Only two and a half weeks left before the elections to the Lower House of the British Parliament. Elections will be held on December 12, and on December 17 a new composition of the House of Commons will gather for the first session. If the current British prime minister receives a majority and forms a government, the Queen will deliver her throne speech on December 19. After that, apparently, the MPs will disperse for the Christmas holidays, and will already begin to consider the Brexit issue in early January. If the Conservatives are unable to form a cabinet, this process will be delayed and respectively, discussion of the deal will take place later.

However, the latest ratings continue to delight Tory representatives: Conservatives have the highest rating since 2017, gradually increasing the gap from the main competitors - the Laborites. The latest YouGov poll suggests that 45% of respondents support Johnson's party, while Jeremy Corbyn's party rating has not changed, remaining at 30%. Liberal Democrats also do not rise above their electoral ceiling of 15%. This survey was conducted last week, so GBP/USD traders anticipate more recent data. According to information published today, YouGov plans to publish new results the day after tomorrow, that is, November 27th. This release is likely to cause strong volatility for the pair, especially if they are in favor of Conservatives. If the Tories increase the margin from the Labour, the pound may again approach the 30th figure - the mark of 1.3000 is now the main resistance level for GBP/USD traders.

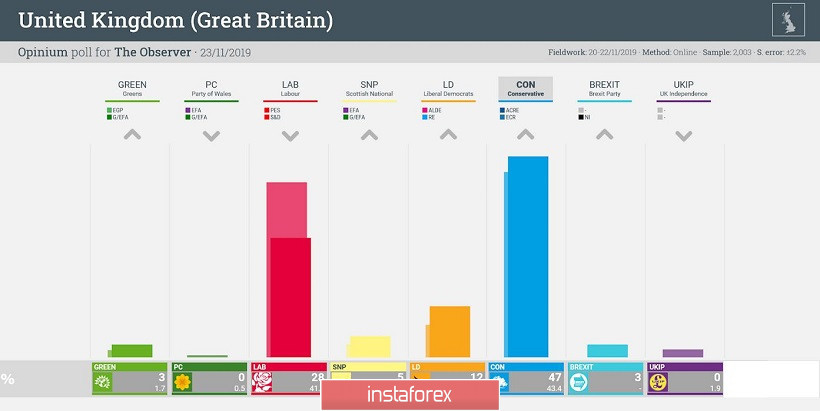

Sociological studies of other institutions also speak of the successes of Conservatives. Today's surge in optimism for the pound was based on a survey conducted by Opinium commissioned by The Observer. The published figures demonstrate the phenomenal success of the Tories: almost half of the respondents (47%) are ready to vote for the Conservatives, while the Labour Party is still content with relatively modest support (28%). Liberal Democrats, according to Opinium, are also losing ground - they are supported by only 12% of respondents.

Such results helped the pound move away from the lows of last week and return to the framework of the 29th figure. And although the rise in GBP/USD price is impulsive and unstable, the fact of growth speaks volumes. First of all, that the bearish moods in the pair are quite fleeting. Last week, the pound fell for several days, but the downward dynamics did not continue. The pound is still spinning around the 29th figure, being in orbit of the flat movement. And apparently, the pair will remain in this price range until December 12, until the real (and not expected) election results become known.

Due to the specifics of the UK electoral system, experts do not undertake to identify the rating of Conservatives with the estimated number of seats in the House of Commons. For example, four years ago, during the next parliamentary elections, Conservatives had almost 37% of the vote, and they were able to form their own majority (330 seats). In 2017, when Theresa May initiated an early election, the Tories lost their majority, receiving only 317 mandates, although they received 42.5% in the elections. Such is the specificity of the British electoral system - the Parliament is elected by the majority system, but the parliamentary majority is formed by parties. Secondly, elections in the UK are often characterized by unexpected jerks of ratings of political forces. Again, returning to the 2017 elections, we can say that in just a month of the campaign, the rating of Laborites increased one and a half times - from 24% in April to 42% at the end of May.

Thus, despite the Conservatives' impressive ratings, the GBP/USD bulls cannot break the 1.3000 mark to gain a foothold in the 30th figure. Last week, the pound was completely under pressure: weak British macroeconomic reports, Johnson's uncertain victory in the debate, as well as the general strengthening of the dollar, did their job.

Nevertheless, the downward impulse again turned out to be false. At these minutes, the GBP/USD pair is again testing the 29th figure: fresh ratings and the weakening of the US currency returned the pair's confidence to the pair's bulls. In addition, according to the Global Times, Washington and Beijing came close to the final part of the trade agreement as part of the first phase of negotiations. Trump has also replaced anger with mercy - at least his rhetoric has become more friendly to China. He once again said that the parties are at the finish line of negotiations. He also tried to maintain balance in the Hong Kong issue. Trump said that he'll carefully study the bills to protect democracy in Hong Kong, and added that in addition to the rebellious Hongkongers, he also supports Xi Jinping. This attitude also somewhat relieved the market situation, although it is hard to imagine that the American president endorsed legislative initiatives that were unanimously supported by all senators - both Democrats and Republicans.

Thus, the fresh sociology amid the decline in anti-risk sentiment in the foreign exchange market helped the pound regain its position. The GBP/USD pair continues to fluctuate in the price range of 1.2780-1.3000. If on Wednesday the data from YouGov again turns out to be in favor of the Conservatives, the pair will be able to approach the upper boundary of the above price range.