Hello!

In today's article, we will analyze a couple of North American dollars. This is quite an interesting and technical currency pair, and this review will only confirm this.

But first, you should identify the events that today may have an impact on the price dynamics of USD/CAD.

At 14:30 (London time), reports on the labor market in Canada will be published: the unemployment rate, as well as the change in the number of employees. Do not forget about the publication of construction permits and the number of new foundations, but the main releases will still be labor.

In turn, the United States will provide investors with an index of consumer sentiment from the University of Michigan and the number of active oil drilling rigs from Baker Hughes.

I would like to remind you that the Canadian dollar is a commodity currency and correlates quite well with the movement of oil prices. However, a few years ago this correlation was more obvious, but the market is changing all the time and we need to take this into account.

Perhaps it is time to move on to the technical part of this review, and since weekly trading is closing today, I would like to look at the corresponding timeframe to understand the prospects for closing the current five-day period.

Weekly

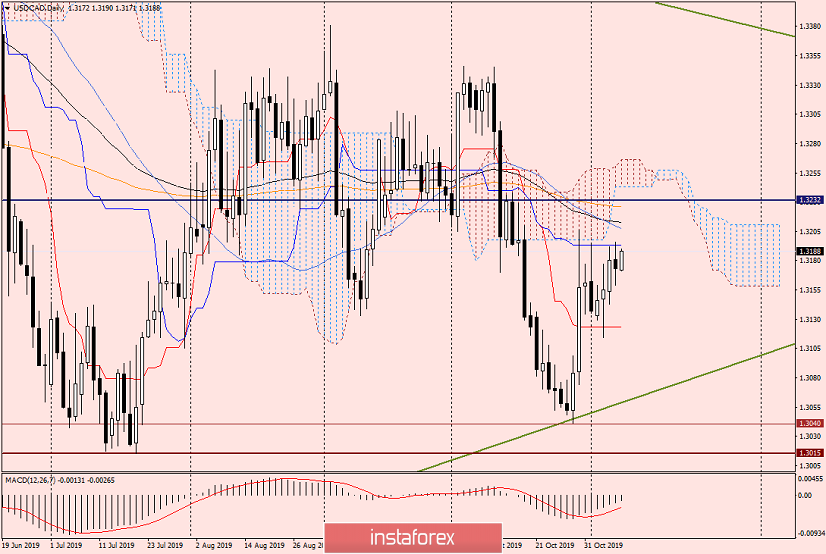

In my opinion, a rather interesting picture is observed on the weekly chart, which can affect the movement of the "Canadian", possibly even in the medium term.

It's about the Ichimoku indicator. As you can see, last week the lower border of the cloud and the Tenkan line repulsed the bulls on USD/CAD, showing themselves as a strong resistance. Now the past highs shown at 1.3206 are the nearest target of the players to increase.

It is significant that the Tenkan at 1.3194 and the lower border of the cloud (Senkou Span B) at 1.3203 so far continue to restrain the price approach to the highs of the last trading week.

In this regard, the importance of today's trading and the closing price of the whole week cannot be overestimated. If the November 4-8 session ends above Tenkan, the lower border of the cloud and 1.3206, there will be good prospects for continued growth. In this scenario, the first goal will be a strong technical level of 1.3232, the passage of which will open the way to the area of 1.3283-1.3289, where 50 MA and the Kijun line are located. The bulls' further targets are the upper cloud boundary and the green resistance line plotted at 1.4689-1.3563 points. In my opinion, only the exit from the cloud up and the true breakdown of the designated resistance line will finally determine the bull market for USD/CAD. It should be added that the 32nd figure is quite strong and often has an impact on the price.

And one more nuance. Do not forget that the Ichimoku indicator cloud is a zone of uncertainty, and quotes often linger there for a long time. However, much will depend on the external background, macroeconomic statistics, as well as market sentiment.

What conclusion can be drawn on the weekly timeframe? Readers will ask. Nothing! The author will answer. Buying under resistances is technically wrong, and there is no corresponding signal for sales, primarily candlestick.

Daily

The picture on the daily chart confirms the assumptions about the presence of strong resistance at the top, which can include the current one in the form of the Kijun line, and above 50 MA (1.3207), 89 EMA (1.3213) and 200 EMA (1.3226).

All the indicated moving averages are quite capable of providing strong resistance to the upward movement of the pair, so it is necessary to monitor the signals of Japanese candlesticks near these moves. If reversal candlestick patterns appear in the areas of the listed prices, this will be the basis for opening deals for sale.

It is also worth noting that the pair is trading between the Tenkan and Kijun lines, which offer resistance and support, respectively.

I believe that the breakdown of Kijun and consolidation under this line will also be a bearish factor for USD/CAD. In the case of such an outcome, on the rollback to the broken Kijun line, you can consider opening short positions.

As for today's trading, I would not advise opening a pair of deals. First, the last day of the week, and secondly, important labor statistics from Canada, which will undoubtedly have a strong impact on the results of daily and weekly trading.

If you are interested in the author's personal opinion on USD/CAD, then I have a bearish view on this currency pair, however, to open short positions, you need to wait for the necessary signals.

Successful completion of the week!