Today's data on the eurozone economy did not significantly affect the EURUSD pair, since in general they did not belong to important fundamental indicators. The report on the Chinese economy and the revision by some leading analytical agencies of forecasts on GDP growth rates did not have a significant effect on commodity currencies.

EURUSD

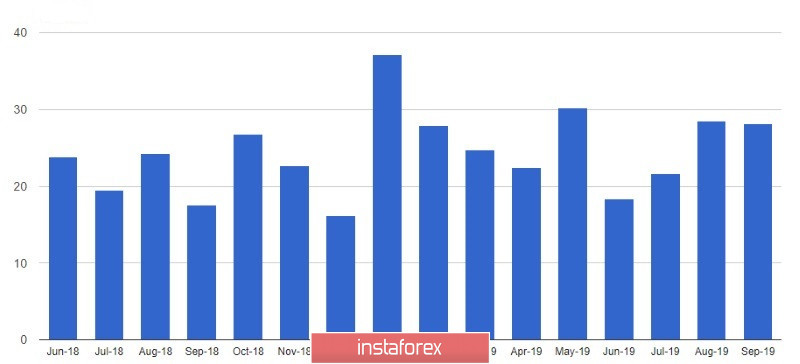

News that the current account surplus of the eurozone balance of payments slightly fell in September this year compared to August. This was ignored by the market. On the other hand, the report turned out to be better than economists' forecasts. According to the data, the balance amounted to 28 billion euros in September against the positive balance of 29 billion euros in August this year. Economists had expected a balance reduction to 22 billion.

Today it has also become known that the number of new car registrations in the European Union has grown and peaked over the past ten years. According to the association of European car manufacturers, the number of new car registrations increased by 8.7% in October compared with the same period last year, to 1.18 million units. Let me remind you that in October last year the number of registrations fell by 7.3%. However, this happened after the introduction of new rules for testing cars for exhausts. Despite structural changes in the automotive industry, the highest growth was recorded in Germany, 13%.

As for the technical picture of the EURUSD pair, problems with the resistance of 1.1090 remain. The bullish scenario will continue to be realized only after it is possible to overcome this high and continue the upward correction to the area of highs 1.1110 and 1.1140. However, the probability of a downward correction should not be excluded, since a break of the intermediate support of 1.1050 may push the pair to the lower boundary of the upward channel in the area of 1.1020.

Given the absence of important fundamental statistics, you can pay a little attention to the report of Moody's Investors Service on the global economic growth, which, apparently, in 2020 remains rather weak. Although Moody's does not expect a recession to begin in 2020, they note that its risk will remain high. Problems with economic growth will be observed not only in Europe, but in the US and China. Trade problems of these two countries affect the entire global economy. The report also indicated that the increased risk of economic downturn would adversely affect the situation with lending, which would result in a drop in retail sales.

Not surprisingly, by the end of the year, growth in government spending in China is projected to slow, which will negatively impact economic growth. According to the Ministry of Finance of China, in the first ten months of this year, China's budget expenditures grew by only 8.7% after rising by 9.4% from January to September. But China's budget revenues from January to October increased by only 3.8% compared with the same period last year. China's total budget deficit was 2.29 trillion yuan.

Many analysts expect that in the fourth quarter, China's annual GDP growth rate will slow down to 5.8%, after 6.0%, which were recorded in the third quarter of this year. After a recent reduction in repo rates, the Chinese authorities may take tougher stimulus measures and increase the budget deficit from the current 2.8%. This will increase the sale of bonds to finance government spending, which will support the economy next year.