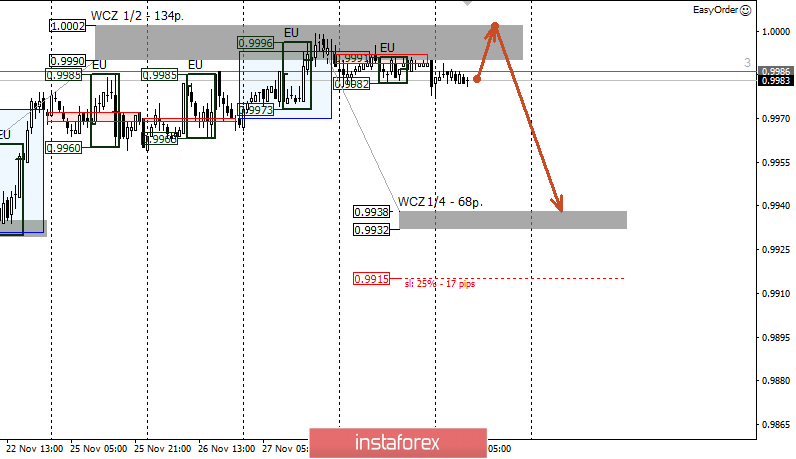

The maximum of the current week is within the limits of the Weekly Control Zone 1/2 1.0002-0.9990, which indicates the possibility of searching for a "false breakdown" pattern for sale. Now, if today's update of the weekly extreme will lead to a sharp increase in supply, then sales will come forward. The first goal of the reduction will be Weekly Control Zone 1/4 0.9938-0.9932.

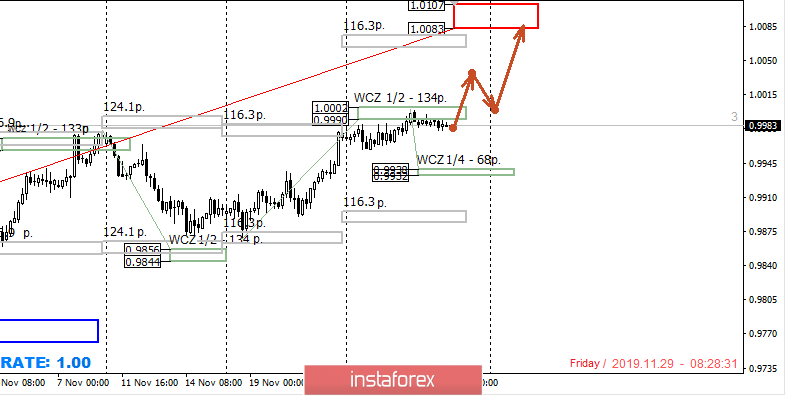

Developing within the framework of the formed flat implies the search for patterns when testing one of the boundaries. The upward movement remains a medium-term impulse, so purchases from support areas are more profitable.

An alternative growth model will be developed if today's trading closes above the the Weekly Control Zone 1/2. This will open the way for the weakening of the Swiss pound. On the other hand, the next growth target will be the weekly control zone 1.0107-1.0083. This will enable purchases with a favorable ratio of risk to profit at the beginning of next week.

Daily CZ - daily control zone. The zone formed by important data from the futures market that changes several times a year.

Weekly CZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone that reflects the average volatility over the past year.