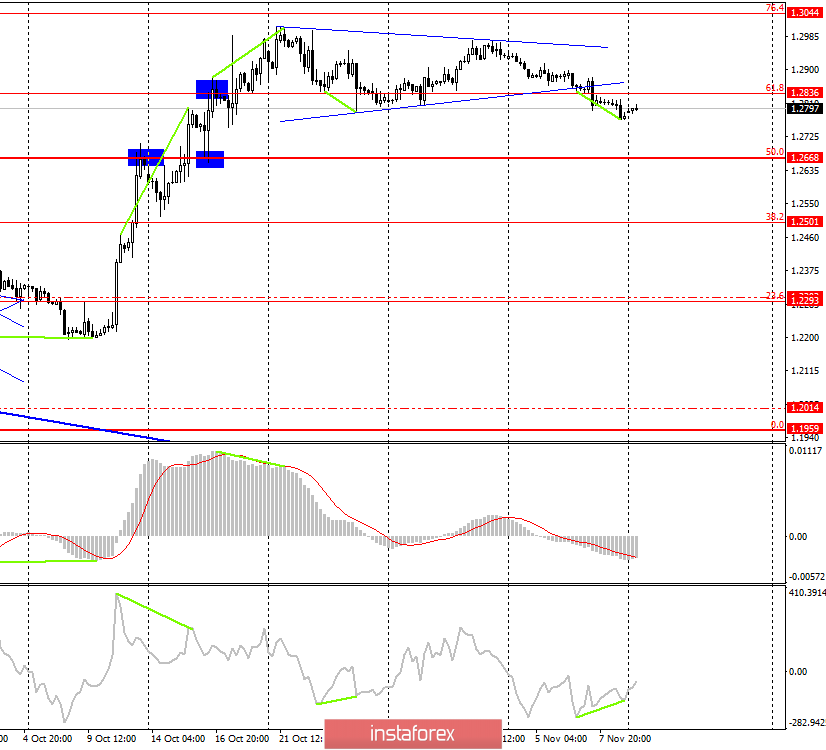

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a consolidation under the correction level of 61.8% (1.2836) and left the narrowing channel. Thus, traders are entitled to expect a fall in quotes of the pair in the direction of the correction level of 50.0% (1.2668), but the formation of bullish divergence at the CCI indicator may push quotes up a bit. At the same time, I do not expect strong growth of the pound, neither indicators nor the information background speaks in favor of this.

The United Kingdom of Great Britain continues to be mired in a whole swamp of problems and crises. Once again, it is worth saying that none of these problems of an economic and political nature is moving towards a solution. All political problems are generally postponed to December, as the country's parliament is officially dissolved and everyone is waiting for elections. I have already said about the results of these elections, they are impossible to predict, and all the ratings of various German institutions do not matter. But to all the political problems in the UK, economic ones have recently begun to appear. If earlier we observed a stable slowdown in the growth of the country's economy based on the same Brexit, then now economic reports frustrate bull traders more and more. The Bank of England at its last meeting showed that a rate cut is very likely and it will not necessarily wait for the election results and clarity on Brexit to lower the rate. And lowering the British refinancing rate is another rock in the pound's garden, another nail in the lid of its coffin, which the British currency has been able to slightly raise in recent weeks.

The current week will be quite interesting for the pound. In addition to all the economic reports from the US, which were studied in the article on EUR/USD, in the UK, there will be data on GDP, industrial production, unemployment rate, applications for unemployment benefits, changes in the level of average earnings, inflation, and changes in retail trade. The first two reports will be released today, in just an hour. However, all these reports can only aggravate the situation of the British currency. If now we can still say that the "Briton" is kept afloat, then by Friday, it will be possible to state its fall, as GDP is expected to decline to 1.1% y/y, industrial production may decline by 1.2% y/y, the level of wages will not change, inflation will fall to 1.6% y/y, and only retail sales on Friday can show a higher value than a month earlier. It is on Friday in the US economic data may come out weak, respectively, the pound will have chances to grow as well as the euro, towards the end of the week. Naturally, if the reports in the first four days of the week do not turn out to be sharply opposed to the forecasts.

Forecast for GBP/USD and trading recommendations:

The pound/dollar pair closed under the Fibo level of 61.8% (1.2836). Thus, I expect a moderate drop in quotes towards the level of 1.2668 and recommend selling the pair with this goal and the stop-loss level above the correction level of 61.8%. Taking into account the formed divergence, it is possible to sell the pair after the closing of quotations under the last low of divergence.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.