Today, the attention of the investors will be drawn to the speech of ECB's President C. Lagarde at the Economic Forum in Frankfurt am Main. Thus, markets expect her to break her silence regarding her view on the regulator's prospects on monetary policy.

It should be noted that the last time she covered her view on the monetary policy of the ECB was in the summer, as soon as she was elected to the position of head of the bank. After that, she said that we should consider it necessary to continue super-soft monetary policy to stimulate economic growth in the region. But since then, confusion and wobble began in the ECB. Moreover, some of its representatives began to express dissatisfaction with the policy of the regulator, expressing the opinion that there was no need to further reduce rates and expand asset purchases. This actually caused the recent local appreciation of the euro, and then the beginning of the consolidation period.

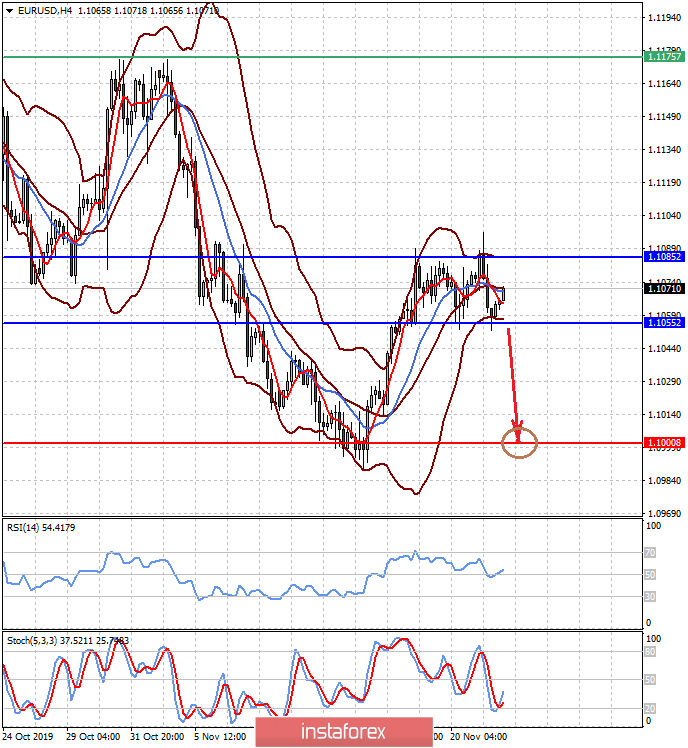

We believe that if today Lagarde, nevertheless, expresses an opinion on the need to maintain the monetary policy adopted by M. Draghi, this will lead to a resumption of a decline in the single European currency. We also believe that the euro together with the US dollar, may rush to the recent local minimum of 1.1000, and then to the minimum of 1.0900 from October 1 of this year.

Today, investors will also pay attention to the publication of data on the index of business activity in the US manufacturing sector and the value of the index of consumer expectations from the University of Michigan. It is expected that the index of business activity in the manufacturing sector in November will add to 51.5 points from 51.3 points, and the index of consumer expectations from the University of Michigan will grow from 84.2 points to 86.1 points. If the data doesn't let us down, this can provide significant local support for the US dollar and give positivity to the local stock market.

At the same time, a slight improvement in the position of the dollar may also be facilitated by a slight improvement in investor sentiment regarding US-China trade negotiations after a speech by Chinese President Xi Jinping, who said he wants to enter into a "phase one" deal with the United States.

Forecast of the day:

EUR/USD continues to trade in a narrow range of 1.1055-1.1085 in anticipation of the speech by C. Lagarde at the economic conference in Frankfurt am Main. The soft tone of her speech may be the reason for the price decline below 1.1055 and its fall to 1.1000.

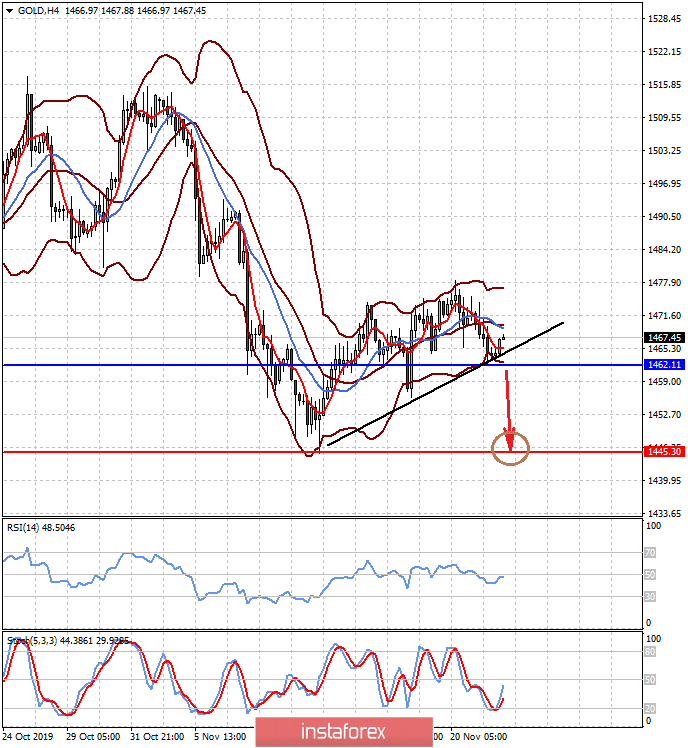

Spot Gold is consolidating above 1462.10. We expect it to continue to decline after falling below this level with a local target of 1445.30