EUR/USD

Analysis:

In the dominant downward trend of the European pair, the short-term wave from September 9 has a counter-course. The wave has the form of a stretched plane and has reached the minimum possible proportions of its parts. Since October 21, a wave zigzag has been developing downwards. So far, it does not go beyond the correction of the previous wave. The price has reached the potential reversal zone.

Forecast:

Today, there is a high probability of a flat mood of the movement, in the price corridor between the counter zones. In the upcoming session, an upward vector is likely. By the end of the day, you can expect a return to the bearish rate.

Potential reversal zones

Resistance:

- 1.1080/1.1110

Support:

- 1.1020/1.0990

Recommendations:

Until there are clear reversal signals, trading in the euro market can be risky. Within the intraday style, short-term deals are possible, according to the expected sequence.

AUD/USD

Analysis:

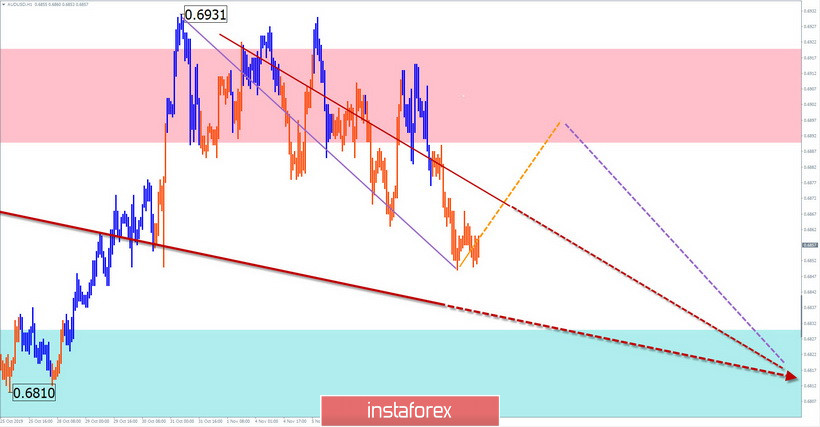

The price of "Aussie" in the last 2 years has been shifted down by a downward trend. Its last section started on September 12. The wave is of irregular form, it is nearing completion of the middle part (B). The bearish section from October 21 has the appearance of an expanding plane.

Forecast:

The range of the expected daily course is limited by the calculation zones. The move to the upper limit can be expected in the morning. By the end of the day, a bearish course is more likely.

Potential reversal zones

Resistance:

- 0.6890/0.6920

Support:

- 0.6830/0.6800

Recommendations:

Before the appearance of clear signals of a change in the purchase rate, the pair is a priority. As part of the intraday, short-term sales with a reduced lot are possible today.

GBP/JPY

Analysis:

The main direction of the short-term trend is upward. The bullish wave of August 5 reached the zone of a potential reversal. Since the middle of last month, the price is in a flat price corridor, forming a correction to the entire previous rise.

Forecast:

The current mood of the pair will continue today. In the next session, a short-term pullback to the resistance zone is not excluded. At the US session, a new round of decline is expected in the area of settlement support.

Potential reversal zones

Resistance:

- 139.90/140.20

Support:

- 139.00/138.70

Recommendations:

Until the end of the current correction, trading transactions in the pair market make sense only in the intraday style. Purchases today are unpromising. The main attention should be paid to the search for points of sale of the instrument.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure, dotted – the expected movement.

Attention: The wave algorithm does not take into account the length of time the tool moves!