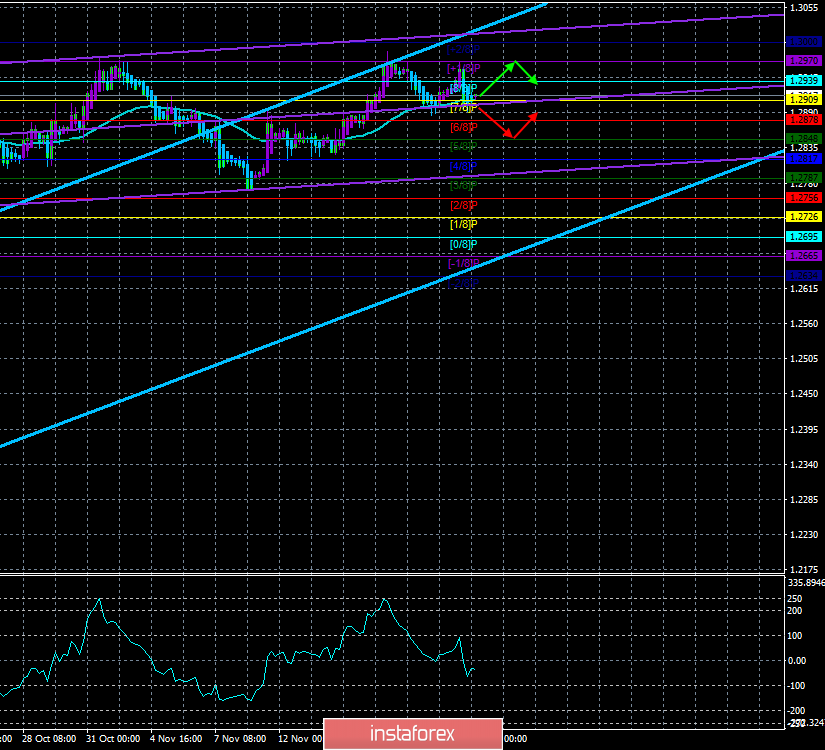

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - sideways.

CCI: -26.6231

For the last few weeks, the British pound cannot leave the channel 1.2786 - 1.2986, and in the last few days: 1.2900 - 1.2980. It is difficult to say whether traders are preparing for something serious, or waiting for any important events, but the pound/dollar pair freezes more every day, and its average volatility does not exceed 60 points. This is a very low value for GBP/USD. However, how can the pair show higher results if traders stubbornly ignore all macroeconomic statistics, and it does not matter where it comes from - from the UK or the States and would be happy to work out the news on Brexit or the elections, but that's just no news now. There is no news on Brexit for obvious reasons. Since the UK Parliament is dissolved, and political parties are preparing for elections, there can be no news on this topic in principle. As for the elections themselves, all parties continue to acquaint the people of Great Britain with their programs and goals. However, even here, no particularly important information would track the reflections on the chart of the currency pair. The main data from which you can start now:

1) The Brexit party will not nominate candidates in the 317 constituencies where the conservatives won the 2017 election.

2) The rating of the Conservative Party according to various data is higher than the positions of Laborites by 12-15%, but the TV debates between Boris Johnson and Jeremy Corbyn showed only a 2% gap in support of these two politicians.

3) The positions of political parties on Brexit have been known for a long time and have not changed: the conservatives are in favor of a "divorce" from the European Union on the "deal" of Boris Johnson, the Labor Party - for a new deal and a second referendum, the "Brexit" party - for leaving the EU without any agreements, the Liberal Democrats - for the abolition of Brexit, the Scottish party - for the abolition of Brexit or withdrawal from the UK in the event of Brexit.

Thus, based on all this information, only one conclusion can be drawn: it is necessary to continue to wait for December 12, the results of the elections and only after that to draw any conclusions. The pound, from our point of view, is now firmly stuck in one place. It doesn't have any growth factors now. Traders have already played down the high probability of Boris Johnson's party winning the election, but the main question is - "How many votes will the conservatives get?" remains unanswered. And it is the answer to this question that is basic for the future of the country and Brexit. By itself, a victory for the conservative party will do nothing. We need a victory with the necessary number of votes for making decisions "on our own". And if the conservatives fail to meet this goal, Brexit risks dragging on for another year or two.

As for the macroeconomic data, which traders persistently continue to ignore, today everything will be quiet and calm. In the UK, the indices of business activity in the services sector and production will be published (preliminary values for November), and the latest index may again show a negative trend. Thus, potentially the pound may be under market pressure today, but it is unlikely that the reaction of traders will be strong on the preliminary values of business activity.

The technical picture implies today either overcoming the moving average line or a rebound from it with the resumption of some semblance of an upward trend. In the first case, the bears will get another chance to "remember" 5 failed reports from the UK last week and start selling the pound more actively, in the second - the bulls will have a chance to show strengthening to the area of 1.2970-1.3010 for the fifth time.

Nearest support levels:

S1 - 1.2909

S2 - 1.2878

S3 - 1.2848

Nearest resistance levels:

R1 - 1.2939

R2 - 1.2970

R3 - 1.3000

Trading recommendations:

The GBP/USD pair corrected to the moving average line again. Given that traders are still unresponsive to fundamental data, volatility is unlikely to change today. Also, there is a high probability that traders will not overcome the area of 1.2970 - 1.3010. Thus, purchases with targets of 1.2970 and 1.3000 are formally relevant now but would recommend extremely cautious about opening any positions. It will be possible to sell the pair in case of consolidation below the moving average with a target of 1.2848, but also with minimum volumes.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the regression window of the indicator.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.