To open long positions on GBP/USD you need:

Yesterday's polls showed growing interest in the Labour Party, which caused the pound to fall, but did not reach a sell-off. Currently, the fight is for the resistance of 1.2876, on which the upward correction depends. Only a return and consolidation above this range will allow us to return to the high of 1.2926 and update it, reaching the resistance of 1.2959, where I recommend profit taking. However, the scenario with a decrease in the support area of 1.2836 and the formation of a false breakout there, which will be the first signal to buy the pound, seems more likely. Otherwise, I recommend to open long positions immediately for a rebound at a low of 1.2805, but this is subject to good statistics for the United States and the absence of news on elections in the UK.

To open short positions on GBP/USD you need:

An important point for sellers is keeping GBP/USD below the resistance of 1.2876. The formation of a false breakout at this level will lead to a larger downward correction to the support area of 1.2839, and it is quite possible to update the low of 1.2805, where I recommend profit taking. However, such a powerful bearish impulse will be realized only with good data on US GDP growth for the third quarter of this year. Large players will leave the market if the bulls manage to regain the resistance of 1.2876. However, talking about the continuation of the upward trend in this scenario is also wrong, since growth will be limited by the upper level of the side channel near 1.2915, from where I recommend opening short positions immediately for a rebound.

Signals of indicators:

Moving averages

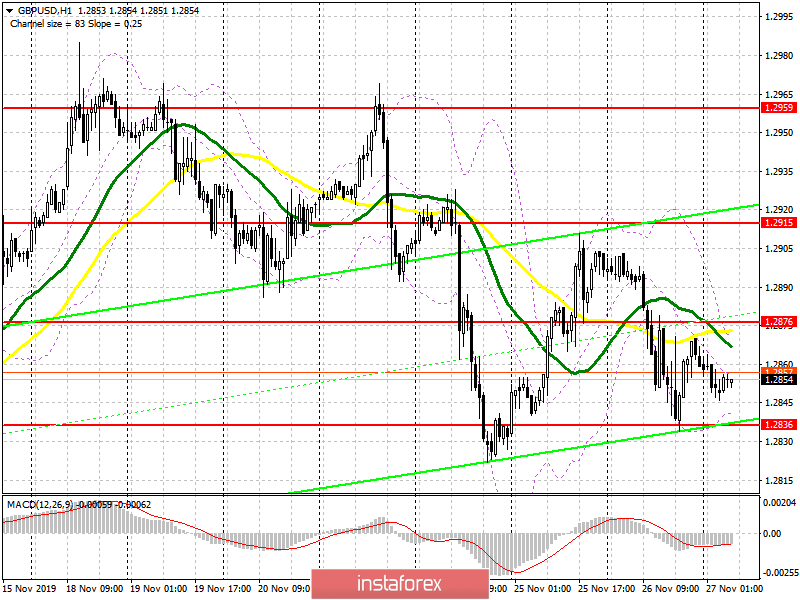

Trading is below 30 and 50 moving averages, which indicates a bearish advantage.

Bollinger bands

A break of the lower boundary of the indicator at 1.2836 will lead to the pound's sell-off. Growth will be limited by the upper level at 1.2870.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20