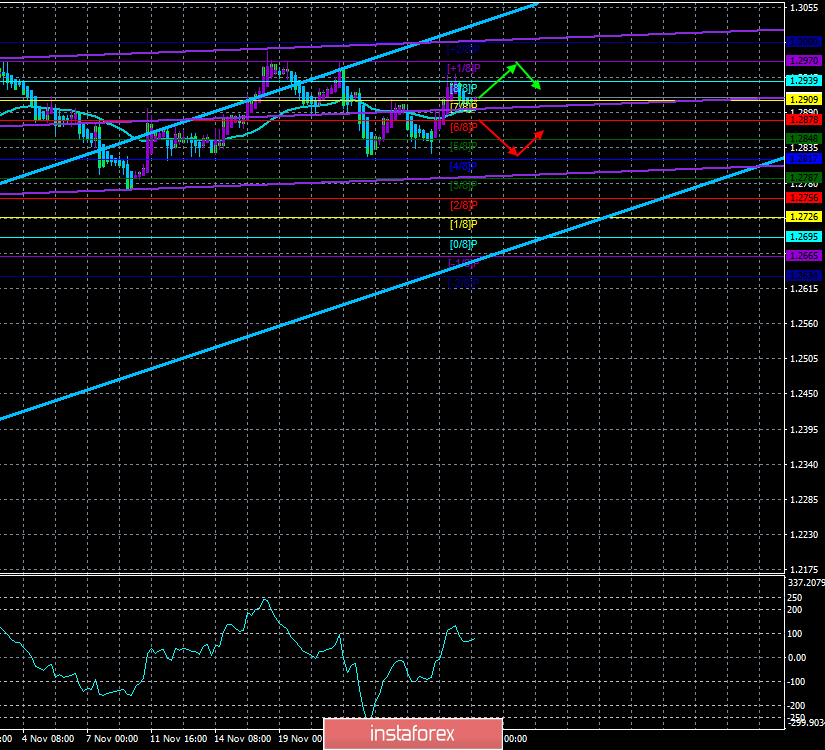

4-hour time frame

Technical data:

Upper linear regression channel: direction - up.

Lower linear regression channel: upward direction.

Moving average (20; smoothed) - sideways.

CCI: 90.3272

The GBP/USD currency pair continues to trade inside the side channel. The upper boundary of which is the Murray level of "+1/8" - 1.2970. Yesterday, traders tried to overcome this level once again, but they did not have enough strength to even get to it. Thus, the pair continues to be within the side range and, accordingly, the technical picture remains the same. The pound / dollar volatility has increased slightly, but this is still not enough to resume the trend movement. If for the EUR / USD pair we have at our disposal a "paradoxical situation" that does not allow quotes to go up or down, then in the case of the GBP / USD pair we have a complete reluctance of traders to trade until the announcement of the results of the elections to the UK Parliament is announced. The fact is that despite the possible victory of the conservatives, in which no one doubts, the question remains open whether they will gain the necessary number of votes in order to freely implement Brexit until January 31? According to the latest large-scale studies, it turns out that yes, they will, but still this is not a reliable fact. In addition to the fact that Brexit can still take place before January 31 and the long-standing saga finally ends, we draw the attention of traders to the fact that the UK will not have less problems. Yes, the problem of "divorce" with the European Union will go away, and immediately a much more serious problem "life of the country after the termination of all ties with the EU" will arise. Even if Brexit is "soft," it still will not save the UK economy from the economic downward turn, which is now visible to the naked eye even before leaving the EU. Now, for the economic situation in the UK to stabilize, it will need to establish trade relations with the European Union and other countries. This may take a year, or maybe more time. Thus, all of us are now witnessing trade negotiations between China and the States and we understand how long trade negotiations can last. However, Johnson's Great Britain also wants a "deal" with America.

In addition to problems with the "new life of Great Britain", London may also face serious losses in the form of Scotland's exit from the United Kingdom. It can be recalled that the Prime Minister of Scotland, Nicola Sturgeon has repeatedly stated that the Scottish people do not want to leave the European Union, not impressed with the "deal" of Boris Johnson with Brussels. Yesterday at the event, which is eloquently called "Stop Brexit," Nicola Sturgeon reiterated that "Scotland's future is in jeopardy, and the outcome of the election will determine which path the country will take and who will determine its future." Sturgeon also noted that "Prime Minister Boris Johnson is dangerous and unsuitable for his office, and that his proposed Brexit deal will be a nightmare for Scotland."

Thus, after the epic "Great Britain's exit from the European Union" is over, we can immediately witness the epic "Great Britain's exit from Great Britain", which can also last at least a year. Needless to say, the loss of Scotland has potentially additional economic problems for London? Thus, we believe that the prospects for the pound remain in any case extremely vague, even if the long-awaited Brexit takes place.

At the moment, the pound/dollar pair is trading near the moving average line, which is directed to the side and still does not respond to any fundamental data, either economic or political in nature. Since no important publications are planned for Friday, November 29, it is unlikely that traders will be able to withdraw a pair from the wide side channel today.

The nearest support levels:

S1 - 1.2909

S2 - 1.2878

S3 - 1.2848

The nearest resistance levels:

R1 - 1.2939

R2 - 1.2970

R3 - 1,3000

Trading recommendations:

The GBP/USD remains inside the side channel. The area of 1.2970-1.3010 has remained unsurpassed, so we are not waiting for the formation of a new upward trend. Nevertheless, trading inside the side channel is possible. For example, a rebound is possible from the level of 1.2970 and a turn of the Heiken Ashi indicator down may signal a round of downward movement.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanations for illustrations:

The upper linear regression channel is the blue unidirectional lines.

The lower linear channel is the purple unidirectional lines.

CCI - blue line in the indicator regression window.

Moving average (20; smoothed) - a blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible price movement options:

Red and green arrows.