Economic calendar (Universal time)

The economic calendar is relatively calma gain today. In it, you can pay attention only to the data on the consumer price index from Europe (10:00) and to the change in the volume of retail trade in the USA (13:30). In addition, today, we are closing the week. Thus, some players may want more specifics and prefer to fix successful positions.

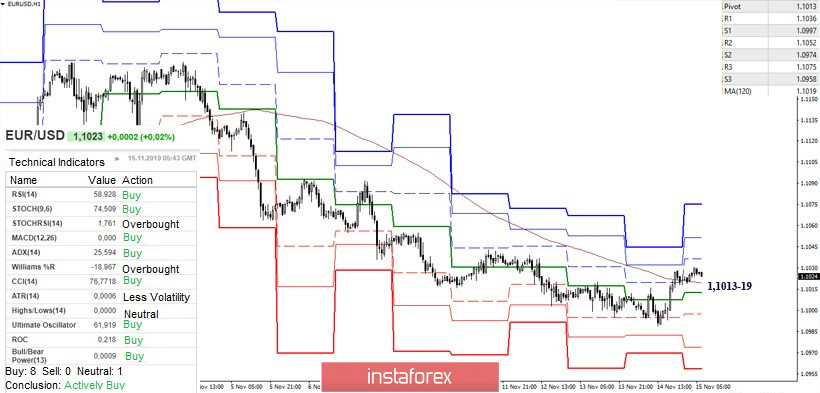

EUR / USD

Yesterday, the upward players not only indicated the inhibition, but also formed the prerequisites for the development of an upward correction. At the same time, the pair returned under significant resistance in this area - a weekly short-term trend (1.1030). Overcoming the level can significantly help in the continuation of the increase. The following upward orientations are now concentrated in the area of 1.1065-82 (upper border of the daily cloud + daily cross + weekly Fibo Kijun). However, failure to cope with the current resistance, braking or consolidation, as well as the formation of rebound in this place will return the bearish mood. The main task of the players to lower in the current situation is still the exit from the daily cloud to the bearish zone (1.0976 Senkou Span A).

On the lower time frames, the upward players managed to change the preferences of technical instruments. As a result, the advantages on H1 are now on the side of the bulls. The key levels of the lower halves - the weekly long-term trend (1.1013) and the central Pivot level (1.1019) - are now responsible for maintaining these sentiments. Moreover, the price is below the level of yesterday's accomplishments of players on the rise, returning to the same opportunities to the opponent. To strengthen the bullish positions, it is necessary to maintain supports (1.1013-19) and resume testing of resistances, which coincide with important levels of high halves today. On H1, they are represented by the resistances of the classic pivot levels (1.1036 - 1.1052 - 1.1075) .

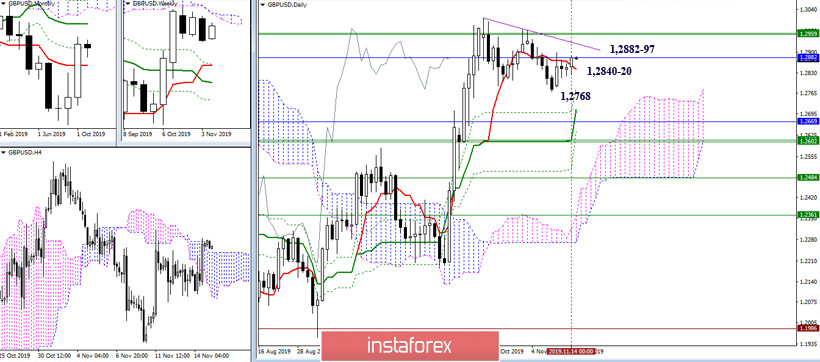

GBP / USD

Yesterday, the upward players showed activity and turned out to be stronger than the opponent, but so far they have not managed to achieve a reliable result, since the maximum of Monday (1.2897) and the monthly resistance of Fibo Kijun (1.2882) were not passed. Only a reliable fixation above (1.2882-97) opens the way to the following benchmarks 1.2959-63 - 1.3012 (weekly cloud + maximum extreme). To restore the bearish sentiment and advantages in this situation, you need to implement the following - go down under 1.2840-20 (daily short-term trend + H4 cloud), then close Monday's upside gap and update the low of last week (1.2768).

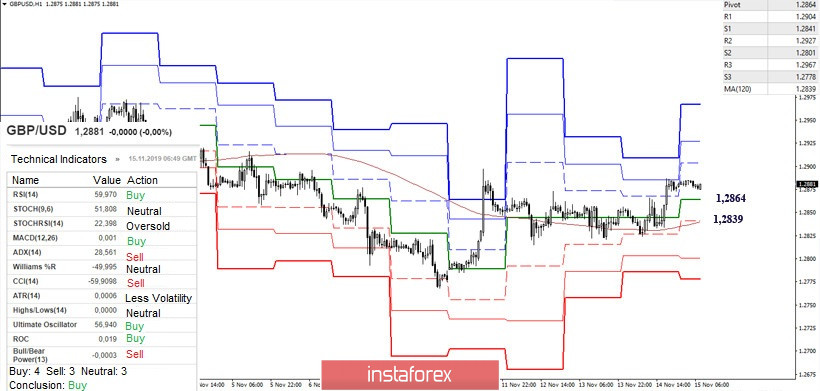

Players on the upside used the power of key supports, thanks to which they managed to continue the rise yesterday. In the case of further strengthening of positions, resistance within the day can be played by classic Pivot levels (1.2904 - 1.2927 - 1.2967). However, changing the sentiments may return the pair to the key support of the lower halves, which form a wider support area - 1.2864 (central Pivot level) - 1.2839 (weekly long-term trend) today. The loss of these boundaries will affect the current balance of power, deprive the bulls of yesterday's conquests and create conditions for the return of bearish sentiment.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)