Hello, dear colleagues!

In today's article, we will analyze one of the most interesting cross-rates of the euro/pound. The increased interest and volatility of this instrument adds to the process between the European Union and the UK, which still cannot be completed.

Honestly, you don't already know if the UK will leave the EU or if there will be a second vote on this issue.

Former Prime Minister David Cameron brewed porridge, now you can't get out of it!

However, it is up to the British to decide, whose opinions on staying in the European Union or leaving it are divided approximately equally.

Describing the EUR/GBP pair itself, it should be noted that often movements in this cross-rate have a significant impact on the main currency pairs EUR/USD and GBP/USD. You can say that the tail is wagging the dog, and this will not be far from the truth.

Before moving on to the technical part, one more important point. Despite the economic risks associated with the UK's exit from the EU, the pound feels more confident than the single European currency. Perhaps this is since the negativity of the never-ending divorce process is largely already played out by the market. However, technical factors should not be discounted, it is to them right now that we will move on.

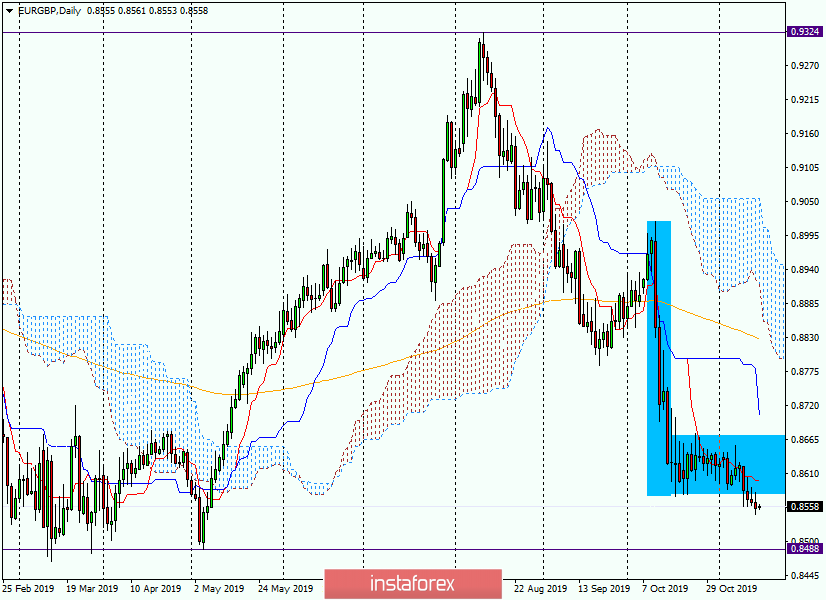

Daily

As can be seen in this timeframe, the growth from 0.8488 to 0.9324 has been completely leveled. Now it's up to you to break through the support level of 0.8488 and gain a foothold below. After that, the downward dynamics of the cross will continue and may find a second wind.

However, it is better to talk about targets below 0.8488 after the breakdown of this support level. Now I want to draw your attention to the figure for the continuation of the technical analysis of the "inverted Flag".

The breakdown of the figure's panel indicates a high probability of its development. On the other hand, I would like to note that the figures for technical analysis are practiced less by the market.

If the figure nevertheless begins to work, sales should be considered in attempts to return to the borders of the banner. Alternatively, from 0.8600, where the Tenkan line of the Ichimoku indicator is located. If EUR/GBP returns to the flag and exits from it up, we will have to state the reluctance of market participants to work out this figure and prepare for a full correction of the instrument.

In this scenario, the opening of short positions looks good from the Kijun line, which lies at 0.8705. Thus, judging by the daily timeframe, the opening of short positions on the cross can be considered near 0.8600 and 0.8700.

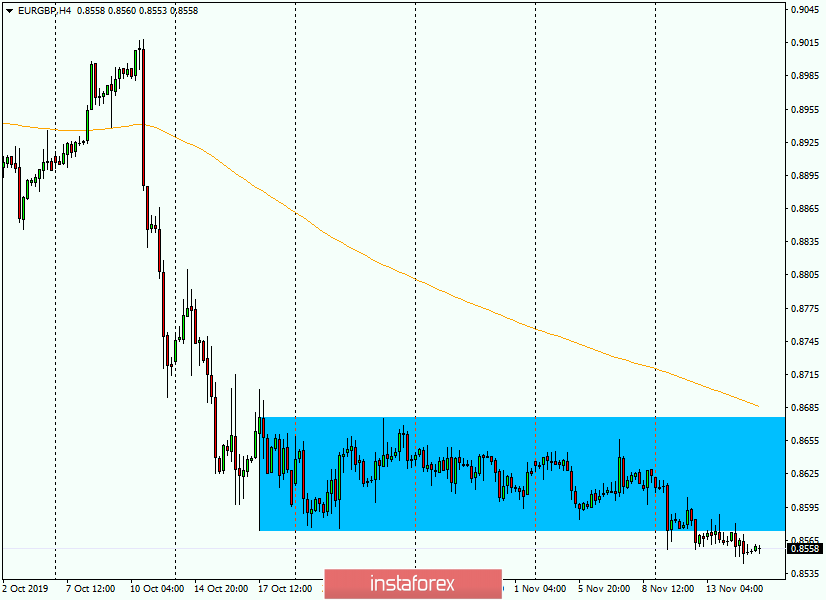

H4

At a shorter time interval, the euro/pound was in the lateral range for a rather long time, and only a few days ago began to show signs of an exit from it down.

However, looking at how uncertainly and without much enthusiasm this happens, there are doubts about the ultimate success of this action.

Surely many people know and understand that it is better to sell more expensive and buy cheaper. Since the main trading idea for EUR/GBP is selling, it would be good to see a correction to higher prices and from there prepare to open short positions.

To the above levels of 0.8600 and 0.8700, for potential sales, it is worth adding the levels of 0.8655, 0.8675, and 0.8686, where the 200-exponential moving average is located.

In conclusion, I note – it is not a fact that we will see prices for opening short positions today. If at all, see. It is not necessary to enter the market on the last trading day of the week. Transferring open positions to Monday is not the best trading option.

Successful completion of weekly trading!