Economic calendar (Universal time)

The economic calendar is relatively calm today, apart from the important news block from the UK at 9:30 UTC+00. Thus, we are waiting for statistics on GDP, as well as data on changes in the volume of industrial production.

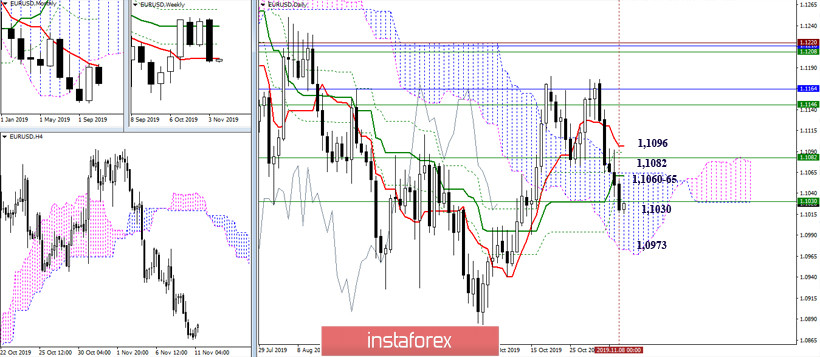

EUR / USD

The bears dominated last week, as a result of which they won almost everything that their rivals had so actively conquered. Meanwhile, lower players managed to regain the weekly short-term trend and close below the daily gold cross. Now, the pair is in the daily cloud - the zone of uncertainty. Maintaining positions and continuing decline will make the lower boundary of the cloud the next bearish reference point (1.0973 Senkou Span A), and the main task, in this case, will be to exit the cloud and consolidate in the bearish zone. As for the resistances, the nearest 1.1030 (weekly Tenkan + daily Fibo Kijun) now acts not only as resistance, but also as a center of attraction. Next, it should be noted a fairly wide area, consisting of 1.1060-65 (daily Senkou Span B + daily Kijun) - 1.1082 (weekly Fibo Kijun) - 1.1096 (daily Tenkan). If the players on the downside lose the resistance data, then the question of the current advantage will again arise.

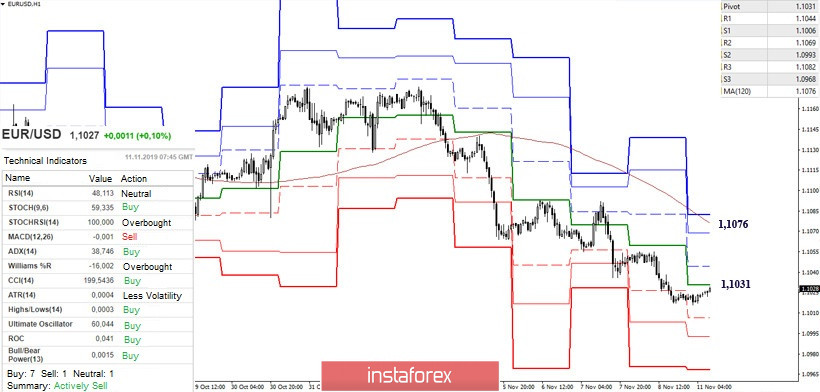

On H1, we observe the prerequisites for an upward correction. More significant prospects can be discussed after a reliable fixation above the central pivot level (1.1031). The next important resistance in this case will be waiting for the bulls at 1.1076 (weekly long-term trend), intermediate resistance levels are located at 1.1044 (R1) - 1.1069 (R2). You may notice that the formed benchmarks of the lower halves are correlated with the benchmarks and resistances of the higher time intervals. With the continuation of the downward trend, the support on H1 will be the classic pivot levels S1 (1.1006) - S2 (1.0993) - S3 (1.0968).

GBP / USD

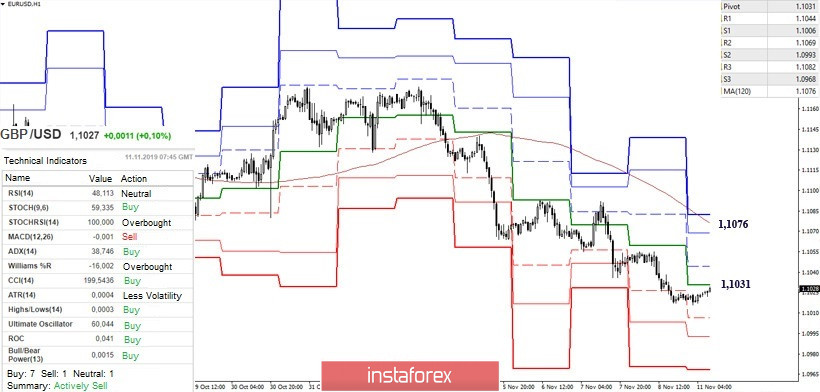

Last week, the players on the decline slowly but surely realized the decline. At the same time, they managed to go down to the previous minimum (1.2788). The continuation of this strategy will lead the pair to the most fortified and significant support area of 1.2700 - 1.2600 (daily Fibo Kijun and Kijun + monthly Tenkan + weekly Tenkan and Fibo Kijun). Today, some levels of the zone have changed their location, but from the rearrangement of the places of the summands the amount has not changed, the boundaries, significance and importance of the zone are the same as well (1.2700 - 1.2600). Regarding the resistances, with the opening of the new week, they also only slightly changed the location, but did not change the essence. It can be noted 1.2882 (daily Tenkan + monthly Fibo Kijun) -

The week opened with a rising gap, so the upside players are now busy realizing the existing advantage. They fixed above the central pivot level (1.2789) and tested the resistance R1 (1.2810). The following benchmarks in this situation were grouped in the region of 1.2843 - 51 - 64 (R2 + weekly long-term trend + R3). A return of 1.2789 and the closing of the rising gap may return the bearish optimism of the past week, with the downside indicators within the day 1.2756 - 1.2735 - 1.2702 (supporting the classic pivot levels).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)