Economic calendar (Universal time)

After the speech of the President of the ECB, we are waiting for the continuation of reports on the economy of the European Union and the UK, led by data on business activity in the manufacturing sector and the services sector (UK, 9:30). Moreover, further statistics from the United States are expected, but there are no important indicators there.

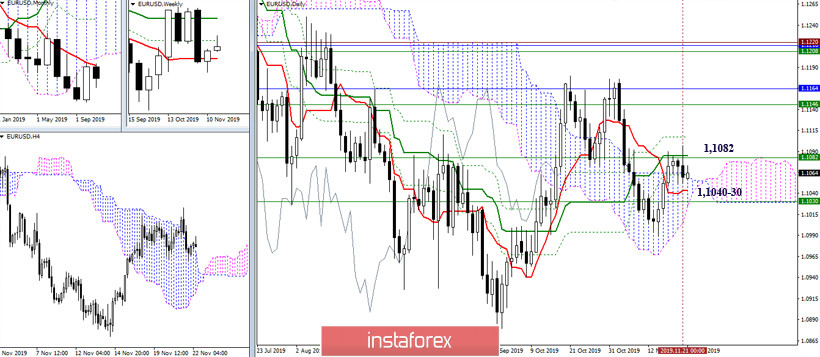

EUR / USD

The week passed in the zone of attraction of the upper boundary of the daily cloud between the resistance of 1.1082-84 (daily Kijun + weekly Fibo Kijun) and support of 1.1040-30 (daily Tenkan + weekly Tenkan). The prospects for leaving the zone of this consolidation were announced earlier and have not changed. On Monday, there may be a change in the location of some levels, so the situation can be re-evaluated.

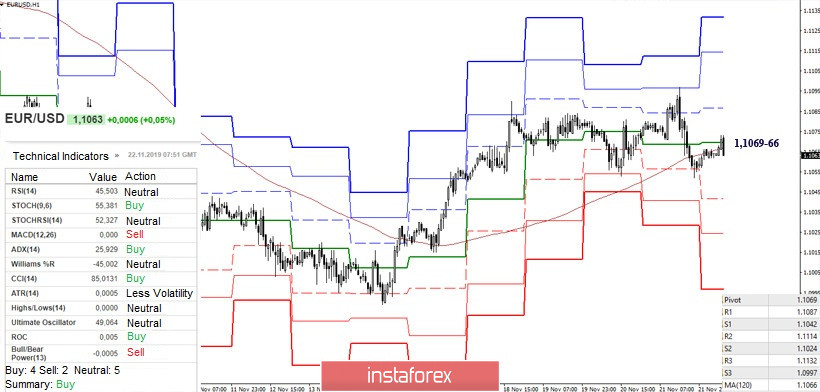

At the moment, players on the downside are fighting for an advantage in the lower halves. A retest of key levels 1.1066-69 is performed (central pivot level + weekly long-term trend). The formation of the rebound as well as the continuation of decline will open the way to the support of the classic pivot levels within the day 1.1042 - 1.1024 - 1.0997. In this case, the passage of the zone 1.1040-30 (levels of high halves) and consolidation in the bearish zone relative to the daily cloud will be of primary importance for players to fall. Meanwhile, consolidation above 1.1066-69 will preserve the uncertainty and influence of the attraction of the upper boundary of the daily cloud (1.1065).

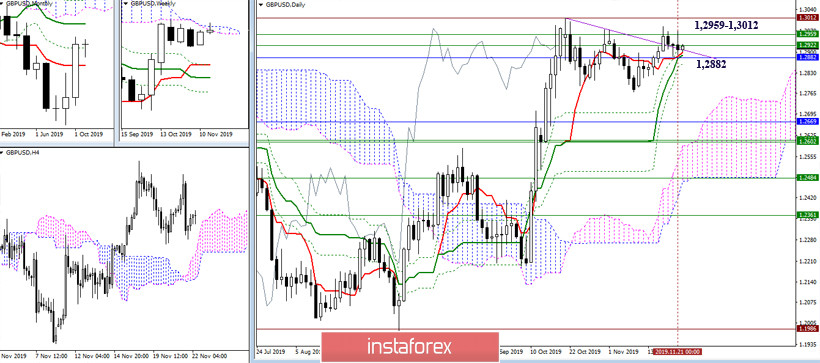

GBP / USD

This week, the pound did not manage to decide on its preferences. The influence of strong levels, in the attraction zone of which it spent the whole week, did not allow either side to prove itself. Thus, I think that a clarification of the situation can be expected next week. So far, the boundary of the most significant supports remains in the region of 1.2882 (daily cross + monthly Fibo Kijun), and the role of the main resistance is played by 1.2959 - 1.3012 (weekly cloud + maximum extreme).

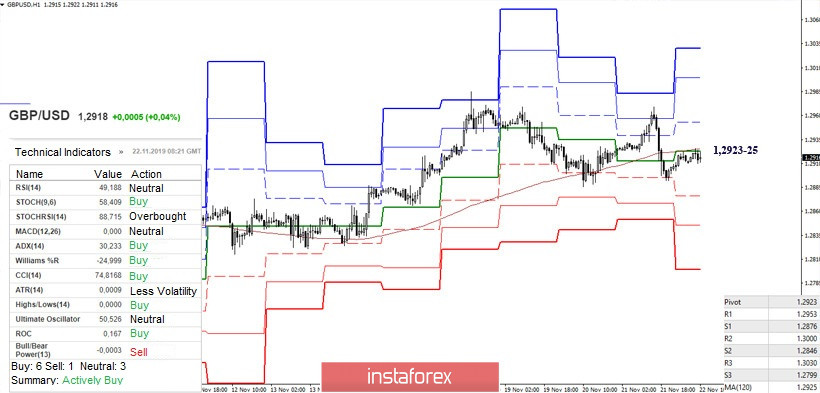

The players on the downside cannot leave the attraction of key low-level halves 1.2923-25 (central pivot level + weekly long-term trend), which weakens their positions. At the same time, consolidating above will give an advantage to the opponent. Therefore, the struggle for priority and excellence continues. Today, support for the classic pivot levels are located at 1.2876 - 1.2846 - 1.2799 while resistances are at 1.2953 - 1.3000 - 1.3030.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)