EUR/USD

On Monday, the euro tried for the second time to push the support of the MACD line on the daily chart. This attempt was not very firm, since trading volumes were less than average for the current month. Today, investor interest in dollar purchases may increase, since macroeconomic statistics on the sale of new homes in the United States in the October estimate may grow from 701 thousand to 708 thousand, the Conference Board consumer confidence index is expected to increase from 125.9 to 126 this month. 9, wholesale inventories in October may increase by 0.2%, the home price index for September is expected to rise from 2.0% y/y to 2.1% y/y.

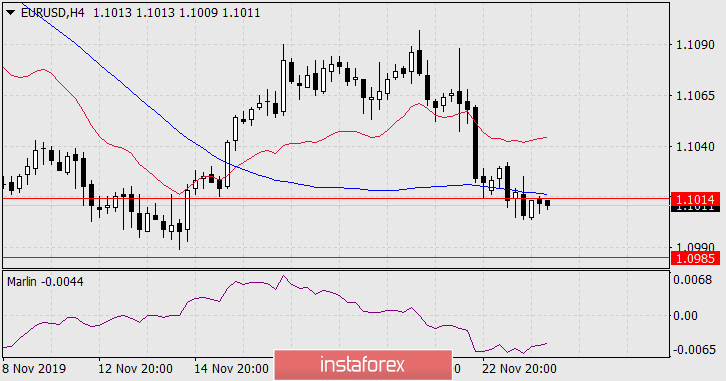

Today in the Asian session, trade began with a slight decrease in the euro, but this is enough for the price to be able to gain a foothold under the MACD line. The signal line of the Marlin oscillator is going down in the negative zone. Consolidating the price at 1.0985 (Fibonacci level 138.2%) opens the underlying target 1.0925 - the low level on September 3 and 12.

On a four-hour chart, the price consolidated below the MACD line, the Marlin in the zone of decline. The immediate goal is 1.0985.