Politics again intervened in the measured course of events, and now it has become the reason that the single European currency stood still. The stock market began to rush right after Donald Trump signed a bill designed to maintain Hong Kong's special status, as well as imposing sanctions on individuals and companies taking actions to undermine its autonomy. Beijing's response, which summoned the United States ambassador, was even more impressive, and besides expressing concern, he assured him that China's response would be rather harsh. But the funniest thing about all this is that everyone has long known that Trump will sign this bill. This was not something unexpected. In any case, it is clear that trade negotiations between the United States and China will drag on even longer. Most likely, it is now worth waiting for the introduction of new trade restrictions, which was the reason for the decline in the stock market.

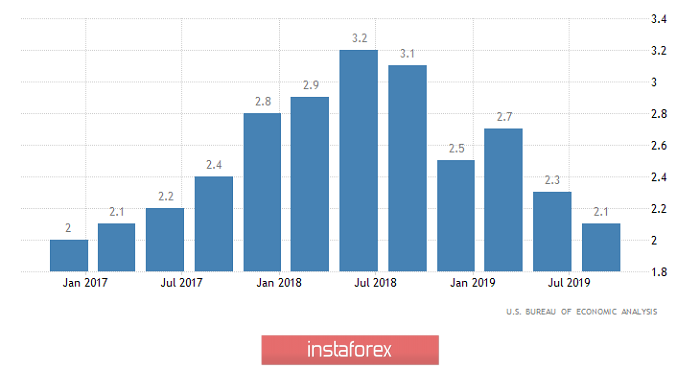

However, the single European currency stood still, as a new aggravation in relations between the United States and China, only offset American statistics, which was simply fantastic. The second estimate of GDP for the third quarter showed that the pace of economic growth slowed from 2.3% not to 2.0%, but to 2.1%. Moreover, orders for durable goods, which were supposed to decrease by 0.8%, unexpectedly increased by 0.6%, which means that the decline in industrial production will be temporary. In addition, the total number of applications for unemployment benefits decreased by 72 thousand, while they expected a decrease of 14 thousand. In particular, the number of initial applications for unemployment benefits decreased not by 7 thousand, but by 15 thousand. The number of repeated applications decreased by 57 thousand, with a forecast of 7 thousand. Such an impressive reduction in the number of applications for unemployment benefits, clearly indicates a possible improvement in macroeconomic indicators in the labor market as a whole. So the dollar was supposed to go up, but the ongoing debate between Washington and Beijing did its dirty work.

GDP growth rate (United States):

Today will not be so busy, and obviously you should not wait for any reaction from Beijing in response to Washington's actions. China will obviously take a balanced approach to this issue, and will respond in other directions. Moreover, China is unlikely to spoil Thanksgiving celebration for Americans. So investors should switch to macroeconomic statistics, which today are almost nonexistent. The only thing is the data on the lending market in Europe, the growth rate of which should accelerate from 3.4% to 3.5%. However, these data are not so interesting, and do not have a serious impact on the market. Especially when it is a holiday in the United States.

Consumer lending growth (Europe):

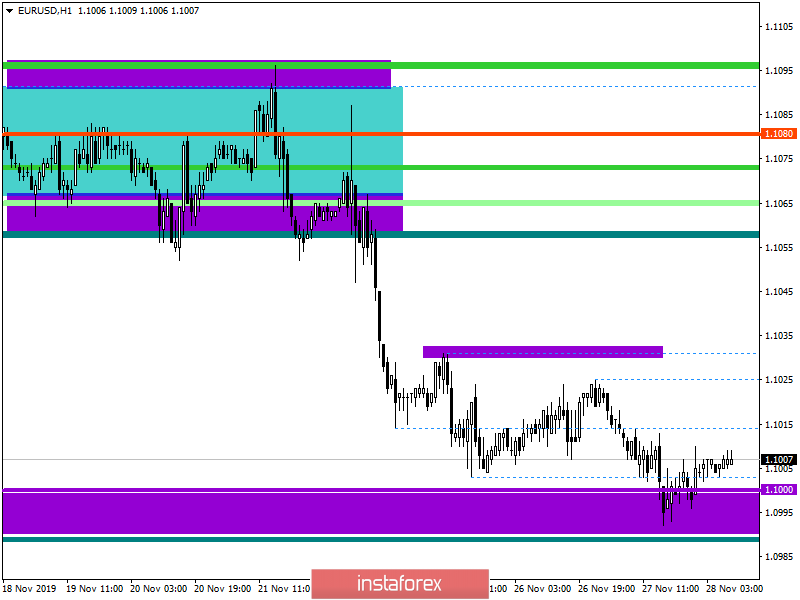

In terms of technical analysis, we see an attempt to break the psychological level of 1.1000, but instead received another false breakout, with the price returning back to the accumulation framework. In fact, there were no bursts of activity on the market, even with such strong statistics, where the result was not just the return of the quotation back, but the preservation of a kind of ambiguity, which already hung on the market even before the attempt to break the control level.

In terms of a general review of the trading chart, we see that in this case, the psychological level of 1.1000 plays the role of a control value in terms of further recovery of the quotation, relative to an elongated correction.

It is likely to assume that a kind of lateral swing along the psychological level of 1.1000 will not go anywhere and today we will continue to concentrate within the same amplitude. In turn, the trading tactics remain the same; traders are most interested in seeing price consolidation relative to the control values of 1.0990/1.1035 than trading in a narrow band.

Concretizing all of the above into trading signals:

- Long positions, we consider in case of price consolidation higher than 1.1035, not a puncture shadow.

- Short positions, we consider in case of consolidating the price lower than 1.0990, not a puncture shadow.

From the point of view of a comprehensive indicator analysis, we see that, to a greater extent, indicators signal a downward interest than an upward one. In turn, the minute intervals alternately operate on the existing bounce, inside a closed circuit, thereby having a versatile signal.