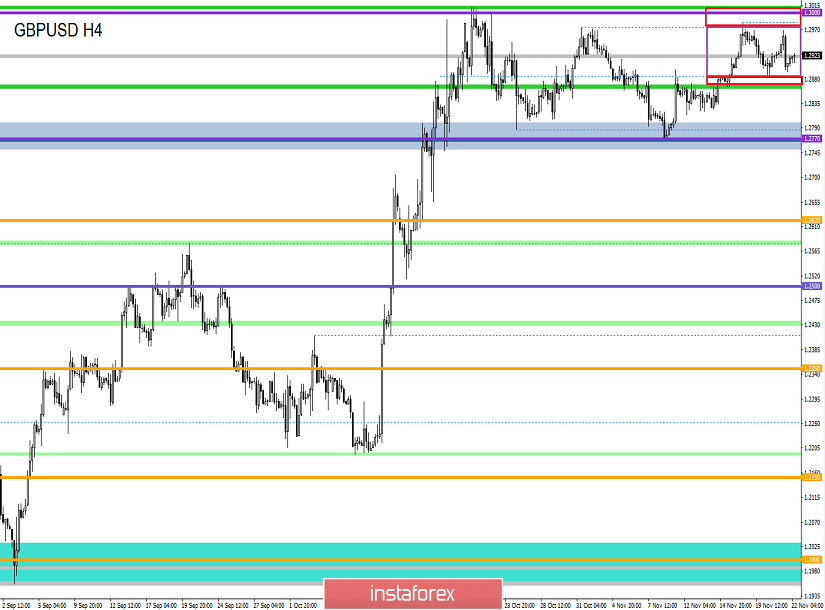

From the point of view of technical analysis, we see confirmation of the previously posed theory, which was built on the proposition that a closed oscillation pattern can occur between the mirror level of 1.2885 and the upper boundary of the flat formation of 1.3000, which temporarily narrows the main framework of flat 1, 2770 / 1,3000. The characteristic cyclicality at low amplitude can play into the hands of market participants, subsequently accelerating volatility. What I mean is that now we have a kind of accumulation, that is, an extremely restrained market interest, which on a fine line will distribute buyers and sellers to the market, which as a result, can lead to a surge in activity and is now needed more than ever. Let me remind you that for 20 consecutive trading days we have had a rare occurrence for the GBP/USD pair, expressed in weak volatility,

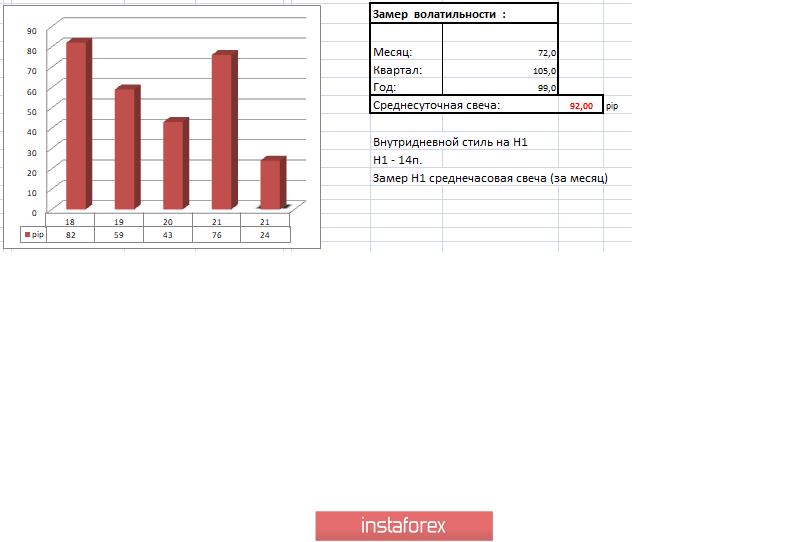

[Dynamics of daily candles from High to Low: 58 -> 65 -> 97 -> 62 -> 75 -> 45 -> 67 -> 58 -> 53 -> 83 -> 53 -> 118 -> 58 -> 40 -> 63 -> 51 -> 81 -> 59 -> 43 -> 76 points]

The reason for such an indecisive movement lies in many factors, in particular, in the information background and the emotional mood of market participants. That is, the compression of 1.2885 / 1.3000 is a small part of the flat fluctuation, which has been holding the market from further actions for five weeks already.

Analyzing the past hourly hour, we see that almost a solid impulse jumps were recorded in the interval 13:00 - 15:00 UTC+00 [time on the trading terminal] for the first time in a week. In fact, during this period, we saw movement from the upper boundary to the mirror level. Now, here's a few words about the upper boundary. We often put the pointer at the level of 1.3000, but we see the development of the value much earlier - what is the difference? The fact is that the level of 1.3000 is the psychological level in the structure of the current flat, where there are stocks based on fluctuations on October 31 and accumulations on November 18-19. Thus, the convergence of prices with conditional allowances gives a signal to develop the level of 1.3000.

As discussed in the previous review, many traders took a waiting position relative to the coordinates of 1.2885 / 1.3000. As we can see from the result, the highlighted values were never broken, thus, no trading operations were performed. Moreover, I do not exclude the possibility that ardent speculators manage to develop within the accumulation [1.2885 / 1.3000], although the risk is great in some cases.

Considering the trading chart in general terms [the daily period], we see the same movement within the flat, where the quotation develops within the upper boundaries and its middle. In terms of the main trends, everything is unchanged, the trend is downward.

The news background of the past day contained data on applications for unemployment benefits in the United States, where they expected a reduction of 4 thousand, but received an increase of 3 thousand as a result.

At the same time, there was no market reaction to statistics due to the same information background.

Thus, yesterday, the Laborites in the person of its head Jeremy Corbyin managed to stir up all the media sources with their statements and, most importantly, with the manifesto of their party, where they blamed the entire existing system along the way. What was the main focus? Corbyn emphasized once again that he intends to bring radical changes to the country such as nationalized railways, energy and water companies, as well as royal mail. The total tax revenue of the government will increase by about 10%. This would make it possible to finance higher wages for public sector employees, to promote free tuition at universities, and to transfer to a free care for the elderly and a number of other benefits. He also had a complete list of enemies: billionaires, tax evaders, bad managers. These, he said, are people who cash in on a rigged system.

Jerome Corbyn's election campaign is admirable, you just go to his Twitter account, one or another propaganda program is published there almost every hour, as well as accusations against conservatives.

From the last tweet:

"We can end privatization and save our NHS [National Health Service]. We can defer Brexit and unite our country. We can deal with the climate crisis that threatens us all and we can rewrite the laws of our economy so that the activity is for everyone, not for the elite. The future is ours. #RealChange ", - twitter @jeremycorbyn

"It seems that Boris Johnson has stopped the discussion. He doesn't want you to hear the truth: he is bribed by billionaires and is preparing to sell the NHS to Donald Trump, "- twitter @jeremycorbyn

In turn, Boris Johnson is trying to keep up with his competitor and plans to introduce a 3% surcharge. In addition to the existing land tax for non-residents who buy British homes. The income received will be utilized on programs to combat homelessness.

"The facts show that adding significant volumes of demand to limited housing supply leads non-residents to overstate housing prices. That is why we are introducing a higher rate for non-residents of the United Kingdom, which will help solve this issue," Treasury Secretary Rishi Sunak said in a statement.

Today, in terms of the economic calendar, we have a preliminary index of business activity in the services sector from Markit, where the data should be confirmed at the level of 50.0.

The upcoming trading week in terms of the economic calendar is highlighted only by US statistics and only at the beginning of the week, since Thursday and Friday are strictly inactive due to Thanksgiving in the United States. At the same time, do not forget about the spontaneous information background, which can bring activity to the market.

The most interesting events displayed below --->

Tuesday November 25th

USA 14:00 Universal time - Composite housing price index S & P / CS Composite-20 seasonally adjusted (YoY), for September: Prev. 2.0% ---> Forecast 2.1%

USA 15:00 Universal time - Sales of new housing, October: Prev. 701K ---> Forecast 707K

Wednesday November 26th

USA 13:30 Universal time - Basic orders for durable goods, Oct: Prev -0.4% ---> Forecast 0.2%

USA 13:30 Universal time - GDP (preliminary): Prev 1.9%

Thursday November 27th

USA - Thanksgiving

Friday November 28th

USA - Thanksgiving - Early Closing at 10:00

Further development

Analyzing the current trading chart, we see the next local development of the mirror level 1.2885 with a sluggish upward trend. In fact, the development of quotes remains in the same established framework of accumulation where the previously given theory, as described above, is preserved in the market. In terms of volatility, a characteristic weakness persists, but the interest of market participants in the current situation has grown.

By detailing the movement per minute, we see a stop within the values of 1.2910 / 1.2925, which is an extremely narrow range and a way out is planned for the near future.

In turn, traders are in no hurry to rush to action, the analysis of control coordinates of 1.2885 / 1.3000 is saved in the work.

Having a general picture of actions, it is possible to assume that the fluctuation in the accumulation of 1.2885 / 1.3000 focuses on itself increased interest, which as a result, give activity in the market and, as a fact, impulses to breakdown of one or another boundary. If we refer to the general movements and background, then a breakdown of the lower boundary [1.2885] has more probability than a breakdown of the upper boundary.

Based on the above information, we derive trading recommendations:

- Buy positions are considered in case of breakdown of the psychological level of 1.3000, not a puncture in the shadow of a candle.

- Sales positions will resume after a clear fixation of the price lower than 1.2885, not a puncture in the shadow of the candle.

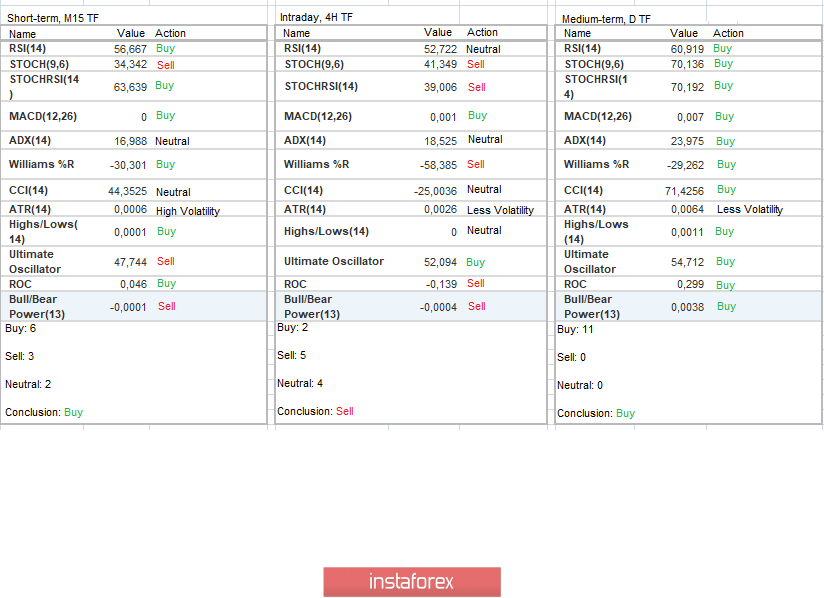

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that the indicators have a characteristic ambiguity when we look at the indicators of short-term periods and intraday. Meanwhile, medium-term sections retain an upward interest for the reason that we are still hanging near the upper boundary of the flat.

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(November 22 was built taking into account the publication time of the article)

The current time volatility is 24 points, which is an extremely low indicator for this time section. It is likely to assume that there will still be an acceleration of volatility as soon as the accumulation framework falls.

Key levels

Resistance Zones: 1.3000; 1.3170 **; 1.3300 **.

Support Areas: 1.2885 *; 1.2770 **; 1.2700 *; 1.2620; 1.2580 *; 1.2500 **; 1.2350 **; 1.2205 (+/- 10p.) *; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **.

* Periodic level

** Range Level

*** The article is built on the principle of conducting a transaction, with daily adjustment