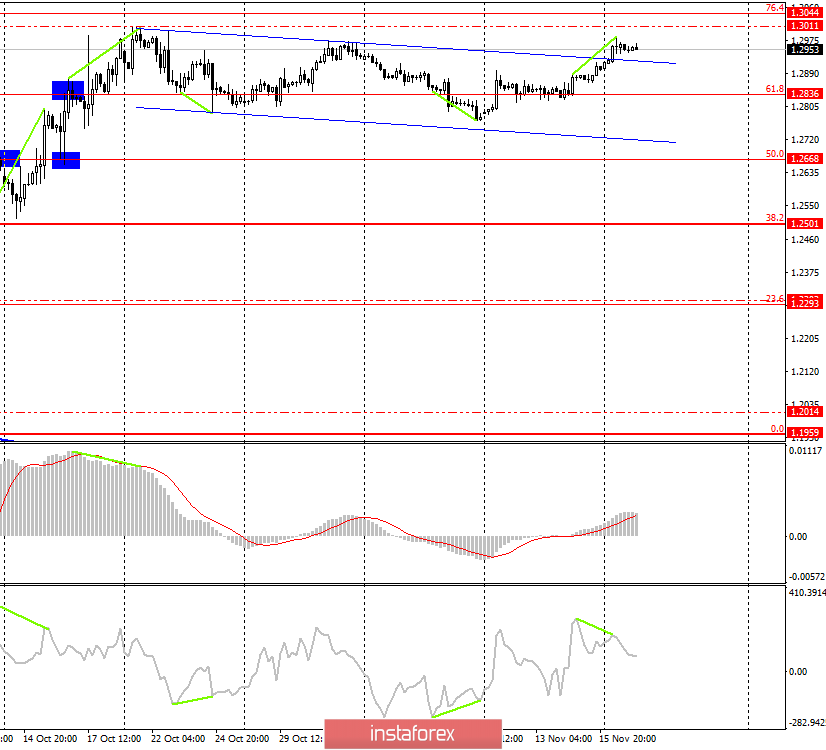

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a consolidation above the upper line of the downward trend range. Thus, at first glance, the pair can easily continue to grow in the direction of the correction level of 76.4% (1.3044). However, on its way there is now a peak level of October 21 – 1.3011, and also formed a bearish divergence in the CCI indicator, which allows you to count on a reversal in favor of the US dollar and some fall in the pair in the direction of the correctional level of 61.8% (1.2836). Thus, although the chances of growth have increased slightly, nevertheless, they do not exceed the chances of a fall in the pair's quotes.

Pound traders continue to stubbornly ignore any economic reports, as well as virtually any other news from America and/or the UK. If last week traders missed a lot of the most important economic reports from the UK, at the beginning of this week, they missed the meeting of Trump and Powell. For example, the euro, which is in a period of weak activity of traders, still showed growth, and then rollback. The pound, with the complete absence of news and economic reports from Britain, simply continued to grow, and at some point stood up and stuck in this place.

Since traders are only interested in Brexit news now, and Brexit will pause until the parliamentary elections take place, there is nothing else to do but to pay attention to what seems to be the only factor that plays a role for traders now. Despite the fact that all the ratings of political parties, which are now published in the media, do not reflect the real situation, and can also be "made to order" (it is no secret that any periodical has an owner who supports a particular party), traders stubbornly believe in these same ratings, and at the same time in the victory of the party of Boris Johnson in the elections, and such a victory that will allow the conservatives to complete the three-year procedure for secession from the European Union. And for this, I remind you, at least 45% of the seats in Parliament must belong to conservatives. This is a very high result, and therefore many experts have doubts that it is generally achievable. However, it is not only members of Nigel Farage's party who "help" the conservatives, but also the Labor Party. The leader of the Labor Party, Jeremy Corbyn, has repeatedly stated that he wants to implement the will of the people, which could change over the past few years (after the referendum). Accordingly, he intends to win the election and give the residents of the UK a second chance to express their position. Such a position is to the liking of a certain part of the electorate, but there are also many of its opponents. And it is precisely the absence of a clear position on Brexit that identifies the Labor crisis, which can help conservatives win the necessary victory.

Forecast for GBP/USD and trading recommendations:

The pound/dollar pair continues its growth but now has two obstacles on the way to the correction level of 76.4% (1.3044). Thus, purchases, from my point of view, are still not very expedient, especially considering the bearish divergence, the lack of a short-term information background and a negative long-term one. Selling a pair after exiting the corridor is also impractical. It is better to wait for some time, to observe the development of events.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.