Hello, dear colleagues!

Since it is hardly possible to see any significant changes in the technical picture of the main currency pair of the market, I will start this article with a brief description of the external background, as well as the upcoming macroeconomic reports.

So, the trade epic between the US and China continues. As recently as yesterday, President of the United States Donald Trump said that the United States and China are almost a step away from signing a trade agreement. According to Trump, he has an excellent relationship with Chinese leader Xi Jinping, and work on a new trade agreement between the two countries is in the last stage.

I suppose it's not all so obvious and simple. First, the topic is quite difficult and requires compromises from both sides of the trade conflict. Secondly, the 45th President of the United States today says one thing, and tomorrow he can express a completely different point of view. Especially such statements often appear in the now legendary Twitter of Donald Trump.

Nevertheless, the topic of trade confrontation between countries with the first and second world economies cannot but excite investors and influence the course of trading. However, the markets have already become "accustomed" to various kinds of statements, which at the moment are only statements.

Now, about the main macroeconomic reports of today.

No releases are expected from the eurozone, but from overseas at 14:30 (London time), revised GDP data for the third quarter will be presented, as well as a block of statistics on durable goods.

A little later, the US will publish data on personal spending and incomes of Americans, the Chicago purchasing managers index, reports on pending home sales transactions, the basic price index of personal consumption expenditures. The publication of the Fed's Beige book will end the day so full of statistics from the US at 20:00 (London time).

I believe that investors, given the numerous American reports, may have a driver for more active actions and the pair will finally start a consistently directed movement.

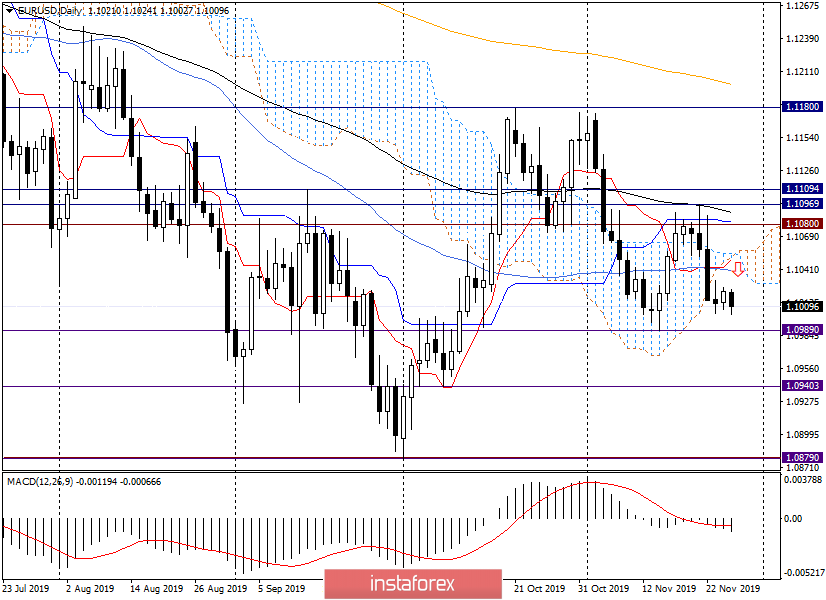

Daily

At yesterday's trading, the quote has grown, but so far it can be considered only a correction to the previous decline, as well as a candle "Doji" which appeared a day earlier.

At this point, the EUR/USD is trading lower in the area of 1.1012. It is necessary to note one very important point. Despite the pressure under which the single European currency remains, not one daily candle (of the last) has not closed below the important psychological and technical level of 1.1000. I believe that this is quite indicative of the reluctance of the market to trade below this important mark.

In this regard, today's trading, saturated with numerous macroeconomic data from the United States, can change the situation. In the case of positive statistics for the dollar and, most importantly, the same positive reaction to the reports of market participants, a decline below 1.1000 for EUR/USD is inevitable. Moreover, the important support level of 1.0989 is likely to be broken.

If this happens and we see the closing of today's session below 1.0989, then we can expect a downward movement to the levels of 1.0940, 1.0900 and 1.0880.

With the alternative and disappointing data from the US, the pair will rise to the area of 1.1040-1.1060, where 50 MA, Tenkan line and the lower boundary of the Ichimoku indicator cloud are located. I assume that the euro/dollar will meet strong enough resistance to turn back to the decline. I think the trading idea is clear and it is indicated on the chart by an arrow. Earlier (and therefore the riskiest) sales can be tried near 1.1028/30.

From purchases in the current situation, it is better to refrain. First, at this stage of time, the market is under the control of bears. Secondly, there are no corresponding signals to open long positions on the EUR/USD pair. Let's see what will be the reaction of market participants to today's numerous reports from the United States. Well, according to the technique, the most relevant positioning is sales after corrective rollbacks to the goals indicated in this article.

Good luck and big profits!