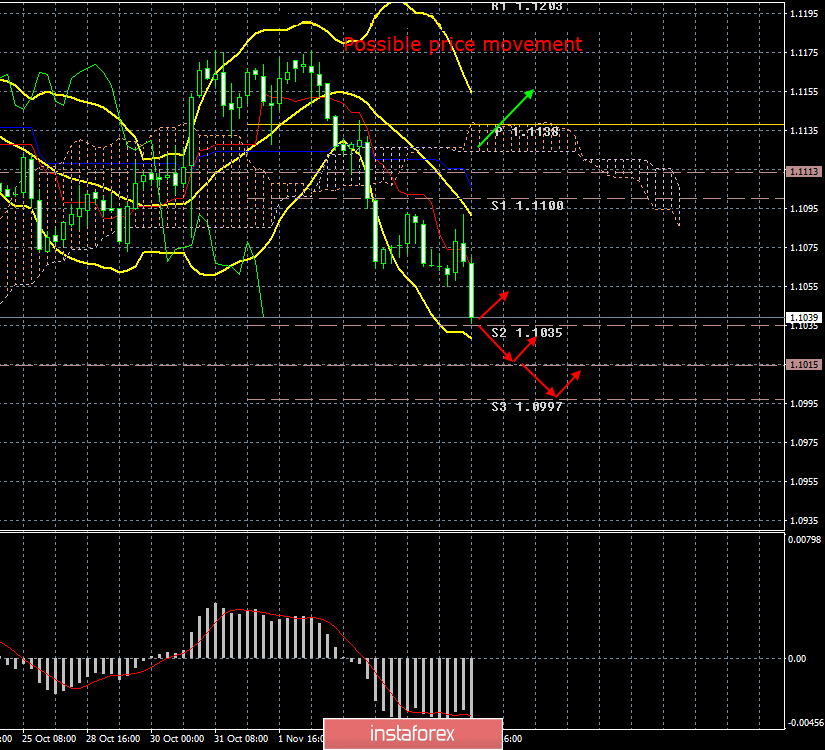

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.