Germany failed again, and the economic forecast from the European Commission turned out to be negative: such a fundamental background determined the dynamics of the euro-dollar pair yesterday. Amid an almost empty economic calendar, these fundamental factors will also have some influence today. Buyers of EUR/USD finally said goodbye to the 11th figure, especially after optimistic speeches by the Federal Reserve representatives. However, the bears also do not yet have the strength to scale down - the pair is stuck in the 1.1050 area in anticipation of further news impulses.

Just the day before yesterday, traders of the pair had certain reasons for optimism: the German indicator of production orders suddenly jumped by 1.3% in September with a modest growth forecast of only 0.1%. This despite the fact that in the summer months, this indicator, which is a leading indicator of the dynamics of industrial production, was in the negative area. The market talked about the possible recovery of the German economy, since the industrial sector has the most powerful influence on the dynamics of German GDP growth.

The European currency has reacted rather carefully to this release. The fact is that many analysts drew attention to another indicator - the volume of production shipments, which fell by 1.3% on a monthly basis. According to analysts, this dynamics indicates a decrease in the level of industrial production in Germany. They were not mistaken: the indicator of industrial production really turned out to be rather weak - in monthly terms the index came out worse than forecasts (-0.6%), and in annual terms it dropped to -4.3%. Such devastating figures offset all optimism regarding the recovery of the German economy, putting background pressure on the euro.

The economic forecast published yesterday by the European Commission also disappointed. EC experts have been publishing this document for six years (three times a year), voicing their assessment of the economic growth of both the eurozone as a whole as well as its countries. In the latest report this year, the European Commission has worsened their forecast for Eurozone GDP growth and inflation, warning at the same time that the European economy could lose stability next year. The reasons are the same - the global trade war, the slowdown in the global economy and the uncertainty with Brexit.

According to a published forecast, eurozone GDP will increase this year by only 1.1% (the previous estimate was at 1.2%). Longer-term forecasts for the next and 2021 were also revised downward (1.2% instead of the previous forecast of 1.4%). Here, the European Commission again focused on the negative consequences of the US-China trade war - according to them, if tensions between the superpowers persist, the eurozone will feel a further decline in investment, a slowdown in the manufacturing sector and export sector. In view of the slowdown in the global economy, according to EC experts, the pace of expansion of the European economy will depend on the stability of those sectors that are oriented to the EU internal market, which, in turn, depends on the state of the labor market, growth of salaries, consumer activity and, in general, the state of financial conditions.

Experts of the European Commission also evaluated the prospects of the "locomotive of the European economy" - Germany. Unfortunately, in this case, they also noted a worsening situation: the forecast for German GDP in 2019 was worsened to 0.4% (previously - 0.5%). In 2020, the growth rate should increase to one percent, but here the EC has revised the forecast towards a worse side (earlier it was at the level of 1.5%).

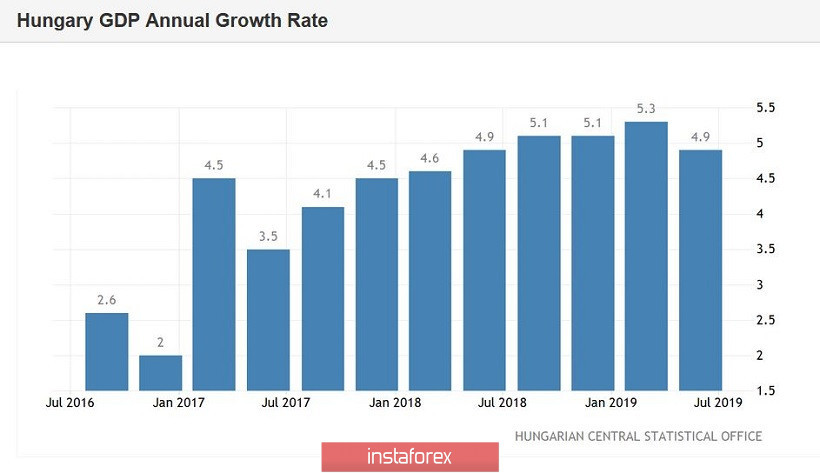

However, the report of the European Commission included positive aspects. For example, Brussels noted the growth of the French economy - it turned out to be more stable than expected in the third quarter. In addition, steady growth of the Spanish economy was recorded. In France, the European Commission expects the economy to grow by 1.3% in 2019 and 2020 and by 1.2% in 2021, in Spain by 1.9%, 1.5% and 1.4%, respectively. The highest economic growth rates this year are projected in Ireland (+ 5.6%), as well as in Malta (+ 5.0%) and Hungary (+ 4.9%).

But it is worth noting here that the situation in France looks a little better due to the smaller share of industrial production in GDP, as well as more active efforts in fiscal stimulation. But the Spanish economy, according to experts, showed good results thanks to the government's active efforts to stimulate revenue growth and domestic consumption.

What conclusions can be drawn from the above EC report? In principle, they all lie on the surface: the global trade war continues to have a negative impact on the world economy, and therefore on the economies of the leading countries of the world. Europe's manufacturing sector suffered the most from the global recession, so Germany was on the verge of a technical recession, as the industrial sector is pulling the German economy to the bottom.

It is noteworthy that in its recommendations, the European Commission called for the active use of "accessible fiscal space". Similar theses were recently voiced by Christine Lagarde, first acting as head of the ECB. She stated that European countries should "show courage" and take appropriate steps with fiscal measures and structural reforms. First of all, this message was about Germany, which adheres to a strict budget policy while completely ignoring requests from other EU countries to increase government spending. But, judging by the latest statements by representatives of the German Ministry of Finance, the corresponding signals from the ECB (and now the European Commission) were never heard. As German Finance Minister Olaf Scholz noted this week, global trade tensions could be reduced in the near future, and this fact could have a positive effect on the growth of the German economy.

In other words, Germany is still ignoring the calls of the ECB and the European Commission on the need for fiscal stimulus. All this suggests that Lagarde, in turn, will soften her rhetoric regarding the prospects of monetary policy, thereby exerting downward pressure on the euro.