Dissatisfied with the weak activity and growth of the index of business sentiment in Germany, buyers of risky assets chose to consolidate long positions that were gained at the Asian session on Monday. Such a scenario instantly returned sellers to the market, taking advantage of the problematic situation associated with trade negotiations between the US and China.

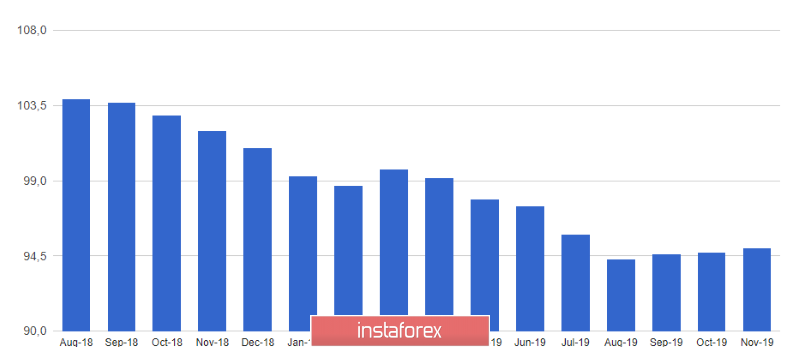

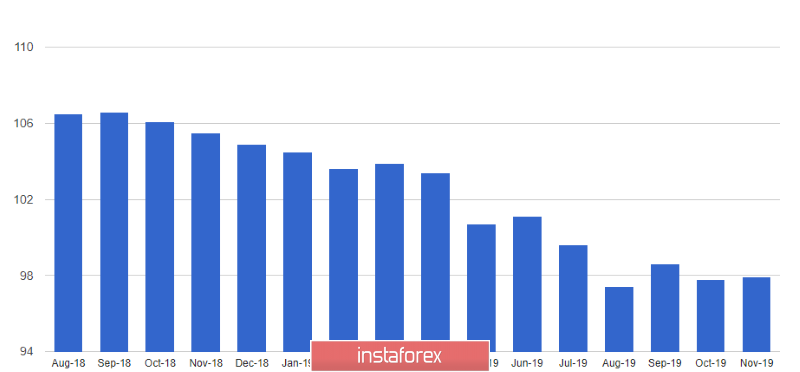

According to Ifo research institute, the sentiment of German business circles in November this year, although it improved, it failed to meet economists' expectations. The business sentiment index was 95.0 points versus 94.7 points in October. Economists had expected the indicator to reach 95.1 points. Meanwhile, the current conditions index rose to 97.9 points against 97.8 points in October, while the expectations index showed an increase to 92.1 points against 91.6 points. Economists had expected the current conditions index to be 98.0 points, and the expectations index to 92.5 points.

The report also noted that, although the German economy is demonstrating stability, a slowdown is expected in the fourth quarter. In the best case, Germany's GDP will add 0.2%. The whole problem remains with the manufacturing sector, where activity continues to decline.

While there are still problems with the implementation of fiscal stimulus measures in the eurozone, there is no need to talk about a change in the downward trend. During the Friday speech of the new president of the European Central Bank, Christine Lagarde, many market participants expected her to raise this topic, but in reality, the first speech of Lagarde was crumpled in nature and did not concern monetary policy.

Meanwhile, euro sellers take advantage of the moment and open short-term problems in risky assets, while the signing of a trade agreement, namely its first phase between the US and China, has come to a standstill. If the US-China deal allows the abolition of protective duties, it will significantly improve the prospects for the euro, which will lead to an increase in risky assets against a number of currencies.

Meanwhile, the People's Bank of China said that downward pressure on the economy has increased, and possible risks in the financial system are difficult to eliminate in the short term. Beijing's proposal to continue trade negotiations, but already in China, has not yet received the support of the White House.

As for the technical picture of the EURUSD pair, it remained unchanged. The downward trend may continue in risky assets, but for this, the bears need to stay below resistance 1.1040, which will lead to the formation of a new impulse. A break of support 1.1005 at the beginning of the week will lead to an update of the lows of this month around 1.0989. The worsening of trade relations between the USA and China will be an important component in the bearish movement of risky assets.

Meanwhile, the British pound continues to regain its position against the US dollar after the publication of the latest polls that took place this weekend. According to the data, the Conservative Party of Great Britain retains its leadership before the general elections scheduled for December 12. This weekend, Prime Minister Boris Johnson also introduced a conservative program. It focuses on the exclusion of income tax increases.