The euro-dollar pair continues to trade in the flat, without leaving a narrow price range. The contradictory fundamental background does not allow traders - neither buyers or sellers - to show character. In addition, Thanksgiving is currently being celebrated in the United States today, and there are adjustments: US trading floors are closed, so the remaining market participants are forced to trade in low liquidity. A similar picture will also be observed in late December and early January. I believe that by this time the pair will exit the price band of 1.09870-1.1090, in which it was stuck in early November.

So far, traders are not able to create a large-scale price movement to leave the above price niche. For each positive is its negative and vice versa. This applies to both the euro and the dollar. For example, dollar bulls did not have time to be inspired by the growth of the US economy (indicators for the third quarter were revised upwards), as inflation indicators arrived right there, which seemed to fit in the red zone.

The external fundamental background is also replete with conflicting news. Before negotiators exchanged pleasantries during a telephone conversation, Trump signed scandalous bills that actually support protesters in Hong Kong. Similar contradictions keep the EUR/USD pair at the bottom of the 10th figure, although bears and bulls tried to break through the price range: the price fell to 1.0990 yesterday, and today it rose to 1.1025. But the next round of the confrontation ended in a draw, the pair ends Thursday's trading day at their previous positions.

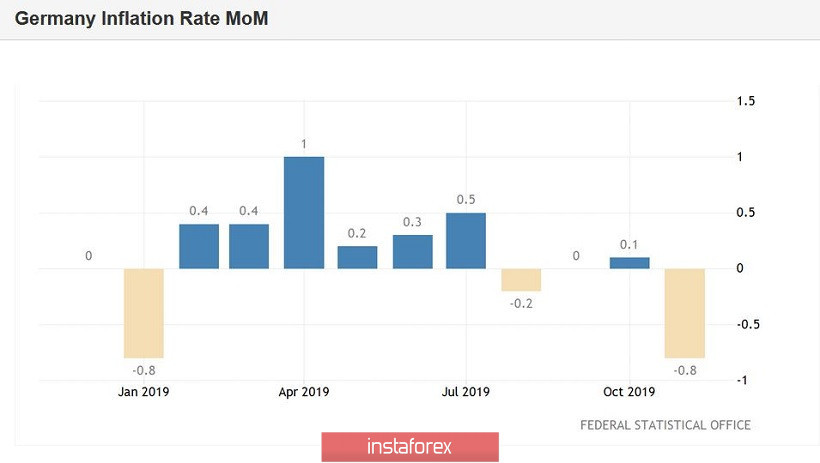

The German inflation data released today left a negative impression. The general consumer price index came out worse than expected: on a monthly basis it collapsed to -0.8% (this is the weakest result since January of this year), and in annual terms it slowed to 1.1% (with a growth forecast of up to 1.2%) . Harmonized consumer price index on a monthly basis also found itself in the negative zone, showing the worst result in the last ten months. While in annual terms, the indicator unexpectedly grew to 1.2% - inflation has not been at this height since June this year. In general, the figures published today do not bode well in the context of tomorrow's release of data on the growth of pan-European inflation. Most likely, the forecasts of low growth will not be confirmed - the general index may reach 0.6%, and the core one - at the level of one percent or even 0.9%. In this case, the bearish pressure on the pair will increase significantly, in view of the dovish intentions of the ECB members.

On the other hand, the dollar also does not feel completely confident. Despite some hesitation, Trump nevertheless signed bills today that actually support Hong Kong protesters. According to the first bill (which has already acquired the force of law), the US Department of State must confirm to Congress at least once a year that Hong Kong maintains sufficient autonomy to maintain favorable conditions for trade with the United States. Otherwise, the law provides for sanctions against city authorities for violating human rights. The second bill prohibits the Hong Kong police from supplying funds that can be used to disperse demonstrations: tear and pepper gases, rubber bullets and stun guns.

As you know, China sees Hong Kong as its administrative unit, following the principle of "one country - two systems." Therefore, it is not surprising that the Chinese regarded the actions of Washington as interference in the internal affairs of the state. Even before the signing of the above documents, Beijing warned the United States that such steps would not be without consequences. And now that the bills have become laws, experts fear that the outbreak of conflict will negatively affect the negotiation process between the United States and China. The fact of signing these bills has already reduced the chances of signing a trade deal between the parties in the near future: after all, in any case, political passions must survive their peak period. Therefore, the visit of the American delegation to China, which according to some rumors was supposed to take place in early December, is now under big question. Another round of confrontation between China and the United States puts background pressure on the US currency, not allowing the dollar to dominate the market, including the pair with the euro.

Thus, the system of checks and balances continues to keep the EUR/USD pair in flat, at the bottom of the 10th figure. In conditions of low liquidity and a contradictory fundamental background, the pair actually stomps on the spot. However, the European currency will have to pass a rather important exam tomorrow, in view of the release of data on inflation in the eurozone. The general consumer price index has been gradually decreasing since June, and reached 0.7% in October. A slight recovery is expected in November - according to analysts, the figure will rise to the level of 0.8%. Core inflation should also slightly grow - according to experts, the core index will be released in the green zone, at around 1.2%.

But given the dynamics of German inflation, I would now warn traders from opening long positions in the pair at a fall in prices: European inflation may disappoint quite a lot, and this fact will allow the pair bears to finally settle in the ninth figure.