To open long positions on GBP/USD you need:

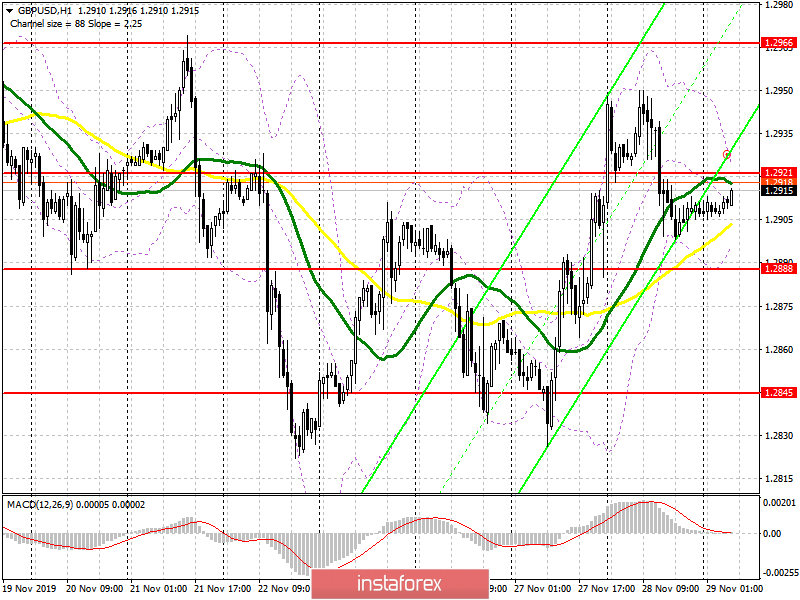

Pound buyers lost the level of 1.2921 yesterday, and now all the emphasis will be in this range. Good data on the indicator of consumer confidence in the UK will make it possible to gain a foothold above this resistance, which will lead to a repeated wave of growth in the region of a high of 1.2966, where I recommend profit taking. If the pressure on the pound persists, and the bears do not let the pair go above the resistance of 1.2921, then I recommend that you look at long positions only after tan update of support at 1.2888, on a false breakout, or buy GBP/USD immediately to rebound from a low of 1.2845.

To open short positions on GBP/USD you need:

Pound sellers have a great chance to prove themselves and return the pair to a support of 1.2888, however, for this you need to keep GBP/USD below the resistance level of 1.2921 in the first half of the day. This can be done after a weak report on the UK consumer confidence index, the level of which will remain quite low amid uncertainty with Brexit. The formation of a false breakout in the region of 1.2921 will be a good signal for the further opening of short positions. A break of support at 1.2888 can very quickly return the pound to the area of a low of 1.2845, where I recommend profit taking. In a bullish scenario of a return of resistance at 1.2921, it is best to consider new short positions only after updating the high of 1.2966.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving average, which indicates the lateral nature of the market.

Bollinger bands

Volatility has decreased, which does not provide signals for entering the market.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20