Hello, dear colleagues.

For the Euro/Dollar pair, we follow the medium-term downward structure of November 4 and the level of 1.1013 is the key resistance. For the Pound/Dollar pair, the price is in deep correction from the downward trend and the level of 1.2900 is the key support for the bottom. For the Dollar/Franc pair, the continuation of the upward movement is expected after the breakdown of 0.9968 and the level of 0.9919 is the key support. For the Dollar/Yen pair, we expect a resumption of the upward movement after the breakdown of 109.28 and the level of 108.82 is the key support. For the Euro/Yen pair, we consider the downward cycle of October 30 as the main trend and the level of 119.83 is the key resistance. For the Pound/Yen pair, we follow the formation of the downward structure from November 5; the level of 140.72 is the key support and the level of 139.36 is the key resistance.

Forecast for November 11:

Analytical review of currency pairs on the H1 scale:

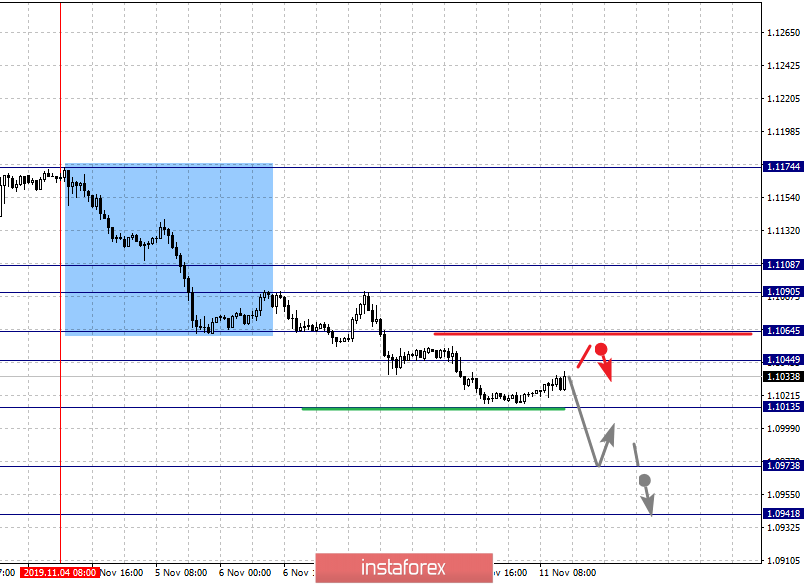

For the Euro/Dollar pair, the key levels on the H1 scale are 1.1108, 1.1090, 1.1064, 1.1044, 1.1013, 1.0973, and 1.0941. We follow the development of the downward cycle of November 4. We expect the continuation of the downward movement after the breakdown of the level of 1.1013. In this case, the target is 1.0973 and near this level is the price consolidation. We consider the level of 1.0941 as a potential value for the bottom, upon reaching this value, we expect a pullback in the correction.

The short-term upward movement is expected in the range of 1.1044 – 1.1064 and the breakdown of the last value will lead to an in-depth correction. The target is 1.1090 and the range of 1.1090 – 1.1108 is the key support for the downward structure. Before it, we expect the initial conditions for the upward cycle.

The main trend is the downward structure from November 4.

Trading recommendations:

Buy: 1.1045 Take profit: 1.1062

Buy: 1.1065 Take profit: 1.1090

Sell: 1.1012 Take profit: 1.0975

Sell: 1.0971 Take profit: 1.0941

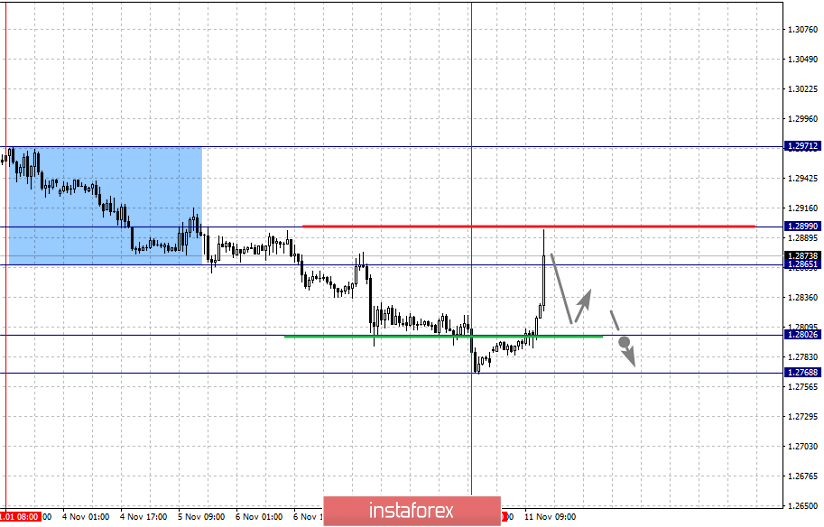

For the Pound/Dollar pair, the key levels on the H1 scale are 1.2899, 1.2865, 1.2802, and 1.2768. The price is in deep correction from the downward cycle on November 1 and forms the potential for the top of November 8. After the expressed initial conditions, we expect to reach the level of 1.2899 and in the area of 1.2899 – 1.2865 is the consolidation. The breakdown of the level of 1.2899 will lead to the unstable development of the upward structure. We expect the cancellation of the corrective movement and the continuation of the downward trend after the breakdown of 1.2802. The first target is 1.2768.

The main trend is the downward structure of November 1, the stage of deep correction

Trading recommendations:

Buy: Take profit:

Buy: 1.2867 Take profit: 1.2897

Sell: 1.2802 Take profit: 1.2780

Sell: Take profit:

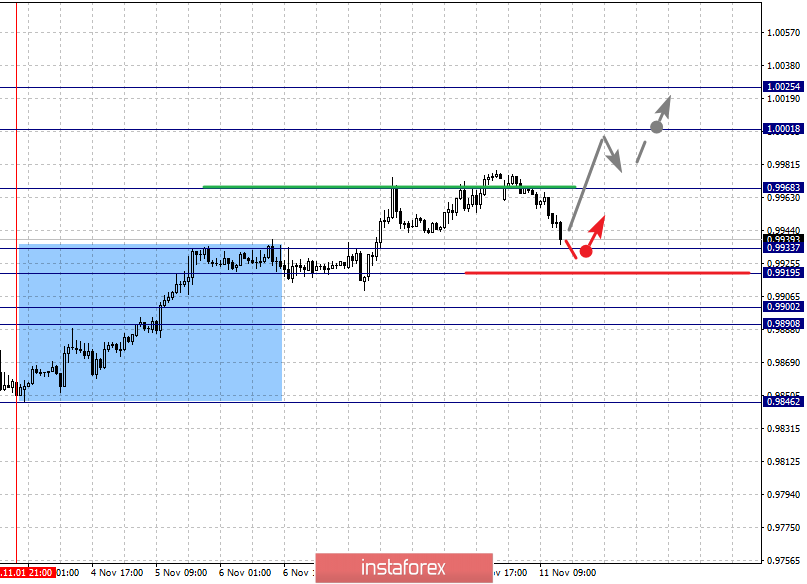

For the Dollar/Franc pair, the key levels on the H1 scale are 1.0025, 1.0001, 0.9968, 0.9933, 0.9919, 0.9900, and 0.9890. We follow the medium-term upward structure from November 1. We expect the continuation of the upward movement after the breakdown of 0.9968. In this case, the target is 1.0001 and near this level is the consolidation. We consider the level of 1.0025 as a potential value for the top, upon reaching this level, we expect a pullback to the bottom.

A short-term downward movement is possible in the area of 0.9933 – 0.9919 and the breakdown of the last value will lead to an in-depth correction. The target is 0.9900 and the range of 0.9900 – 0.9890 is the key support.

The main trend is the medium-term upward structure from November 1

Trading recommendations:

Buy: 0.9970 Take profit: 1.0000

Buy: 1.0002 Take profit: 1.0025

Sell: 0.9933 Take profit: 0.9920

Sell: 0.9917 Take profit: 0.9900

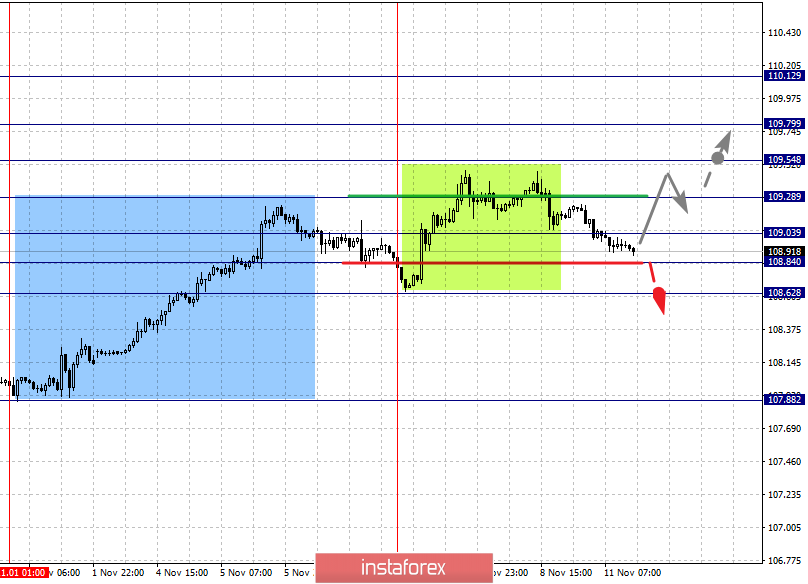

For the Dollar/Yen pair, the key levels in the H1 scale are 110.12, 109.79, 109.54, 109.28, 109.03, 108.84, and 108.62. The price is in the correction zone from the local upward structure on November 7. The continuation of the upward movement is expected after the breakdown of 109.28. The first target is 109.54 and the breakdown of which, in turn, will allow counting on the movement to 109.79 – near this level is the consolidation of rates. We consider the level of 110.12 as a potential value for the top.

The consolidated movement is expected in the area of 109.03 – 108.84 and the breakdown of the last value will lead to the cancellation of the local upward structure from November 7. The first target is 108.62.

The main trend is the upward cycle of November 1, the local structure of November 7.

Trading recommendations:

Buy: 109.28 Take profit: 109.52

Buy: 109.55 Take profit: 109.77

Sell: Take profit:

Sell: 108.82 Take profit: 108.62

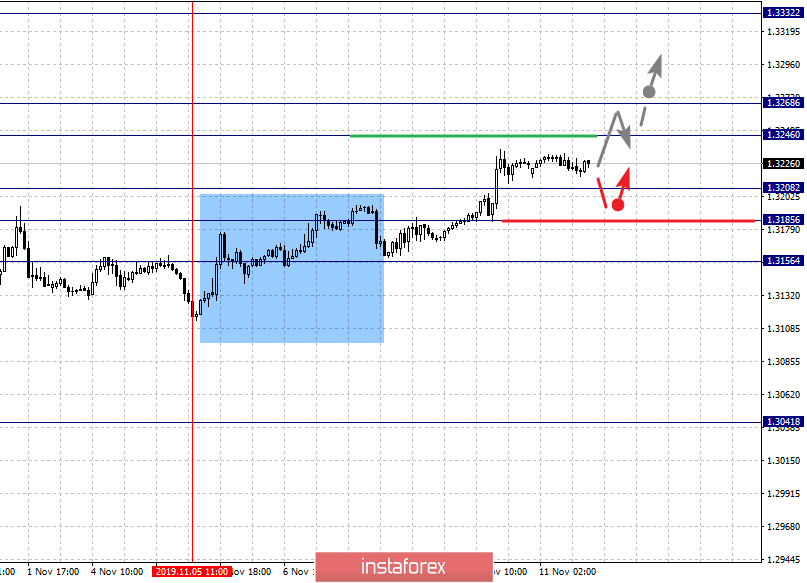

For the Canadian dollar/Dollar pair, the key levels on the H1 scale are 1.3332, 1.3268, 1.3246, 1.3208, 1.3185, and 1.3156. We follow the medium-term upward structure of October 29, as well as the local structure for the top of November 5. The short-term upward movement is expected in the area of 1.3246 – 1.3268 and the breakdown of the last value will lead to a pronounced movement. The potential target is 1.3332, upon reaching this level, we expect a pullback to the bottom.

A short-term downward movement is possible in the area of 1.3208 – 1.3185 and the breakdown of the last value will lead to an in-depth correction. The target is 1.3156 and this level is the key support for the upward structure.

The main trend is the medium-term initial conditions for the upward movement from November 29.

Trading recommendations:

Buy: 1.3246 Take profit: 1.3266

Buy: 1.3270 Take profit: 1.3332

Sell: 1.3208 Take profit: 1.3187

Sell: 1.3183 Take profit: 1.3156

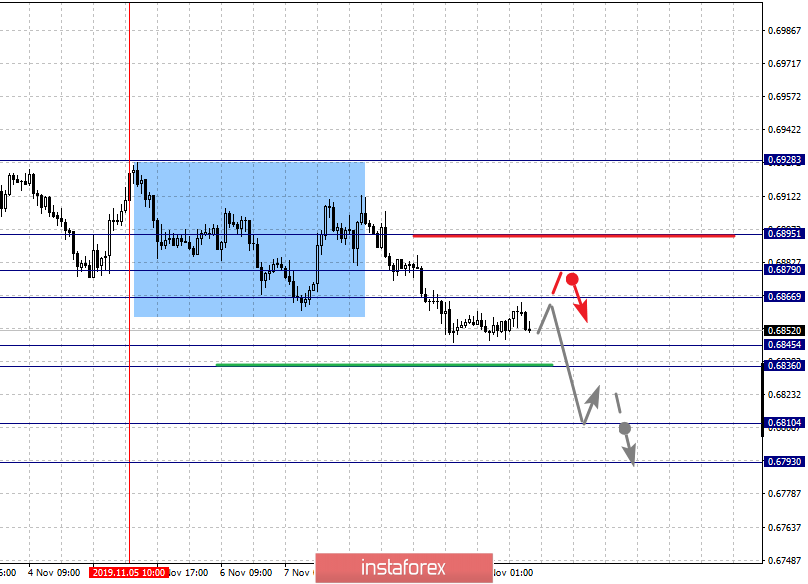

For the Australian dollar/Dollar pair, the key levels on the H1 scale are 0.6895, 0.6879, 0.6866, 0.6845, 0.6836, 0.6810, and 0.6793. We follow the development of the downward cycle of November 5. We expect the continuation of the downward movement after the price passes the range of 0.6854 – 0.6836. In this case, the target is 0.6810. We consider the level of 0.6793 as a potential value for the bottom, upon reaching which, we expect consolidation, as well as a pullback to the top.

A short-term upward movement is possible in the area of 0.6866 – 0.6879 and the breakdown of the last value will lead to an in-depth correction. The target is 0.6895 and this level is the key support for the downward structure from November 5.

The main trend is the downward structure from November 5.

Trading recommendations:

Buy: 0.6866 Take profit: 0.6877

Buy: 0.6880 Take profit: 0.6895

Sell: 0.6836 Take profit: 0.6812

Sell: 0.6808 Take profit: 0.6793

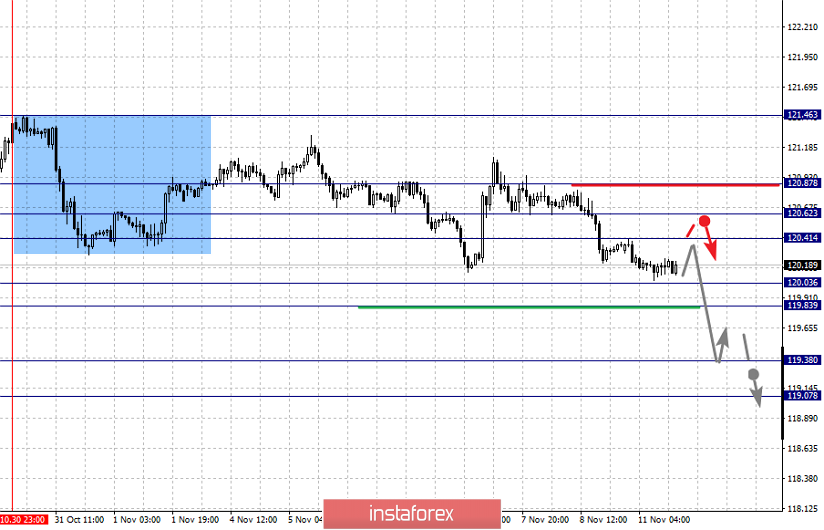

For the Euro/Yen pair, the key levels on the H1 scale are 120.87, 120.62, 120.41, 120.03, 119.83, 119.38, and 119.07. We follow the development of the downward cycle of October 30. The short-term downward movement is expected in the area of 120.03 – 119.83 and the breakdown of the last value will lead to a pronounced movement. The target is 119.38. We consider the level of 119.07 as a potential value for the bottom, upon reaching which, we expect consolidation, as well as a pullback to the top.

The short-term upward movement is expected in the area of 120.41 – 120.62 and the breakdown of the last value will lead to an in-depth correction. The target is 120.87 and this level is the key support for the downward trend.

The main trend is the downward cycle from October 30.

Trading recommendations:

Buy: 120.41 Take profit: 120.62

Buy: 120.64 Take profit: 120.87

Sell: 120.03 Take profit: 119.85

Sell: 119.80 Take profit: 119.38

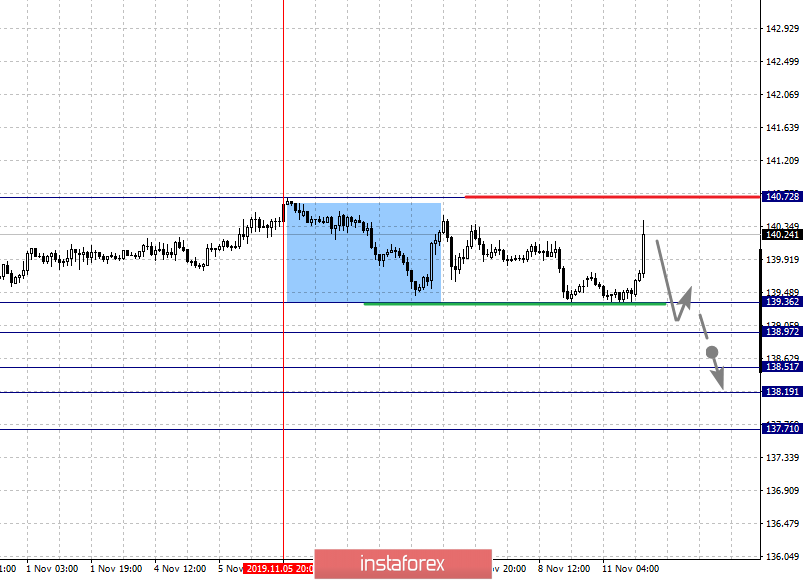

For the Pound/Yen pair, the key levels on the H1 scale are 140.72, 139.36, 138.97, 138.51, 138.19, and 137.71. We consider the downward of November 5 as the main structure. The level of 140.72 is the key support for the initial conditions of November 5. Its passage by the price will lead to the formation of initial conditions for the top. The short-term downward movement is expected in the range of 139.36 – 138.97 and the breakdown of the last value will lead to a pronounced movement to the level of 138.51 and in the area of 138.51 – 138.19 is the consolidation. We consider the level of 137.71 as a potential value for the bottom, upon reaching which, we expect a pullback in the correction.

The main trend is the downward structure from November 5.

Trading recommendations:

Buy: Take profit:

Buy: Take profit:

Sell: 139.36 Take profit: 138.98

Sell: 138.95 Take profit: 138.51