A day that can clarify a lot.

Hello!

At the trading on November 21, the US dollar felt quite confident and showed a strengthening against its main competitors. The positive dynamics of the US currency was influenced by good data on the housing market, as well as the increased yield of ten-year US government bonds.

Given that today is the last day of the week, let's see what are the prospects for the closing of trading on November 18-22 for the main currency pair euro/dollar.

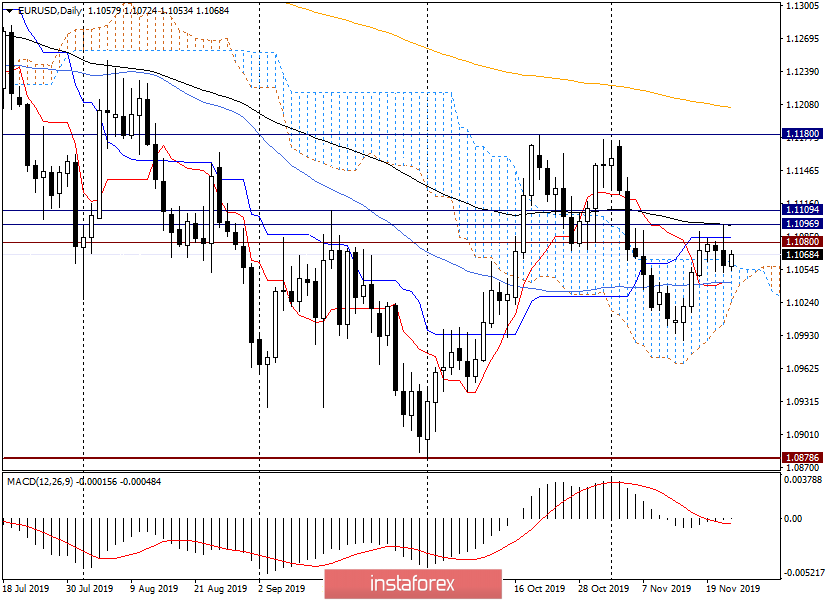

Daily

A very interesting picture is observed on the daily chart. As expected in yesterday's article, the euro bulls tried to break through the strong resistance zone 1.1080-1.1089, the Tenkan line of the Ichimoku indicator and 89 EMA but failed.

Leaving a long tail at the top, the pair descended into the limits of the Ichimoku cloud, where it finished trading on Thursday. This moment may harm the further bullish prospects of the instrument. However, much will depend on the outcome of today's trading day.

At the moment, EUR/USD shows a positive attitude and is growing. If this continues, I expect quotes at 1.1080, 1.1085, 1.0958 and 1.0969, where the maximum values of yesterday's trading were shown.

In the current situation, there are still expectations of growth, but if the euro fails to overcome these obstacles again, the bears may become more active and begin to actively pressure the pair. In this situation, I will once again emphasize the importance of today's trading day.

I venture to assume that today and the whole week as a whole will be closed by the growth of EUR/USD. However, it may not be very significant, and the closing prices of the day and the whole week will come to the fore.

If trading ends above yesterday's highs of 1.0969, it will be a good signal that the market is ready to move further north.

Another failure of the players to increase may be the last straw, overflowing the patience of investors, and the market will turn down.

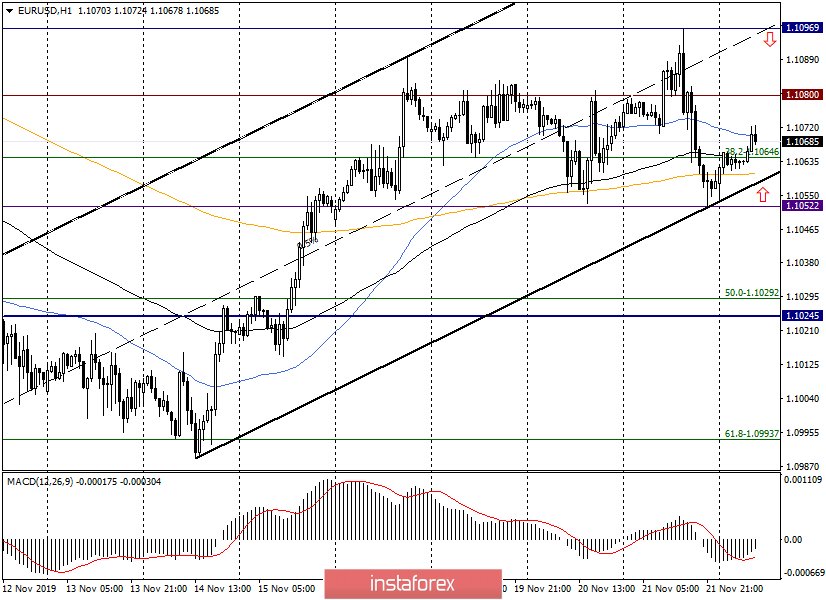

H1

In order not to pile up the reviews with charts, I try to consider only two timeframes, and in this regard, the hourly chart often remains without attention. Today, I will pay it due attention. Most often, it is on the hourly chart that I determine the entry points to the market.

Built an upward channel with the parameters: 1.0989-1.1052 and 1.1089. Once again, I want to draw your attention to the middle line of the channel, which often performs the function of support or resistance.

In this situation, when the growth to the middle line, it can provide resistance, so, taking into account the horizontal level of 1.0969, their intersection looks like a sufficient basis for sales.

In turn, purchases can be planned again at the intersection, but already the support line of the channel with the horizontal level of 1.1052, where the minimum values were shown on November 21.

I believe that the 233-exponential moving average can provide additional and not weak support. Which is located at another well-known level of 1.1060.

If you look at today's economic calendar, then from a not very rich set of macroeconomic reports, you should pay attention to the indices of business activity in the manufacturing sector and the service sector. And both indices will come out first for Germany and the eurozone, and then reports will come from the US. Time and forecasts for these and other events can be seen in today's economic calendar.

Have a nice day!