To open long positions on GBPUSD, you need:

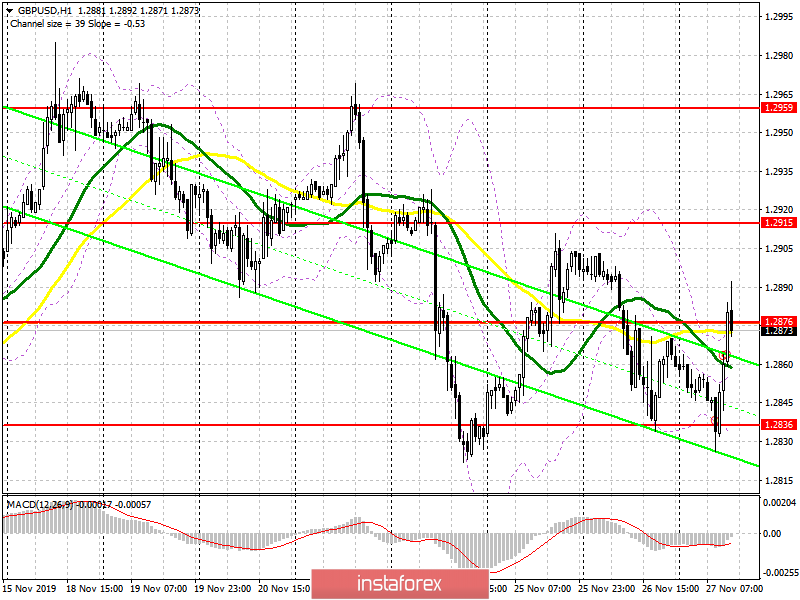

In the first half of the day, I paid attention to the support level of 1.2836, from where I recommended opening long positions provided that a false breakdown was formed there, which happened. Buyers of the pound managed to implement a bullish scenario and are now trying to regain the resistance of 1.2876, a breakthrough and consolidation above which will provide GBP/USD with a new upward momentum that can lead to an update of the highs of 1.2915 and 1.2959, where I recommend taking the profits. However, without good news and confidence in the victory of the Conservative Party of Great Britain in the elections, we should not expect a more powerful bullish momentum. In case of unsuccessful consolidation above 1.2876, and this scenario can be implemented after good statistics on the US economy, you can count on new purchases at the same support level of 1.2836, and open long positions immediately on the rebound is best from the minimum of 1.2799.

To open short positions on GBPUSD, you need:

Sellers tried to break below the support of 1.2836, but failed to do so. The sharp reversal of the market allowed GBP/USD to bounce up to the resistance of 1.2876, for which there is now an active struggle. In the scenario of a return of the pound under this level in the afternoon, and this can happen only in the case of good economic indicators of the United States, the bears will act more actively, which will push the pair back to the support of 1.2836, where I recommend taking the profits, as only a breakthrough of this level will increase the pressure on the pound and will allow reaching the minimum of 1.2799. If the bulls continue their purchases, it is best to consider new short positions on the rebound from the resistance of 1.2915, or even higher, at the maximum of 1.2959.

Indicator signals:

Moving Averages

Trading returned around the 30 and 50 daily averages, indicating that the market may remain in the side channel.

Bollinger Bands

Buyers are trying to cope with the upper limit of the indicator around 1.2876, a breakthrough of which will provide a new wave of growth of the pound. In the case of a decline, the support will be provided by the lower border, which coincides with the support of 1.2836.

Description of indicators

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 50. The chart is marked in yellow.

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 30. The chart is marked in green.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.