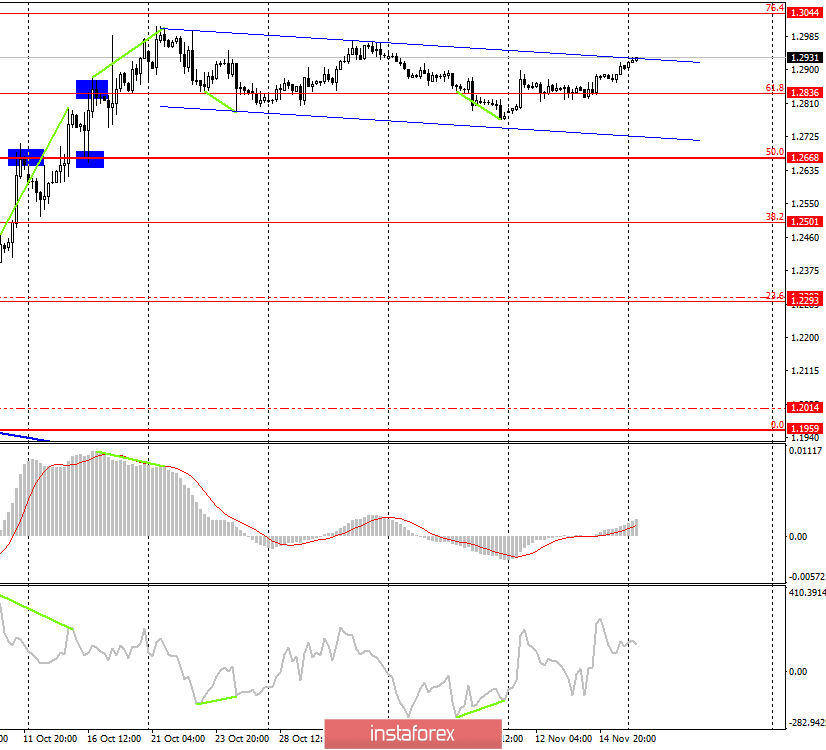

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed an increase to the upper line of the downward trend range. Thus, the fate of the pair for the whole week will also be decided today. If traders close above the trend range, then the chances of further growth of quotations in the direction of the correction level of 76.4% (1.3044) will increase significantly. The pair reversal from the trend range line will work in favor of the US currency and the resumption of decline in the direction of the lower line of the range. Today, the divergence is not observed in any indicator.

The "British week" has remained in the past, and the "empty week" has replaced it. If last week was full of economic reports from the UK and the USA, this week only intermediate figures on business activity in the services and products of the USA and the UK are planned on Friday. In America, there will be several more clearly secondary reports, which are unlikely to attract attention after almost all the reports of last week were ignored, among which were the most important data on UK GDP, inflation, industrial production.

According to many experts, the only reason for the growth of the British currency now is the growing probability of conservatives winning the December 12 parliamentary elections, which is identified with the UK's exit from the European Union on January 31, 2020, according to the agreement reached by Boris Johnson in negotiations with Brussels. It is difficult to say whether conservatives are really ahead of Labor by 12-15%, as the results of various opinion polls say. But since this is the only information on elections that has specific outlines and meanings, traders respond specifically to it. Although I continue to hold the opinion that opinion polls are, of course, interesting, but the results of elections can be completely unpredictable.

In any case, no matter how the parliamentary election ends, what about the terrible economic reports in the UK? Brexit will not solve a single economic problem of the Kingdom, it will only create additional ones. Consequently, traders can expect even worse economic data, both because of Brexit, and due to the absence of Brexit, and because of the trade war between China and America. That is, now not a single option is seen in which economic statistics in Britain could begin to improve. Some might say that in America, economic reports are also getting worse. But, firstly, not so fast, and secondly, if economic data fall in the two countries, this does not mean that the pound should grow.

Based on this, I believe that the British currency walks on very thin ice and can go underwater again at any time. If the conservatives do not win a clear victory in the elections, this will mean that Brexit will drag out for another couple of years, since the parliamentary elections cannot be held once every six months until the party of Boris Johnson gets enough votes.

Forecast for GBP/USD and trading recommendations:

The pound/dollar pair continues its growth and it is unknown whether it will linger near the upper line of the trend channel. I still do not expect a serious increase in the British currency, as all the information factors and economic news do not speak in favor of the "Briton". However, if the pair performs a close over the range, traders will be able to count on further growth, to the correction level of 76.4% (1.3044), in which case I will even recommend small purchases of the pair. The rebound of the pair from the range line will allow considering sales with a target of about 1.2725.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.