The euro continued to decline against the dollar yesterday amid good statistics on the US economy, where GDP growth was recorded in the third quarter of this year, as well as an increase in the number of orders for durable goods, which is also quite important, as it determines the confidence of Americans in the future.

However, the US dollar did not receive much support, since all attention is focused on US-China trade relations. Markets are expecting that the first phase of a trade deal will be signed soon, but until then, demand for risky assets will remain fairly low. However, a number of experts note that one should not expect changes and the euro's growth even after signing the first part of the agreement, since a more detailed breakthrough in trade negotiations is necessary, as well as good macroeconomic indicators for the European economy.

Yesterday, data came out that showed that French consumer confidence rose in November this year. According to a report from Insee statistics agency, the consumer confidence index was 106 points in November 2019 compared to 104 points in October. Economists had expected the index to drop to 103 points in November.

The index for the eurozone will be published today. It is expected that it will remain unchanged at -7.2 points.

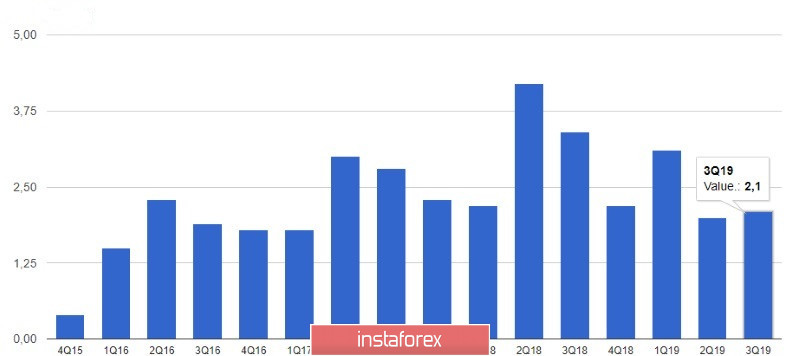

As I noted above, the US economic growth rate in the third quarter turned out to be stronger than what was indicated in the first estimate. According to the U.S. Department of Commerce, GDP in the third quarter of 2019 grew by 2.1% per annum, while the initial estimate implied an increase of only 1.9%. A number of economists expected the second estimate to coincide with the first.

The revision of the overall indicator was due to an increase in capital investment of companies and an increase in inventories.

The report on orders for durable goods in the US also supported the dollar in the afternoon. Despite the fact that a number of economists predicted a reduction, in October of this year, orders for goods with a service life of at least three years increased by 0.6% compared with September. Interviewed economists expected orders to fall by 0.1% during the reporting period. As indicated in the report, mainly the growth of orders was due to the acceleration of business activity in the United States. Excluding transport equipment, order growth was 0.6%.

Support for the economy in the third quarter will also include data that US households continued to increase their spending in October. However, if you look at the report in more detail, you can pay attention that consumers were less active in purchasing goods, and the increase was due to increased costs for electricity and gasoline. According to the US Department of Commerce, personal spending in the United States rose 0.3% in October compared with September. Economists also expected spending to rise by 0.3%. As for household incomes, they remained unchanged in October. The share of personal savings, which is the difference between income after taxes and expenses, reached 7.8% in October compared to 8.1% in September.

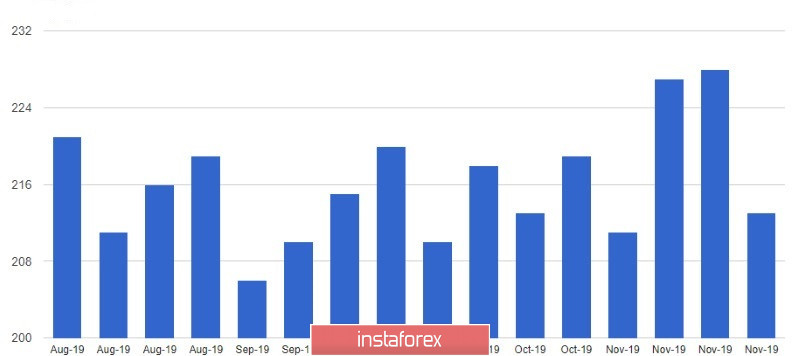

As for the US labor market, the number of applications for unemployment benefits decreased last week. According to the US Department of Labor, the number of initial applications for unemployment benefits for the week from November 17 to 23 fell to 15,000 and reached 213,000. Economists expected that the number will be 220,000. The number of secondary applications for unemployment benefits amounted to 1.64 million The US labor market situation continues to have a positive effect on the economy, as unemployment is at record low levels. Problems are still observed with the selection of qualified personnel.

The market ignored data on the number of home sales contracts in the US. According to the National Association of Realtors, the index of signed agreements on the sale of housing on the secondary market fell by 1.7% to 106.7 points in October, while economists expected the index to rise 0.8% in October. Compared to the same period of the previous year, sales rose by 4.4% in October.

As for the technical picture of the EURUSD pair, the expected breakdown of the week's lows at 1.1005 did not lead to a significant sale of risky assets, which did not allow the bears to build a new downward trend. The market continues to be in a "suspended" state, relying either on data on the US economy, or on the news of US-Chinese trade negotiations. If the bears miss the resistance of1.1015, the demand for the euro may return, which will quickly lead to the renewal of the highs of 1.1040 and 1.1060. An unsuccessful attempt to return to a resistance of 1.1015 can maintain pessimistic views on the purchase of the euro, which will push the pair to a low of 1.0993 and lead to its breakout, making it possible for the bears to reach support 1.0970.