USD/JPY

The dollar is rising for the third consecutive day against the yen, helped by moderate stock market growth. Yesterday, the S&P 500 grew by 0.22%, while the Nikkei 225 is adding 0.38% today. The greatest danger to the global stock market is now the Chinese segment. From November 6, the China A50 index is currently losing 3.82%, today's decline is 0.49%. The markets fear that the fall of Chinese indices will pull the rest of the market. In this case, the USD/JPY pair will decline regardless of other circumstances. Earlier, we noted that the biggest investors reduced investments in US stocks by 30%, that is, they closed their positions in this volume. Thus, the growth of the pair represents an increased risk for purchases.

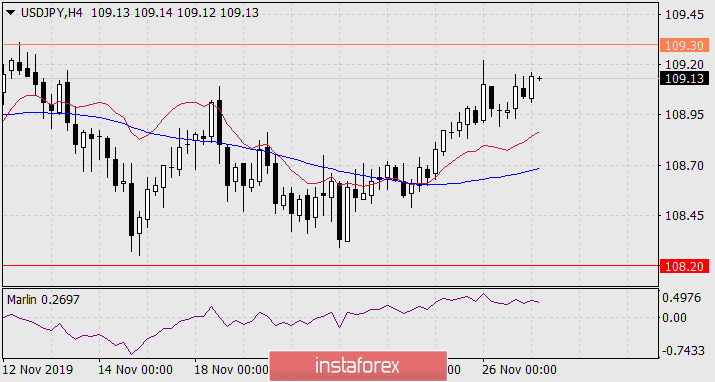

At the moment, the price is approaching the control level of 109.30 (peak on October 30), overcoming which opens the target 109.92. The Marlin oscillator has infiltrated the growth zone, there is the potential for continued movement.

On the four-hour chart, a steady rise in prices continues, the Marlin signal line lies in the horizon, but does still not show signs of a reversal.