To open long positions on EURUSD, you need:

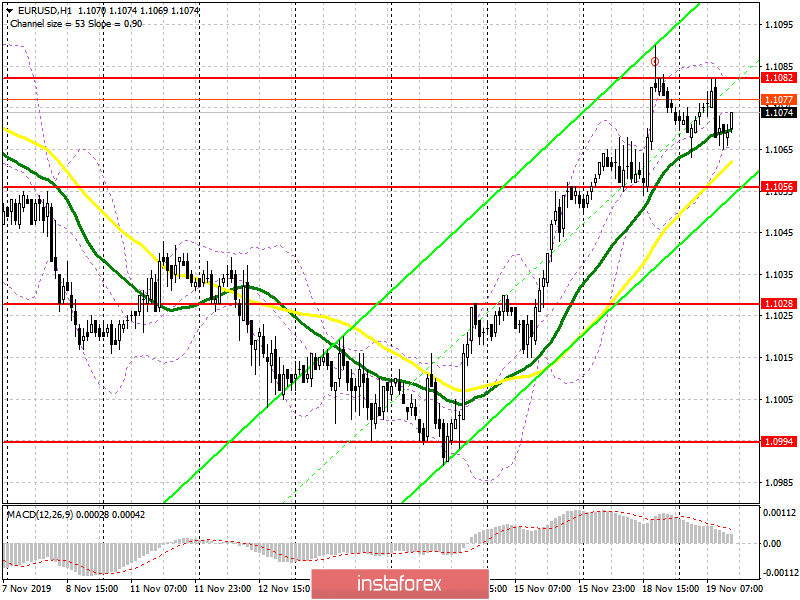

Compared to the forecast for the first half of the day, the technical picture has not changed. The report on the current account balance of payments of the ECB, which indicated a slight reduction in September this year harmed the European currency, but given the fact that the data were better than economists' forecasts, it did not lead to a strong sale of EUR/USD. Oddly enough, but at the moment, buyers of the euro still need the same breakthrough and consolidation above the resistance of 1.1082. Only this will keep the upward trend and will lead to an update of the highs in the area of 1.1109 and 1.131, where I recommend taking the profits. Given that the afternoon is also not complete on fundamental data, and the report on US construction volumes is unlikely to rock the market, pressure on the euro may continue. In the scenario of EUR/USD decline, you can look at purchases only after the formation of a false breakdown in the support area of 1.1056, but you can buy immediately on the rebound from the minimum of 1.1028, just above which the lower border of the current upward channel passes.

To open short positions on EURUSD, you need:

Sellers again achieved the formation of a false breakdown level of 1.1082, which I paid attention to in the morning, and on a weak report tried to reset the euro below the low of today. While trading will be conducted below the range of 1.1082, we can expect a further decline in the euro, and the main goal of sellers will be to return and consolidate below the support of 1.1056, which will push the pair even lower to the lows of 1.1028 and 1.0994, where I recommend taking the profits. However, it will be possible to talk about the formation of a new downward trend only under the condition of the breakdown of the support of 1.1028, where the lower boundary of the current upward correction passes. If the demand for the euro returns today in the morning, as it was yesterday at an unplanned meeting between Trump and Powell, it is best to return to short positions to rebound from a new high of 1.1109 or sell the euro even higher – from the level of 1.1155.

Indicator signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market.

Bollinger Bands

A break of the lower border of the indicator in the area of 1.1070 will lead to a larger sale of the euro.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20