The golden rule of trade is: keep your losses low and let your profits grow. However, far from all investors can withstand the nerves. The longer the uncertainty associated with trade negotiations between the United States and China, the more often fear is present in the oil market. There is talk that the factor of signing the US-China "phase one" trade deal has already been taken into account in Brent and WTI quotes, and if so, then in fact there may be an avalanche-like folding of speculative long positions. Isn't it better to play it safe and wait aside?

The question of which factor is already in the quotes and which is not is extremely important for the pricing of any asset. The next OPEC meeting will be held at the beginning of December, from which the markets are waiting for the extension of the agreement to reduce production by 1.2 million bpd, at least until the end of 2020. If this does not happen, Brent and WTI futures are likely to collapse. However, it is believed that even if the cartel and Russia give the market what it expects, prices will still fall due to the implementation of the principle of "buy by rumor, sell by facts". OPEC+ needs to be extremely careful so as not to trigger a wave of sales. It may even be necessary to extend the agreement beyond 2020 or to scale up production cuts.

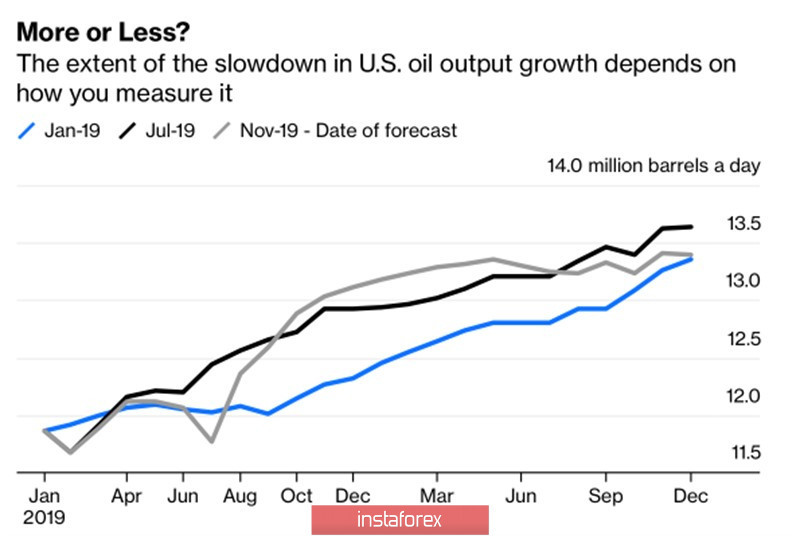

From a fundamental point of view, the slowdown in shale production in the United States, the prolongation of the OPEC agreement and the acceleration of global demand under the influence of the signing of a trade agreement by Washington and Beijing should lead to an increase in black gold. However, the United States and China have not yet agreed, we mentioned the cartel's situation, and the question of slowing down US production remains open. They have been gossiping about this for a long time, so this factor may be ... already laid down in quotes. In addition, the dynamics of forecasts by the US Energy Information Administration indicate that not everything is as bad as is commonly believed.

The dynamics of EIA forecasts for US oil production

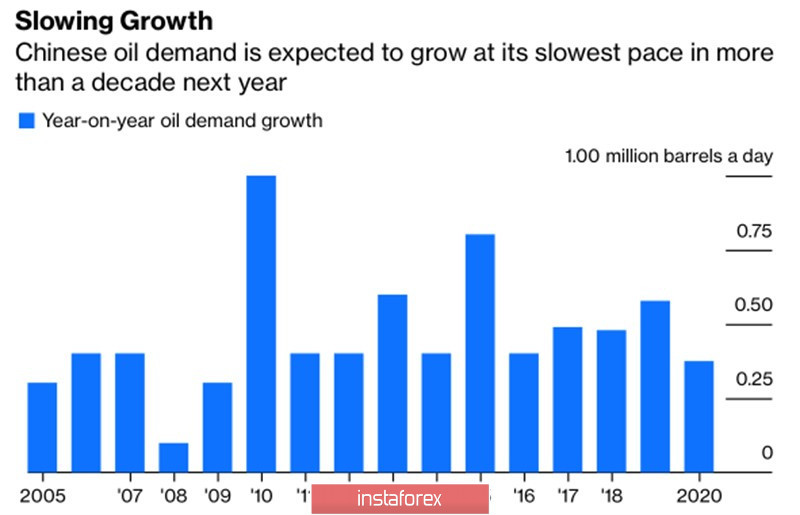

When predicting the future fate of an asset, it is also necessary to take into account the time factor. For example, in 2017, investors believed that tax reform would accelerate the US economy, but this only happened in 2018. That is, with a time lag. It is possible that a large-scale increase in the White House's tariffs on Chinese imports this year will affect the economy of China and oil demand only in 2020. For example, the IEA expects the latter to grow by only 375 thousand b / s, which will become worst dynamics since the global financial crisis.

Dynamics of Chinese oil demand

Thus, if we assume that the prolongation factors of the Vienna OPEC+ agreement on the production cut and the US production slowdown of black gold are already taken into account in Brent and WTI quotes, and the factor of the slowdown in the growth of Chinese oil demand is not there yet, then the market conditions will begin to not look bullish at all.

Technically, buyers of the North Sea variety still have hope for fulfilling the targets for the Wolfe Wave and Shark patterns, however, falling quotes below supports by $62-62.4 and $59.4-59.8 per barrel can return the initiative to sellers.