Thanksgiving is a holiday in the USA today. The local financial market will be closed, which means that activity in world markets will be noticeably lower and will almost completely decline to zero by the end of trading in Europe.

Among the interesting events of yesterday, we highlight the publication of important data on the American economy. First of all, this, of course, is the value of GDP for the third quarter, which exceeded expectations by adding 2.1% against the previous revised value of 2.0% and expectations of a decrease to 1.9%. The data of basic orders for durable goods were also significantly higher. In October, the indicator sharply added 0.6% against the September decline of 0.4% and the forecast of an increase of 0.2%. The number of initial applications for unemployment benefits turned out to be positive, which still remains at the minimum values of the first half of the seventies of the twentieth century.

In the wake of this news, the American dollar received support as we expected, but only limited, due to low pre-holiday activity before Thanksgiving. Thus, we expect a resurgence of activity on Friday, although not in such large volumes, due to the coming weekend again.

In general, if we pay attention to the situation in the markets, it still remains captive to the topic of US-Chinese trade negotiations, which are overshadowed by the civil conflict in Hong Kong, clearly supported by the United States, which also seem to be trying to make China more compliant in trade negotiation process.

Assessing the short-term prospects for the development of events in the currency market, we believe that the dollar will at least continue to maintain its position in a basket of major currencies and, as a maximum, continue to smoothly strengthen. However, its current growth is restrained by the decline in the yield on the Treasury, which is weakening on the wave of the topic of trade negotiations.

Regarding the prospects for gold, we believe that any serious positive on the negotiation process between Washington and Beijing will lead to a breakthrough of the strong support level of 1452.50 and to a further decline in the price of $ 1280.00 per ounce. In fact, to the level from which the rise of quotations began after a serious slippage of the topic of trade negotiations.

Forecast of the day:

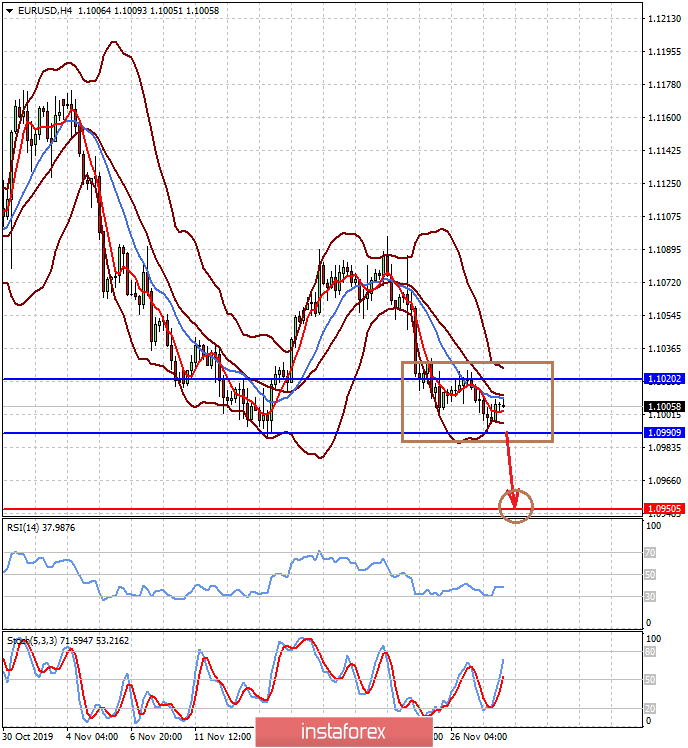

EUR/USD remains under pressure amid generally positive data on the US economy. Today, we expect a continuation of the consolidation of the pair at 1.1000. Breaking through which and consolidating below it will lead to a fall in prices to 1.0950.

The price of gold is also consolidating at a strong support level of 1451.40. It is likely that due to the lack of American investors in the market, gold will move in a narrow range today, but in the future, we expect it to resume declining to 1445.30, and then even lower after breaking through the level of 1451.40.