To open long positions on EURUSD you need:

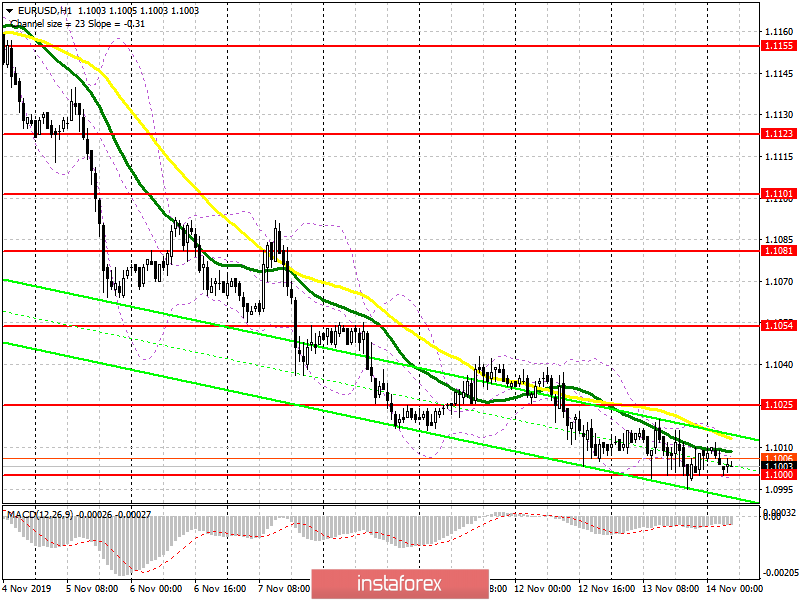

Yesterday's data on US inflation was slightly above economists' forecast and did not lead to a continuation of the downward trend in the EUR/USD pair, which retains, although weak, but hope for an upward correction. The report indicated that the consumer price index in the US rose by 0.4% in October, while economists had forecast growth of 0.3%. Practically nothing has changed from a technical point of view. The bulls need a return to the resistance level of 1.1025, which they could not reach yesterday. Good reports on GDP in Germany and the eurozone can lead to such a scenario. A break of resistance at 1.1025 forms a larger upward correction with an update of highs of 1.1054 and 1.1081, where I recommend profit taking. However, maintaining the 1.1000 support will be an equally important task for the bulls, and the formation of a false breakout there will be the first signal to open long positions. In case of further decline in EUR/USD, I recommend buying only after updating a new local low of 1.0972, or open long positions immediately on the rebound from support at 1.0943.

To open short positions on EURUSD you need:

Sellers continue to keep the pair below the resistance of 1.1025, which is a bearish signal. A weak report on GDP growth in Germany and the eurozone in the morning can lead to a false breakout at this level, which will be a direct signal to sell the euro. However, a more important task for the bears will be to break through and consolidate below the psychological mark of 1.0000, around which trading has been going on for several days. A break of this level will open EUR/USD a direct road to the lows of 1.0972 and 1.0942, where I recommend profit taking. The pressure on the euro will only weaken if the bulls manage to regain the resistance of 1.1025. In this scenario, the first active short positions can be observed in the region of the high of 1.1054, however, larger sellers will prefer to return to the market only after testing the area of 1.1081.

Signals of indicators:

Moving averages

Trading is carried out below 30 and 50 moving averages, which indicates continued pressure on the euro.

Bollinger bands

A break of the lower boundary of the indicator in the region of 1.1000 will increase pressure on the euro.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20