Dear colleagues!

Before proceeding to technical analysis of the dollar / franc currency pair, it is worth noting that yesterday's third-quarter GDP data and reports on durable goods, exceeded experts' expectations and supported the US dollar.

Expectations of an early resolution of the phase of trade contradictions between the US and China also favorably affected the dynamics of the US currency.

Thanksgiving is a day off in the US today, and US markets will be closed. In this regard, today a thin market is expected, trading on which is always riskier.

Now let's see what is observed on the charts of the USD / CHF currency pair, and if there are any interesting trading ideas for this tool.

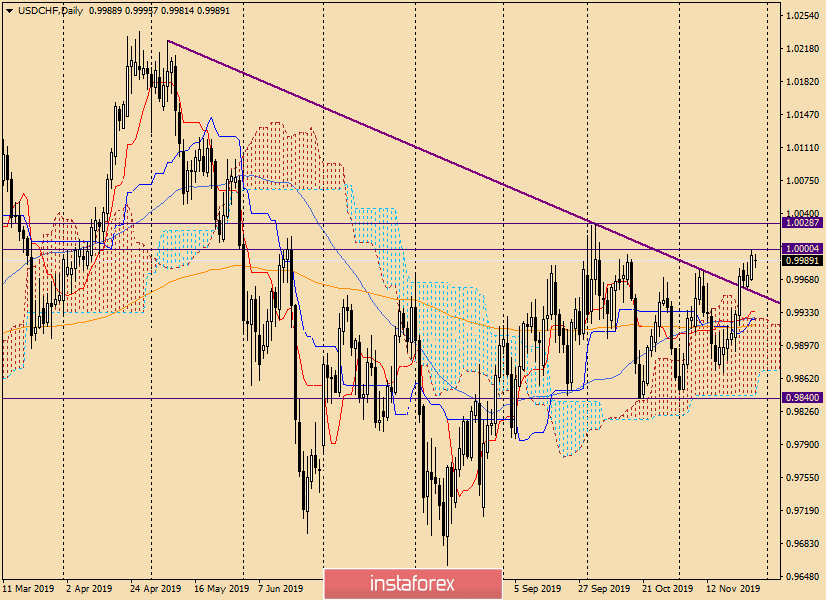

Daily

On the daily chart, we see that the pair came up from the Ichimoku indicator cloud and for more than three candles in a row, at their closing prices, the pair fixed above the violet resistance line 1.0226-1.0028. This factor may indicate a true breakdown of this line, as well as the fact that it can now perform support functions. Actually, this is exactly what was observed at the auction on November 25, when the indicated line stopped the decline and sent the quote up.

Now we are witnessing a very interesting and important point that this is the price approach to the parity level of 1.0000. Historically, this mark is extremely important and very difficult to pass. So yesterday's bidding convinced him again. Having shown maximums at 1.00004, the pair rebounded and ended the session on November 27 at 0.9994, that is, below the notorious parity.

Despite the fact that USD / CHF maintains a bullish mood, players need to raise the quotation above 1.0000 and close not only the last two days but the entire trading week above this level, as well. I believe that only in this case can we count on further heading towards the upside.

At the time of this writing, the pair is moderately strengthening. If the positive trend continues, I am waiting for the rate at 1.00008 and in the area of 1.0028, where the maximum trading values were shown on October 2-3.

When implementing an alternative scenario, the dollar / franc may again fall to the broken violet resistance line, where the fate of the pair will be decided.

Closing the auction under this line will cast doubt on the truth of its breakdown and cheer up the bears, who, such an impression, have hibernated. If the dollar / franc again finds support on the broken line and turns back on the rise, there is a high probability of passing parity and consolidation above 1.0000.

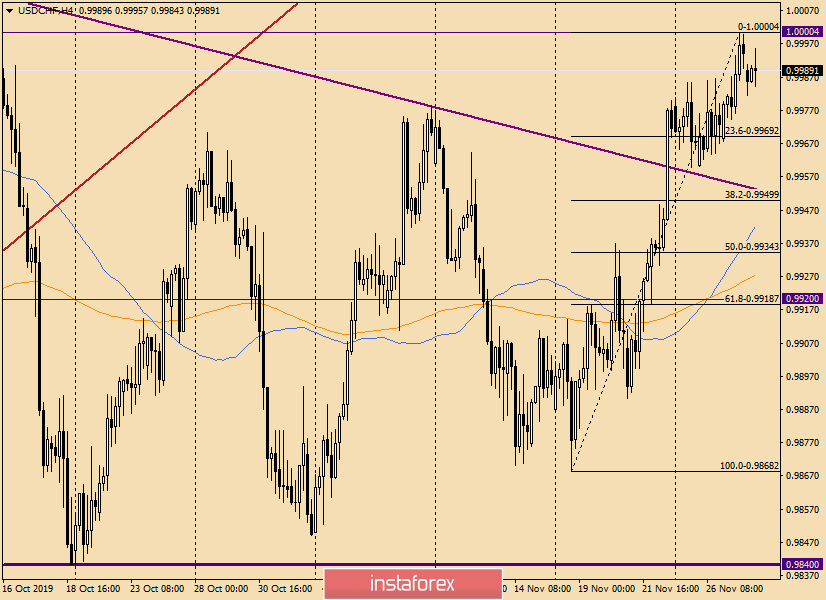

H4

A clearly defined upward momentum is clearly visible on this chart. At the same time, difficulties of further advancement do not escape attention.

If the current candlestick is formed in the form of a bearish candlestick analysis, you can try to sell the pair with a small stop and targets in the area of 0.9965-0.9955. This position will be against the main upward trend, solely in the calculation of the course correction. There are no signals about the end of the bull trend and its change to a bear trend. They are better to wait on the daily or weekly charts.

However, 4-hour candles often have a strong influence on the change in price dynamics, so you can try. At least to buy on highs, and even at parity, there is no desire at all. Moreover, after such growth, a corrective pullback is necessary, and in the conditions of today's thin market, it might actually take place.

As a result, the USD / CHF trading plan is like this, we are waiting for the closure of the current 4-hour candle, and if it is bearish, we will sell it until 0.9965-0.9955, from where it is already worth considering purchases.

For more cautious traders, I recommend staying out of the market and observing how the situation with fixing the pair above parity will be resolved or how the price will behave if it decreases to the violet resistance line.

Good luck!