4-hour timeframe

Technical data:

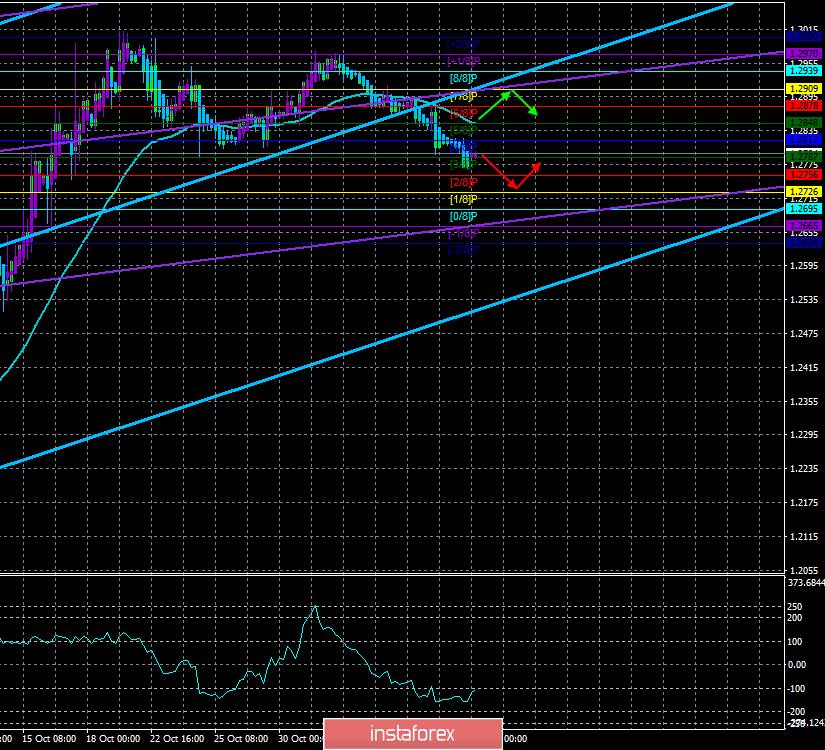

The upper channel of linear regression: direction – upward.

The lower channel of linear regression: direction – upward.

The moving average (20; smoothed) – down.

CCI: -110.9867

The British pound continues a calm and unhurried downward movement. The situation is somewhat similar to the picture for the EUR/USD pair, where there was also a consolidation below the moving average, and both channels of linear regression are directed upwards. Since the British currency also has no special grounds for an upward movement, we believe that the decline will continue. At the moment, there are no signs of the beginning of a corrective movement. Volatility remains "average" for the pair, however, it is surely approaching the definition of "weak".

In the article on EUR/USD, we said that the beginning of the week for this currency pair will be extremely boring and uninteresting. However, this does not apply to the GBP/USD currency pair, paradoxically. Yes, it is in the UK that important macroeconomic data will be published today and tomorrow, after two weeks of almost complete "fundamental calm". Today there are data on GDP for September, the third quarter (preliminary value) and industrial production in September. Unfortunately for the pound, one should not expect anything optimistic from these reports. In monthly terms, GDP is expected to fall by 0.2%, quarterly – a growth of 0.3% is expected, but in annualized terms, most likely, the growth rate of Gross Domestic Product will follow from +1.3% to +1.1%. Well, you don't have to say much about industrial production, since it is clear to absolutely everyone that with the indicators of business activity in the manufacturing sector that have been in recent months in all countries of the eurozone, we can't talk about any growth in this industry. Experts predict a decline in industrial production in September by 1.2% y/y. Accordingly, if the forecasts come true, then traders will not have any reason to buy American currency from traders. Well, tomorrow in the UK no less important data will be released on the change in the average wage in September, as well as the unemployment rate. As you can see, traders will analyze at the beginning of the trading week.

However, we also believe that the British pound will not get much help from these macroeconomic statistics. We believe that the market has entered a phase where sales of the British currency are "approved" by most market participants and even if the British statistics turn out to be positive, particularly strong purchases of the pound will not follow. The problem is, firstly, the strengthening of the British currency by 800 points a few weeks ago, from our point of view, absolutely unjustified, and after which there was no strong downward correction. And secondly, in the general fundamental background, which, given the unresolved Brexit and the uncertainty of the election results on December 12, remains negative. Thus, we believe that the downward movement will continue at least based on these two factors. Also, do not forget that the Bank of England has made it clear to traders that a reduction in the key rate could follow, which would mean stimulating the economy by the British regulator. Since technical factors are now also on the side of the continuation of the fall of the pound/dollar pair, the "puzzle" develops in the best way. In any case, as long as the price is below the moving average line, it is recommended to consider only the purchase of the US dollar.

There is absolutely nothing to say on the topic of the upcoming parliamentary elections, all parties continue to prepare for the most important day for Great Britain over the past few decades, and experts, meanwhile, continue to declare that the results of these elections can be extremely mixed and unexpected.

Nearest support levels:

S1 – 1.2787

S2 – 1.2756

S3 – 1.2726

Nearest resistance levels:

R1 – 1.2817

R2 – 1.2848

R3 – 1.2878

Trading recommendations:

The GBP/USD pair has settled below the moving average line and continues its weak downward movement. Formally, traders can consider selling the pound with targets of 1.2756, 1.2726, and 1.2695. However, we still recommend trading small volumes, as both trend channels of linear regression remain directed upwards, and the volatility of the pair is now quite low. However, it remains more preferable to the downward movement of the pair in the coming days.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression – the blue line of the unidirectional movement.

The lower channel of linear regression – the purple line of the unidirectional movement.

CCI – the blue line in the regression window of the indicator.

The moving average (20; smoothed) – the blue line on the price chart.

Support and resistance – red horizontal lines.

Heiken Ashi – an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.