To open long positions on GBP/USD you need:

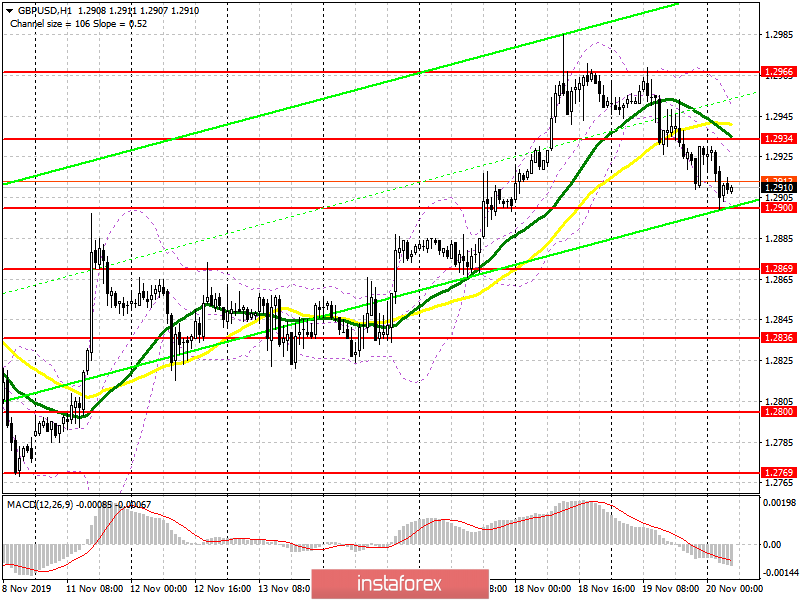

The British pound continued to lose ground late Tuesday after a televised debate between Boris Johnson and Jeremy Corbyn. The prime minister tried to turn the conversation into Brexit's concerns, while his opponent accused the Conservative Party of willingness to sell the economy to the United States. All this led to a decline in the pound, and the focus of buyers is now on the support level of 1.2900. Only the formation of a false breakout there will be a signal to buy the pound, with the main task of updating the resistance of 1.2934. However, only a breakthrough of this range will allow us to talk about the return of buyers to the market and the continuation of the upward trend to the area of highs 1.2966 and 1.3017, where I recommend profit taking. Given that the release of important fundamental statistics is not planned for the UK economy today, we can expect a further decline in GBP/USD. In this scenario, it is best to consider new long positions after updating a low of 1.2869 or even lower, in the support area of 1.2836.

To open short positions on GBP/USD you need:

Sellers will try to break below the support of 1.2900 in the morning, since consolidating below this level will strengthen the bearish trend and lead to the renewal of the 1.2869 area, where I recommend profit taking. A further target for short positions will be a low of 1.2836, a test of which will mean the end of an upward trend. However, keeping the pair below the resistance of 1.2934 continues to be a more important task for the pound sellers, to which a correction is possible today in the morning. The formation of a false breakout at this level will be an additional signal to open short positions in GBP/USD. However, in the absence of activity on the part of the bears in this range, it is best to postpone selling until the larger resistance of 1.2966 is updated.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 moving average, which indicates the possible formation of a downward correction in the pair.

Bollinger bands

The upward movement will be limited by the upper level of the indicator at 1.2945, from where it is possible to open short positions after the formation of a false breakout. A break of the lower boundary of the indicator at 1.2900 will increase pressure on the pound.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20